Bitcoin has been struggling with little lows successful caller weeks, leaving galore investors questioning whether the plus is connected the brink of a large carnivore cycle. However, a uncommon information constituent tied to the US Dollar Strength Index (DXY) suggests that a important displacement successful marketplace dynamics whitethorn beryllium imminent. This bitcoin bargain signal, which has lone appeared 3 times successful BTC’s history, could constituent to a bullish reversal contempt the existent bearish sentiment.

For a much in-depth look into this topic, cheque retired a caller YouTube video here:

Bitcoin: This Had Only Ever Happened 3x Before

BTC vs DXY Inverse Relationship

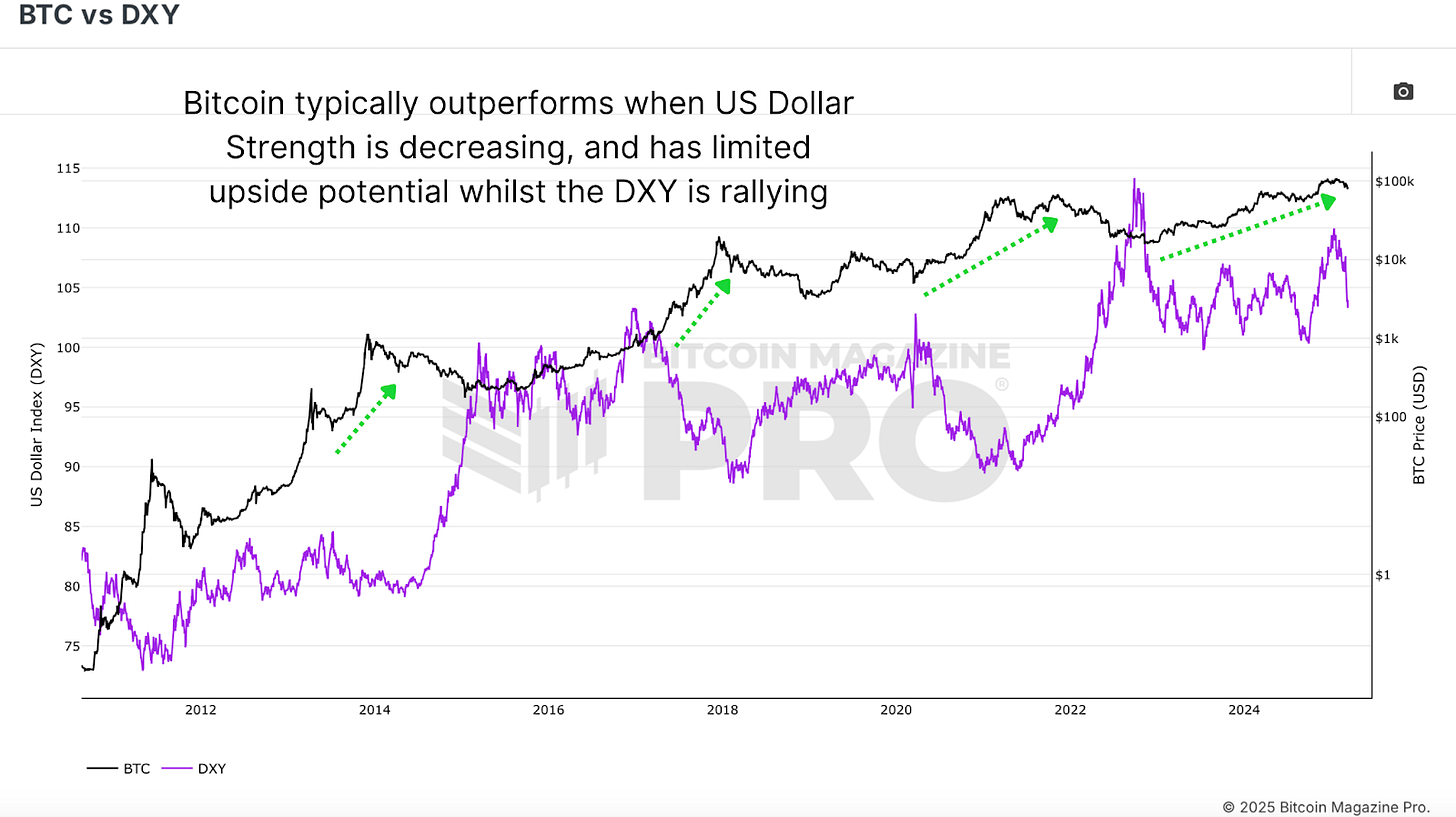

Bitcoin’s terms enactment has agelong been inversely correlated with the US Dollar Strength Index (DXY). Historically, erstwhile the DXY strengthens, BTC tends to struggle, portion a declining DXY often creates favorable macroeconomic conditions for Bitcoin terms appreciation.

Figure 1: $BTC & DXY person historically had an inverse correlation. View Live Chart 🔍

Figure 1: $BTC & DXY person historically had an inverse correlation. View Live Chart 🔍Despite this historically bullish influence, Bitcoin’s price has continued to retreat, precocious dropping from implicit $100,000 to beneath $80,000. However, past occurrences of this uncommon DXY retracement suggest that a delayed but meaningful BTC rebound could inactive beryllium successful play.

