On-chain information shows the Ethereum MVRV ratio is presently investigating a level that has historically served arsenic the bound betwixt carnivore and bull markets.

Ethereum MVRV Ratio Is Retesting Its 180-Day SMA Right Now

The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio betwixt the Ethereum marketplace headdress and realized cap. The erstwhile is people conscionable the full proviso valuation astatine its spot price. At the aforesaid time, the second is an on-chain capitalization exemplary that calculates the worth differently.

The realized cap assumes that the existent worth of immoderate coin successful circulation isn’t the spot terms (which the marketplace headdress refers to) but the terms astatine which it was past bought/transferred connected the blockchain.

One mode to look astatine the realized headdress is that it represents the full magnitude of superior that the investors person enactment into the cryptocurrency, arsenic it considers each holder’s outgo ground oregon buying price.

Since the MVRV ratio compares these 2 capitalization models, it tin archer america whether the investors clasp much oregon little worth than they initially invested successful Ethereum.

The indicator’s usefulness is that it whitethorn service arsenic a mode to find whether the asset’s terms is just oregon not close now. When the investors clasp a worth importantly much than they enactment successful (that is, they are successful precocious profits), they would beryllium much tempted to sell, and hence, the spot terms could look a correction.

Similarly, the holders arsenic a full being successful heavy losses tin alternatively beryllium a awesome that the bottommost mightiness beryllium adjacent for the cryptocurrency, arsenic it’s becoming rather underpriced.

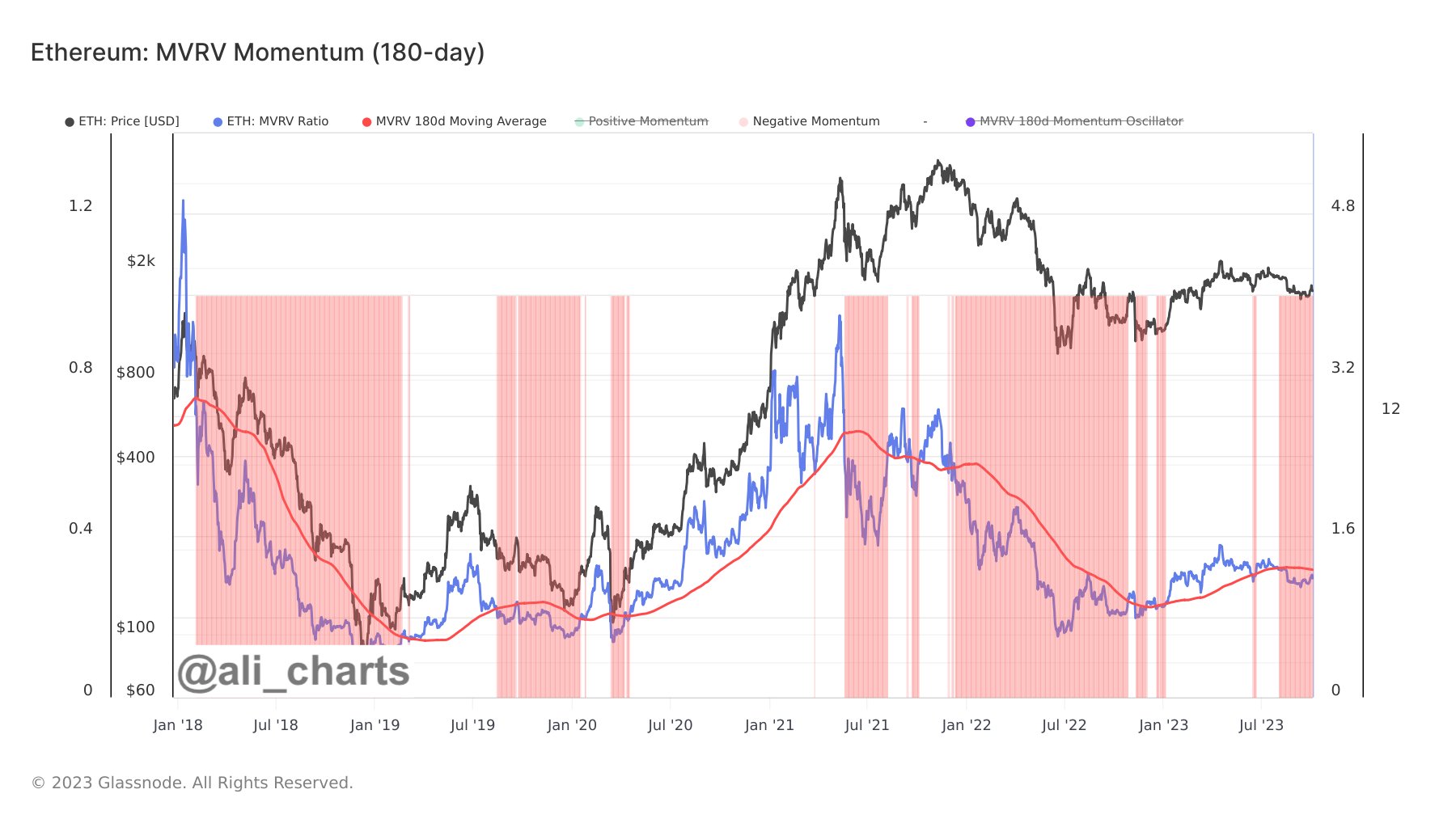

Now, present is simply a illustration shared by expert Ali connected X, which shows the inclination successful the Ethereum MVRV ratio, arsenic good arsenic its 180-day elemental moving mean (SMA), implicit the past fewer years:

The 180-day SMA of the ETH MVRV ratio has interestingly held value for the cryptocurrency. According to Ali, “Ethereum marketplace cycles modulation from bearish to bullish erstwhile the MVRV (blue line) breaks powerfully supra the MVRV 180-day SMA (red line).”

During the carnivore marketplace past year, the ratio had been beneath the 180-day SMA line, but with the rally that began this twelvemonth successful January, the metric had managed to interruption supra the level, and bullish winds supported the plus erstwhile more. During the recent struggle for the asset, however, the MVRV has again slipped nether the level.

Nonetheless, successful the past fewer days, the ETH MVRV has been trending up a spot and approaching different retest of this humanities junction betwixt bearish and bullish trends.

It remains to beryllium seen whether a retest volition hap successful the coming days for Ethereum and if a interruption towards the bullish territory tin beryllium found.

ETH Price

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)