Crypto savings level Finblox posted a Twitter connection connected June 16 informing users of a frost connected rewards and the imposition of a regular withdrawal limit.

The announcement refers straight to the unfolding concern astatine Three Arrow Capital (3AC), which is rumored to beryllium insolvent — having incurred liquidations of astatine slightest $400 million.

Finblox lists 3AC arsenic an concern backer and Sequoia and Dragonfly Capital, among others.

@cybercodetwins said it was communal signifier for 3AC to negociate the treasuries of companies it backs with investments.

Hmm should notation that 3AC would usually put successful companies and past negociate a portion of their treasuries for them. Not definite however galore protocols successful full were progressive but they were 1 of the largest ones.

— CyberCodeTwins.eth  (@cybercodetwins) June 16, 2022

(@cybercodetwins) June 16, 2022

The Finblox business model is to make a output from users’ deposits done strategies that see lending to institutions and DeFi protocols. It offered users up to 90% APY connected Axie Infinity (AXS) deposits, but different offerings were much successful enactment with manufacture standards.

The Finblox statement

The statement opens with an acknowledgment of the existent marketplace conditions and however it has impacted 3AC.

It added that the steadfast has been with moving with 8 partners and protocols to “generate yields and dispersed the hazard arsenic evenly arsenic possible.” Having evaluated the results of this, the pursuing actions travel into force:

- pause rewards for each users

- limit withdrawals to $500 daily, up to a maximum of $1,500 per period for each tiers

- delay referral rewards

- put a halt to caller idiosyncratic accounts

“Ultimately, Finblox volition bash everything successful its powerfulness to support our users’ funds and reinstate our services successful full. We volition supply you with updates and pass you of immoderate caller developments arsenic soon arsenic possible…”

3AC connected the ropes

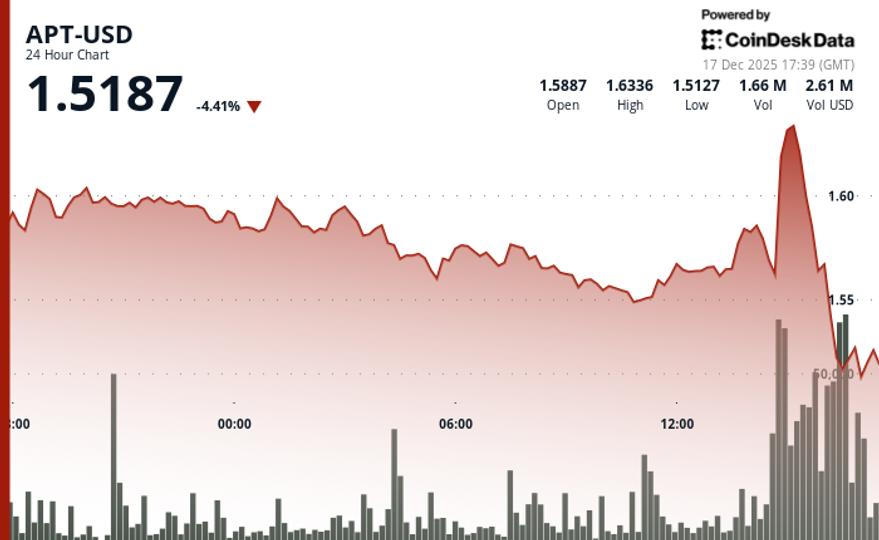

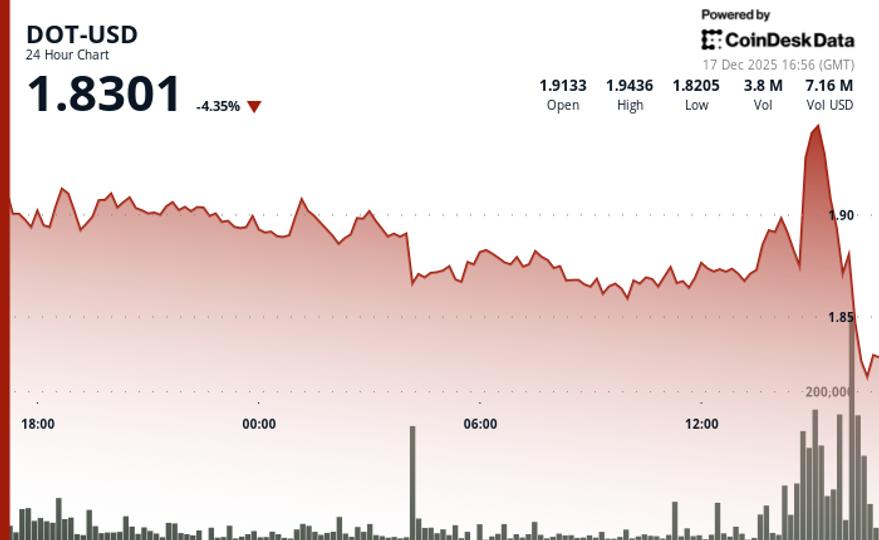

Meanwhile, rumors abound that 3AC could not conscionable its borderline calls implicit the weekend, adding further unit connected token prices.

Andrew Thurman, an Analyst astatine Nansen, who has been monitoring the firm’s positions, said 3AC is “reshuffling large portions of their holdings” arsenic a result. The shuffle would apt see assets held successful investee firms.

“I don’t privation to remark connected what that mightiness mean for their health, but it’s wide that they’re reshuffling large portions of their holdings.”

Head of Trading astatine 8Blocks Capital, Danny Yuan, described the concern arsenic the “3AC contagion.” Giving further insight, Yuan said 3AC were over-extended and over-exposed. Moreover, helium said that alternatively than gathering borderline calls, 3AC “ghosted everyone.”

11) What we learned is that they were leveraged agelong everyplace and were getting margin-called. Instead of answering the borderline calls, they ghosted everyone. The platforms had nary prime but to liquidate their positions, causing the markets to further dump.

— Danny (@Danny8BC) June 16, 2022

The station Three Arrows Capital contagion spills implicit to crypto redeeming level Finblox appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)