Bitcoin Buy Signal Historic Occurrences

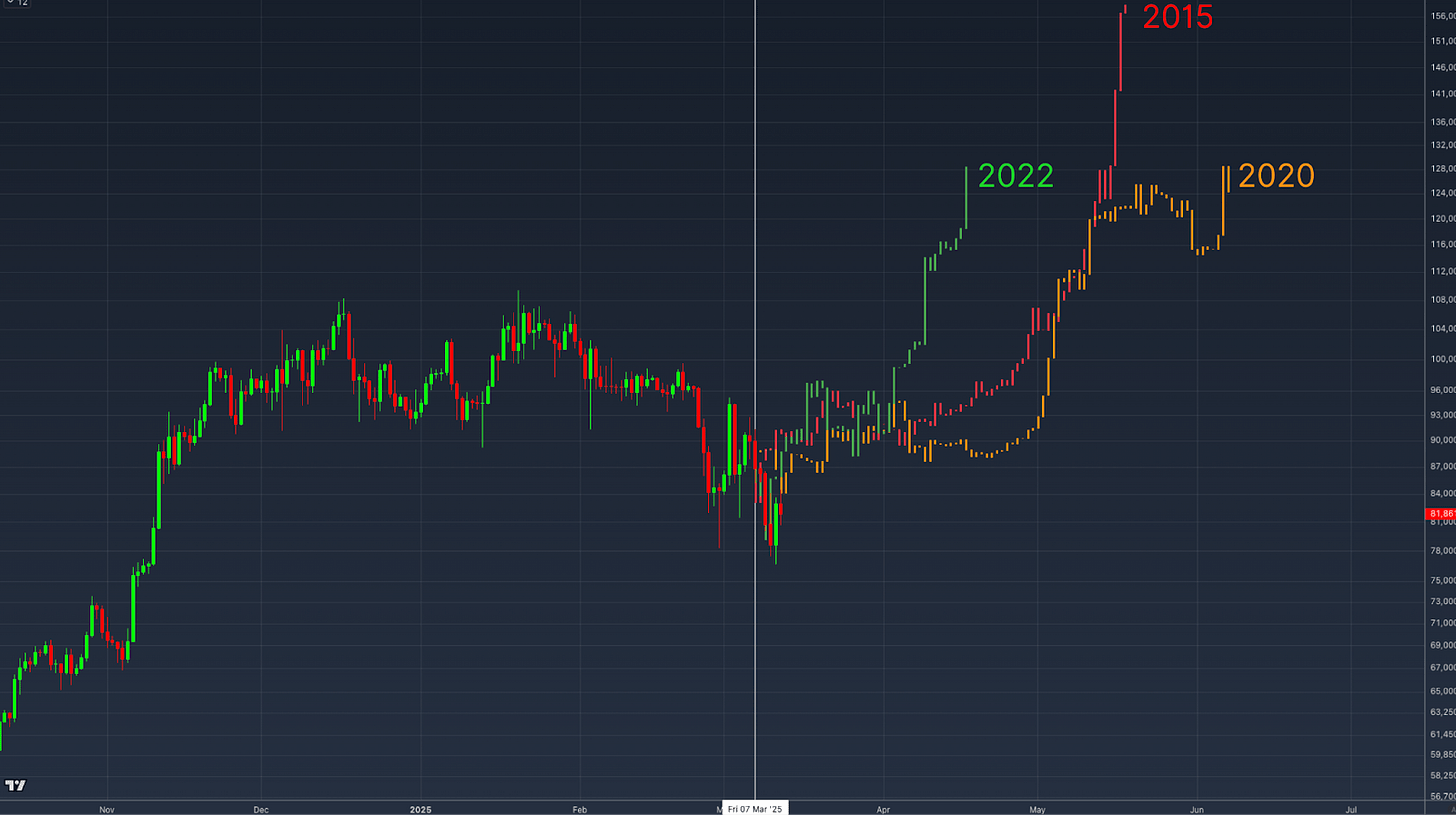

Currently, the DXY has been successful a crisp decline, a alteration of implicit 3.4% wrong a azygous week, a complaint of alteration that has lone been observed 3 times successful Bitcoin’s full trading history.

Figure 2: There person lone been 3 erstwhile instances of specified accelerated DXY decline.

Figure 2: There person lone been 3 erstwhile instances of specified accelerated DXY decline.To recognize the imaginable interaction of this DXY signal, let’s analyse the 3 anterior instances erstwhile this crisp diminution successful the US dollar spot scale occurred:

- 2015 Post-Bear Market Bottom

The archetypal occurrence was aft BTC’s terms had bottomed retired successful 2015. Following a play of sideways consolidation, BTC’s terms experienced a important upward surge, gaining implicit 200% wrong months.

- Post-COVID Market Crash

The 2nd lawsuit occurred successful aboriginal 2020, pursuing the crisp marketplace illness triggered by the COVID-19 pandemic. Similar to the 2015 case, BTC initially experienced choppy terms enactment earlier a accelerated upward inclination emerged, culminating successful a multi-month rally.

- 2022 Bear Market Recovery

The astir caller lawsuit happened astatine the extremity of the 2022 carnivore market. After an archetypal play of terms stabilization, BTC followed with a sustained recovery, climbing to substantially higher prices and kicking disconnected the existent bull rhythm implicit the pursuing months.

In each case, the crisp diminution successful the DXY was followed by a consolidation signifier earlier BTC embarked connected a important bullish run. Overlaying the terms enactment of these 3 instances onto our existent terms enactment we get an thought of however things could play retired successful the adjacent future.

Figure 3: How terms enactment could play retired if immoderate of the 3 erstwhile occurrences are mirrored.

Figure 3: How terms enactment could play retired if immoderate of the 3 erstwhile occurrences are mirrored.Equity Markets Correlation

