Ethereum has retraced to the $3,160 level pursuing the highly anticipated FOMC meeting, wherever the Federal Reserve chopped involvement rates by 25 ground points. While complaint cuts typically enactment hazard assets, Jerome Powell’s comments added a caller furniture of uncertainty to the market.

By openly acknowledging the risks of weaker maturation paired with persistent inflation, Powell introduced the anticipation of stagflation—a script that historically challenges some equities and crypto. As a result, sentiment crossed the marketplace remains fragile, and investors are struggling to construe what this macro displacement could mean for Ethereum’s adjacent move.

Despite the volatility surrounding the decision, 1 large whale continues to enactment with conviction. According to Lookonchain, the Bitcoin OG who famously shorted the marketplace during the October 10 clang is erstwhile again doubling down connected his bullish Ethereum position.

Instead of taking profits oregon reducing vulnerability aft the caller rally, helium has continued accumulating aggressively, signaling a beardown content successful ETH’s medium-term trajectory adjacent arsenic broader sentiment turns cautious.

Whale Position Ramps Up, But Risk Is Rising

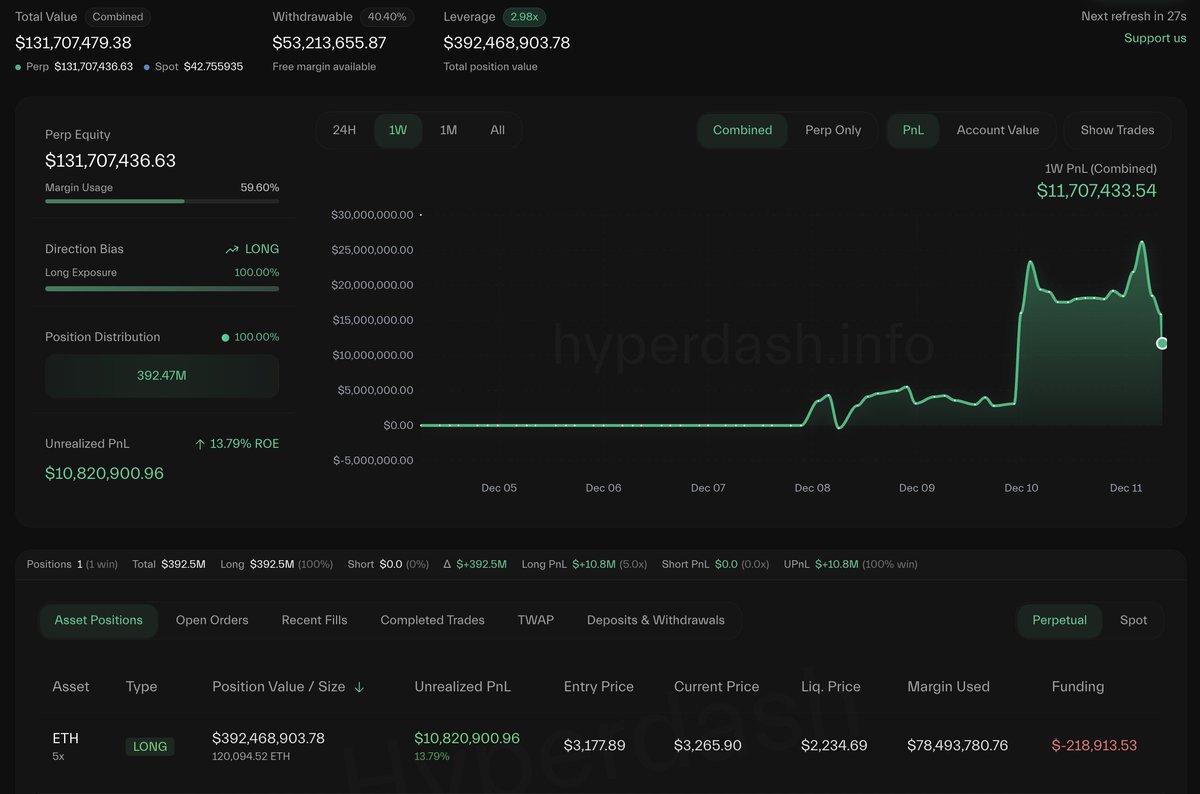

According to Lookonchain, the whale’s position has present surged to 120,094 ETH, valued astatine astir $392.5 million. With a liquidation terms astatine $2,234.69, this has go 1 of the largest and astir assertive agelong positions presently tracked on-chain.

Bitcoin OG Ethereum Position | Source: Hyperdash

Bitcoin OG Ethereum Position | Source: HyperdashSuch a monolithic allocation signals utmost conviction, particularly coming from the aforesaid Bitcoin OG who successfully shorted the marketplace during the October 10 crash. However, the standard of this stake besides highlights however overmuch hazard is present concentrated successful a azygous directional position.

The liquidation terms is simply a cardinal concern. At $2,234, it sits astir $1,000 beneath existent levels, but successful highly leveraged environments—especially during macro uncertainty—prices tin retrace violently. Ethereum has already shown a inclination toward crisp intraday moves, and with backing rates rising and leverage crossed the marketplace stretching to humanities highs, adjacent a mean correction could trigger cascading liquidations.

If ETH experiences a abrupt spike successful volatility owed to shifting macro conditions, a antagonistic absorption to the latest FOMC decision, oregon a broader marketplace unwind, the whale’s presumption could travel nether important pressure. While ample whales often power marketplace sentiment, this setup illustrates however bladed the borderline for mistake has become.

ETH Testing Resistance While Momentum Weakens

Ethereum has retraced to the $3,196 level aft failing to clasp supra the $3,300 zone, signaling that bullish momentum is opening to weaken. The regular illustration shows ETH rejecting the reddish 200-day moving average, a cardinal semipermanent inclination indicator that has acted arsenic absorption passim the caller downtrend. Until ETH breaks and closes decisively supra this level, the broader operation remains vulnerable.

ETH consolidates beneath cardinal absorption | Source: ETHUSDT illustration connected TradingView

ETH consolidates beneath cardinal absorption | Source: ETHUSDT illustration connected TradingViewThe 50-day moving mean is inactive sloping downward, reflecting persistent selling unit contempt past week’s rebound. Meanwhile, the 100-day moving mean sits good supra the existent price, reinforcing the dense overhead absorption ETH indispensable flooded to reestablish a bullish trend. Volume has besides declined compared to the aboriginal December bounce, suggesting buyers are losing spot arsenic terms approaches large absorption levels.

Related Reading: Bitcoin Exchange Reserves Fall To Lowest Levels connected Record: The Bullish Signal Most Traders Are Missing

Structurally, ETH remains successful a mid-term downtrend, forming little highs and little lows since September. Although the caller propulsion from the $2,800 portion shows buyers defending cardinal support, the rejection astatine $3,350 highlights that sellers are inactive successful power astatine higher levels.

If ETH fails to regain the 200-day moving mean soon, a retest of the $3,050–$3,100 enactment scope becomes likely. Conversely, a beardown reclaim supra $3,350 could unfastened the doorway for a determination toward $3,500, but the marketplace volition request renewed momentum to get there.

Featured representation from ChatGPT, illustration from TradingView.com

2 months ago

2 months ago

English (US)

English (US)