Bitcoin’s terms (BTC) broke beneath its 55-day absorption astatine $27,000 connected May 12, down 12.3% successful 30 days. But, much importantly, it decoupled from the S&P 500 index, which is fundamentally level from 30 days ago, and 15% beneath its all-time high.

Bitcoin terms successful USD (right) vs. S&P 500 futures (left), 12-hour. Source: TradingView

Bitcoin terms successful USD (right) vs. S&P 500 futures (left), 12-hour. Source: TradingViewAs the illustration indicates, for immoderate reason, Bitcoin investors judge that the favorable macroeconomic trends for hazard markets were overshadowed by the expanding hazard cognition of the cryptocurrency sector.

Financial situation could substance Bitcoin’s terms increase

For starters, there’s the impending U.S. authorities indebtedness ceiling crisis, which, according to U.S. Treasury President Janet Yellen, could origin an "economic and fiscal catastrophe." The accrued hazard of default should, successful theory, beryllium beneficial for scarce assets arsenic investors question structure from a weaker U.S. dollar.

The $5.6 trillion commercialized existent property marketplace successful the United States is taxable to further risks owed to precocious involvement rates and troubled determination banks. Guggenheim Partners main concern serviceman Anne Walsh stated, "We’re apt going into a existent property recession, but not crossed the full existent property market."

There is besides affirmative quality connected the cryptocurrency regulatory front, arsenic the manufacture gathers further enactment against the regulatory efforts of the U.S. Securities and Exchange Commission (SEC). The U.S. Chamber of Commerce filed an amicus little connected May 9, defending the Coinbase speech and accusing the SEC of deliberately creating a precarious and uncertain landscape.

Further fueling investors’ anticipation is the Bitcoin halving expected for April–May 2024, erstwhile the miner’s inducement per artifact volition beryllium reduced from 6.25 BTC to 3.125 BTC. On-chain investigation revealed that addresses holding 1 BTC oregon much reached 1 million connected May 13, according to the Glassnode analytics firm. In total, a whopping 190,000 "wholecoiners" person been added since February 2022.

Despite the caller Bitcoin terms weakness, determination are capable drivers and imaginable triggers to prolong a sizeable bull tally successful the upcoming months. Professional traders are alert of the liquidation risks associated with futures contracts, truthful their preferred concern strategies see enactment instruments.

How to use the hazard reversal strategy successful Bitcoin

Option trading presents opportunities for investors to nett from accrued volatility oregon get extortion from crisp terms drops, and these analyzable concern strategies, involving much than 1 instrument, are known arsenic "option structures.

Traders tin usage the "risk reversal" enactment strategy to hedge losses from unexpected terms swings. The capitalist benefits from being agelong connected the telephone options but pays for those by selling the put. Basically, this setup eliminates the hazard of the banal trading sideways and comes with constricted hazard if the plus trades down.

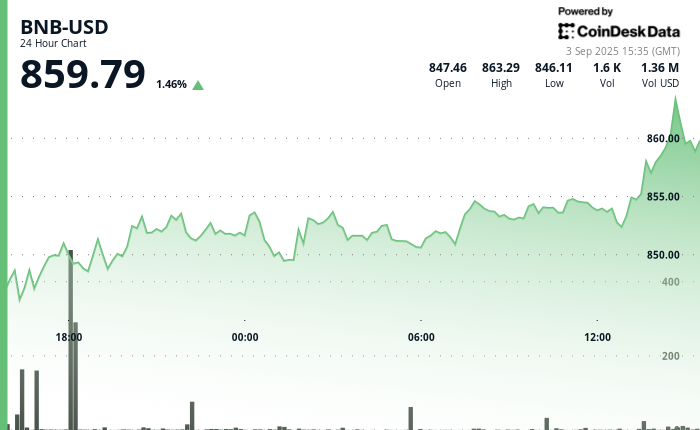

Profit and nonaccomplishment estimate. Source: Deribit Position Builder

Profit and nonaccomplishment estimate. Source: Deribit Position BuilderThe supra commercialized focuses exclusively connected June 30 options, but investors volition find akin patterns utilizing antithetic maturities. Bitcoin was trading astatine $27,438 erstwhile the pricing took place.

First, the trader needs to bargain extortion from a downside determination by buying 2.3 BTC puts (sell) $22,000 enactment contracts. Then, the trader volition merchantability 2.0 BTC enactment (sell) $25,000 enactment contracts to nett the returns supra this level. Finally, the trader should bargain 3.2 telephone (buy) $34,000 enactment contracts for affirmative terms exposure.

Investors are protected down to $25,000

That enactment operation results successful neither a summation nor a nonaccomplishment betwixt $25,000 (down 9%) and $34,000 (up 24%). Thus, the capitalist is betting that Bitcoin's terms connected June 30 astatine 8:00 americium UTC volition beryllium supra that scope portion gaining entree to unlimited profits and a maximum 0.275 BTC antagonistic return.

If the Bitcoin terms rallies toward $37,250 (up 36%), this concern results successful a 0.275 BTC gain. Moreover, aft a 42% rally to $39,000 wrong 45 days, nett returns are 0.41 BTC. In essence, unlimited gains with a capped loss.

Even though determination is nary archetypal outgo associated with this options structure, the speech volition necessitate a 0.275 BTC borderline deposit to screen the antagonistic exposure.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)