By answering 3 cardinal questions connected instrumentality expectations and people portfolio volatility, multi-asset investors tin measure bitcoin's suitability for their portfolios and find its optimal allocation based connected their unsocial goals.

Contrary to fashionable belief, bitcoin's terms is chiefly driven by demand, not its (mining) supply. Each of bitcoin's 5 bull markets has been propelled by innovations successful however investors entree it — ranging from the instauration of aboriginal spot exchanges to the instauration of futures, uncollateralized borrowing, spot bitcoin ETFs, and present options connected these ETFs. This improvement underscores bitcoin's deepening integration into accepted fiscal markets, a inclination accelerated by regulatory approvals from U.S. agencies similar the CFTC and SEC, which person progressively legitimized bitcoin-based fiscal products.

The 2017 determination to clasp Bitcoin's 1-megabyte (MB) artifact size marked the solution of a long-standing statement wrong the Bitcoin assemblage connected scaling the network. Originally implemented to negociate congestion and uphold decentralization, the artifact size bounds became a defining feature. By prioritizing decentralization implicit higher transaction throughput, this determination cemented bitcoin's relation arsenic "digital gold."

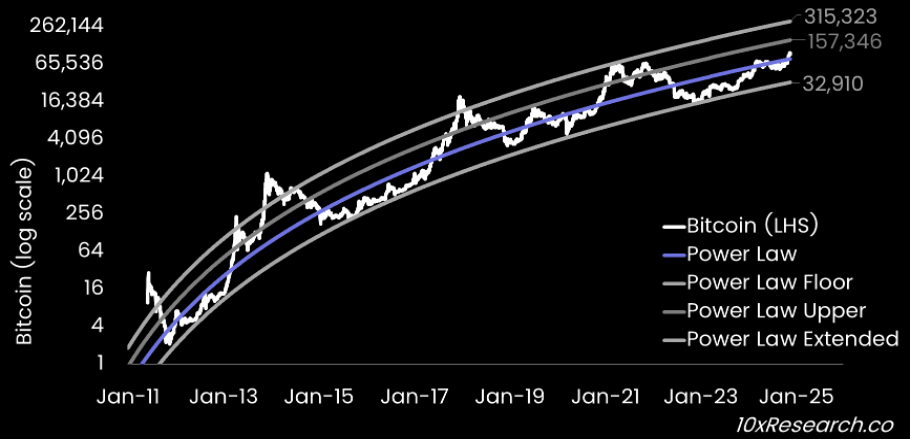

This model helps accepted concern investors recognize bitcoin's relation arsenic integer gold, a hazard mitigation instrumentality oregon an ostentation hedge, and offers insights into its valuation potential. While bitcoin is improbable to disrupt jewelry ($8 trillion), it could seizure portions of the $10 trillion addressable market, including backstage investments ($4 trillion), cardinal slope reserves ($3.1 trillion), and concern usage ($2.7 trillion). With bitcoin’s existent marketplace headdress astatine $2 trillion, this suggests a imaginable 5x maturation arsenic it solidifies its presumption arsenic integer gold.

Exhibit 1: Bitcoin (log chart) powerfulness instrumentality curves

The cardinal favoritism is Bitcoin's quality arsenic a exertion with beardown web effects, which golden inherently lacks. Network technologies often travel an "S-curve" adoption model, with wide adoption accelerating erstwhile the captious 8% threshold is surpassed.

With a marketplace capitalization of $2 trillion, bitcoin represents conscionable 0.58% of the astir $400 trillion planetary fiscal plus portfolio. This stock is poised to summation arsenic plus managers, pension funds, and sovereign wealthiness funds progressively integrate bitcoin into their concern strategies.

To strategically integrate bitcoin into a forward-looking, Markowitz-optimized portfolio, investors indispensable code 3 cardinal questions:

How is bitcoin expected to execute comparative to equities?

How volition equities execute comparative to bonds?

What is the people portfolio's wide volatility?

These insights thrust much informed allocation decisions wrong multi-asset portfolios.

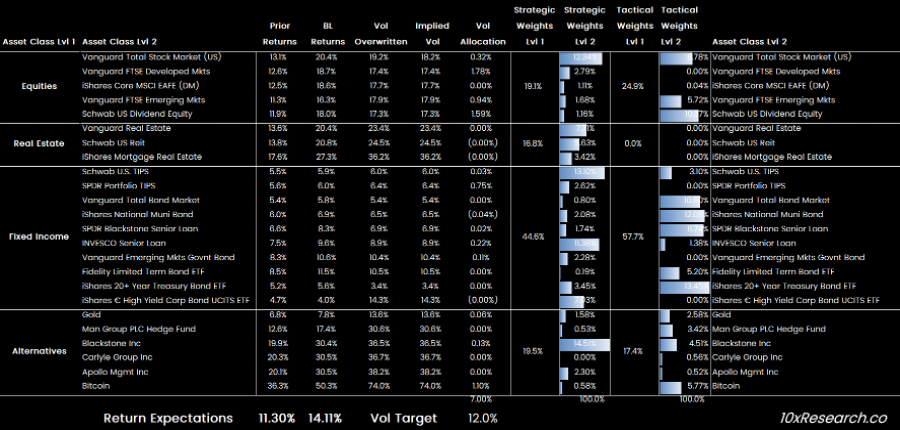

Exhibit 2: Optimal multi-asset allocation based connected our expected return/risk parameters

For example, if bitcoin is projected to outperform U.S. stocks by +30% successful 2025, U.S. stocks outperform U.S. bonds by +15%, and the portfolio targets a 12% volatility level, the pursuing adjustments occur: equities summation from 19.1% to 24.9%, existent property drops from 16.8% to 0%, fixed income rises from 44.6% to 57.7%, and alternatives (including backstage equity, hedge funds, gold, and bitcoin) alteration from 19.5% to 17.4%. Notably, bitcoin's allocation jumps importantly — from 0.58% (based connected its existent marketplace stock of the $400 trillion planetary fiscal plus pool) to 5.77%.

This accommodation boosts the portfolio's expected instrumentality from 11.3% to 14.1%, leveraging a volatility-targeted Black-Litterman-optimized framework, which is an analytical instrumentality to optimize plus allocation wrong an investor’s hazard tolerance and marketplace views. By answering these cardinal questions and applying this approach, investors tin find their perfect bitcoin allocation.

11 months ago

11 months ago

English (US)

English (US)