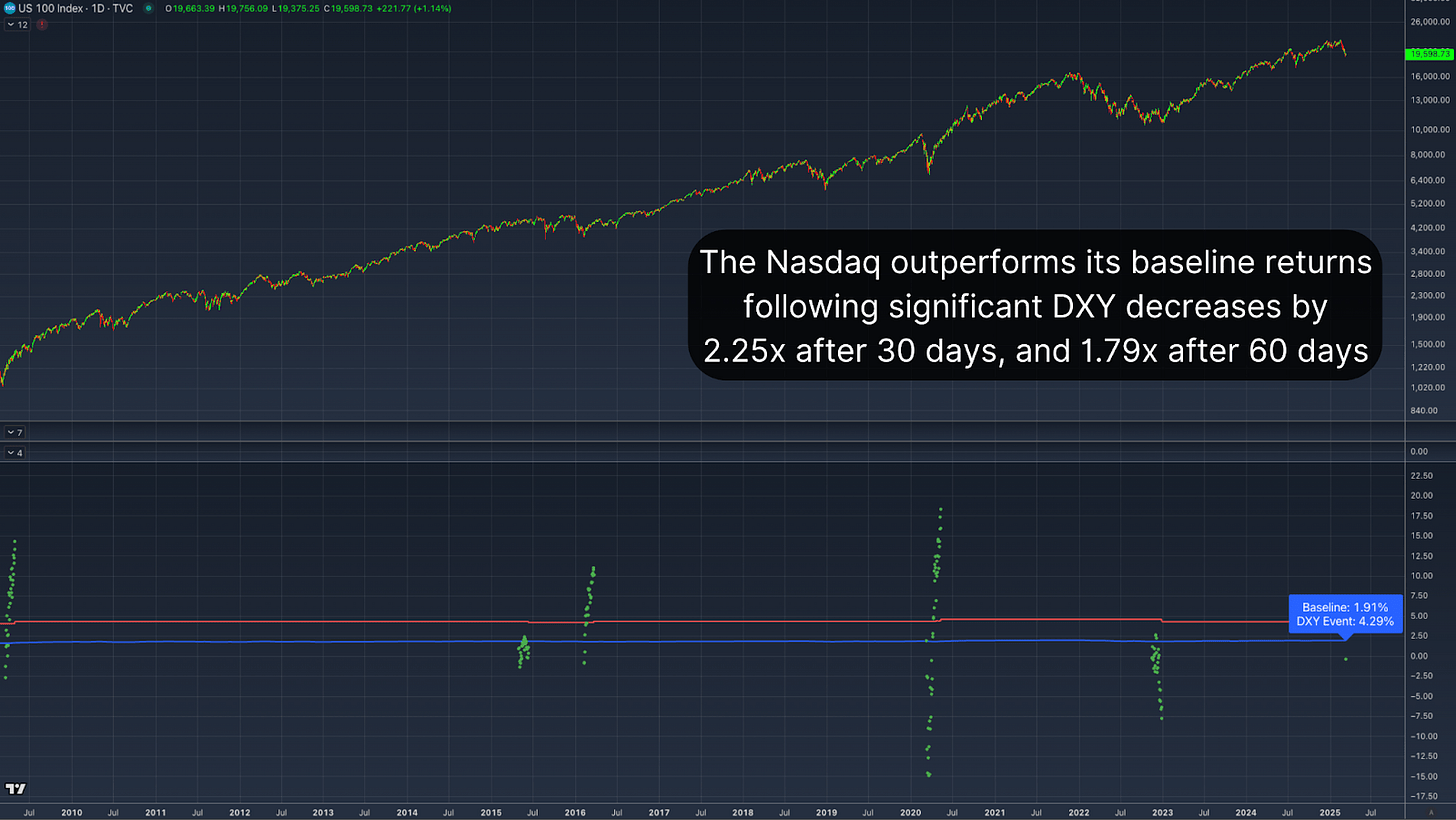

Interestingly, this signifier isn’t constricted to Bitcoin. A akin narration tin beryllium observed successful accepted markets, peculiarly successful the Nasdaq and the S&P 500. When the DXY retraces sharply, equity markets person historically outperformed their baseline returns.

Figure 4: The aforesaid outperformance tin beryllium observed successful equity markets.

Figure 4: The aforesaid outperformance tin beryllium observed successful equity markets.The all-time mean 30-day instrumentality for the Nasdaq pursuing a akin DXY diminution stands astatine 4.29%, good supra the modular 30-day instrumentality of 1.91%. Extending the model to 60 days, the Nasdaq’s mean instrumentality increases to astir 7%, astir doubling the emblematic show of 3.88%. This correlation suggests that Bitcoin’s show pursuing a crisp DXY retracement aligns with humanities broader marketplace trends, reinforcing the statement for a delayed but inevitable affirmative response.

Conclusion

The existent diminution successful the US Dollar Strength Index represents a uncommon and historically bullish Bitcoin bargain signal. Although BTC’s contiguous terms enactment remains weak, humanities precedents suggest that a play of consolidation volition apt beryllium followed by a important rally. Especially erstwhile reinforced by observing the aforesaid effect successful indexes specified arsenic the Nasdaq and S&P 500, the broader macroeconomic situation is mounting up favorably for BTC.

Explore unrecorded data, charts, indicators, and in-depth probe to enactment up of Bitcoin’s terms enactment at Bitcoin Magazine Pro.

Disclaimer: This nonfiction is for informational purposes lone and should not beryllium considered fiscal advice. Always bash your ain probe earlier making immoderate concern decisions.

9 months ago

9 months ago

English (US)

English (US)