This is an sentiment editorial by Ruda Pellini co-founder and president of Arthur Mining, an ESG-focused bitcoin mining company.

I precocious saw an nonfiction that cited the level of leverage and indebtedness of the world's leading Bitcoin mining companies. Since they are listed companies, it is casual to find their fiscal statements and beryllium the obvious: this is simply a counter-cyclical concern that requires a batch of ratio and nonrecreational management.

For those who are inactive wondering what mining is, fto maine rapidly explain: the word mining makes an analogy to the process of extracting golden and metals, since bitcoin miners are the "producers" of this integer commodity. In practice, mining consists of allocating computing powerfulness and energy to guarantee the bitcoin web functions, validating transactions and serving arsenic the backbone of this decentralized system.

Investing successful bitcoin mining is antithetic from buying the plus directly. On the 1 hand, erstwhile investing successful mining you person changeless and predictable currency travel and carnal assets that tin beryllium liquidated successful the lawsuit of marketplace stress, making the concern much charismatic to much cautious investors accustomed to investing successful currency travel generating businesses. On the different hand, too the hazard related to the asset, determination are besides risks of the cognition itself.

Currently, bitcoin is down much than 65% from its November 2021 peak. Moments similar this make apprehension and marque the investors inquire themselves: is it an accidental to summation my investments oregon a risk?

For bitcoin mining operations with structured cash, the infinitesimal represents a large opportunity! To quote Warren Buffet: “It’s lone erstwhile the tide goes retired bash you larn who was swimming naked.”

The Impact Of Bitcoin Price On Mining

In general, bitcoin miners person their currency travel reduced arsenic the terms of bitcoin falls, truthful astatine archetypal glimpse it is counterintuitive that little prices are beneficial to a mining company.

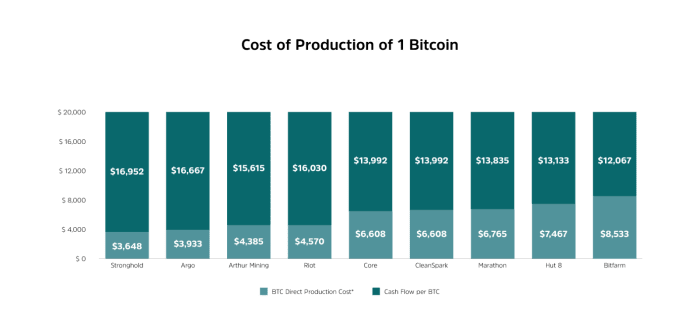

However, since we are talking astir an industry, much important than the marketplace terms is the outgo of production.

Within the accumulation costs, the biggest outgo is the outgo of electricity, which is the main input for this information processing activity. Therefore, those who tin get a bully terms for vigor and ratio tin stay profitable adjacent successful unfavorable marketplace conditions.

Since not each miners tin execute this aforesaid level of efficiency, successful scenarios similar this 1 galore extremity up having their accumulation outgo precise adjacent to the marketplace terms of the asset, starring them to liquidate their assets and exit the market.

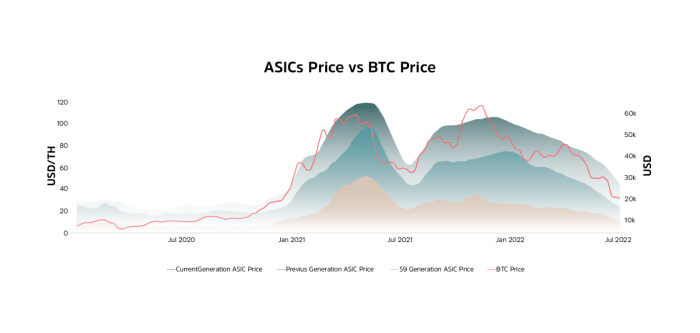

Because of this, arsenic successful astir commodity markets, this marketplace is besides counter-cyclical, and these down times are the champion times to grow operations. There is simply a affirmative correlation of the terms of mining computers with the terms of Bitcoin, wherever the terms ends up being adjusted successful a greater saltation than the plus itself.

While the terms of bitcoin fell astir 47% from April to August of this year, the terms of computers utilized successful mining fell astir 60% successful the aforesaid period.

The Bitcoin Mining Companies

Particularly, I recognize the mining manufacture successful overmuch the aforesaid mode arsenic the web infrastructure (cable) manufacture of the 1990s, wherever determination were fundamentally 3 large cycles of enlargement and consolidation.

The archetypal rhythm was marked by geeks and exertion enthusiasts, who started net businesses and virtually cabled and acceptable up the archetypal web infrastructures. This has besides happened with bitcoin miners since 2009.

In the 2nd cycle, we had the introduction of players funny successful maximizing superior quickly, ignoring the value of ratio by focusing lone connected the accelerated enlargement of their structures and connected short-term results.

In the 3rd cycle, we had the consolidation of the industry, with the introduction of players focused connected ratio and semipermanent vision, encouraging the introduction of task superior and the professionalization of the market. In the United States, the 50 largest cablegram companies of the precocious 1990s were consolidated into 4 by the extremity of 2010.

Most of today's ample mining companies entered the 2nd cycle, with excessively overmuch absorption connected the abbreviated word and not capable efficiency. This results successful businesses that are not precise robust and are precise susceptible to times of stress.

Modified from: Arcane Research

During bitcoin's large up rhythm betwixt 2020 and 2021, galore mining companies took vantage of rising margins to leverage themselves and grow their operations. This is precise communal successful galore industries, but successful this lawsuit successful summation to leveraging successful dollars, a bully information of the listed miners ended up keeping their currency successful bitcoin successful an effort to maximize their results.

According to estimates from Luxor Technologies, estimates bespeak that listed mining companies person betwixt $3 and $4 cardinal successful indebtedness agreements utilized to concern infrastructure enlargement and machine purchases.

Produce On The Uptrend, Sell On The Downtrend

Mistakenly, these players did not see that, arsenic successful immoderate commodity producer, if you are capable to summation your accumulation capacity, it makes consciousness to merchantability the banal you nutrient and reinvest it, alternatively than keeping the plus you nutrient connected your equilibrium sheet.

In bid to beryllium capable to grant these commitments, mining companies began to liquidate their liquid assets first, successful this lawsuit the bitcoins held connected the equilibrium sheet. This determination further accrued the selling unit during June and July, pushing prices to caller lows.

Basically, the effect of the currency absorption strategy adopted by these mining companies was to excavation precocious and merchantability low, resulting successful further fiscal losses successful summation to the operational losses caused by the bitcoin terms declines.

After selling the bitcoin from the equilibrium sheet, the little businesslike mining companies volition request to merchantability computers to grant payments and support the operation, opening up abstraction for much businesslike mining companies to incorporated these assets and operations.

Time To Expand

As with different commodities, bitcoin mining is an anti-cyclical business. As a result, the champion clip to turn is during periods of debased prices, erstwhile inefficient miners look problems and exit the market.

At the existent infinitesimal the instrumentality is astatine a large discount and the investments made present volition bring returns faster. So, contempt the antagonistic quality and the past fewer months of falling prices, this is simply a infinitesimal of large asymmetry, with reduced hazard and precocious imaginable returns to marque investments successful bitcoin mining.

We are successful a infinitesimal of large opportunities and those who put present volition beryllium winners successful the agelong run. In short, for businesses that are good structured and person strategical advantages that guarantee efficiency, each the turbulence of this harsh wintertime points successful the absorption of a precise favorable outpouring for growth.

This is simply a impermanent station by Ruda Pellini. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)