Wall Street’s appetite for companies holding Bitcoin connected their equilibrium sheets is cooling, and investors are starting to amusement it, according to the New York Digital Investment Group.

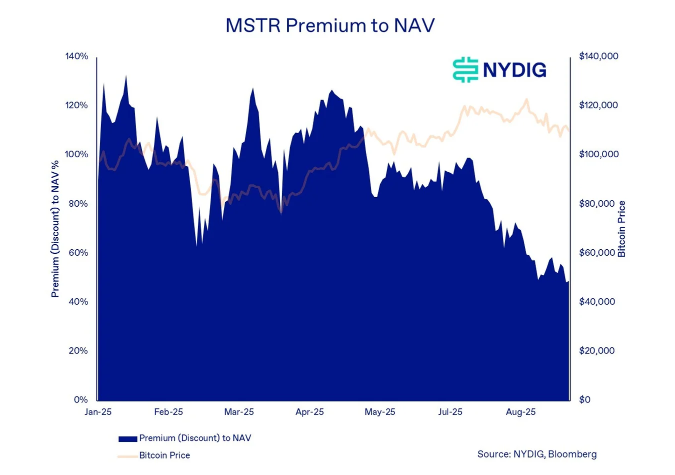

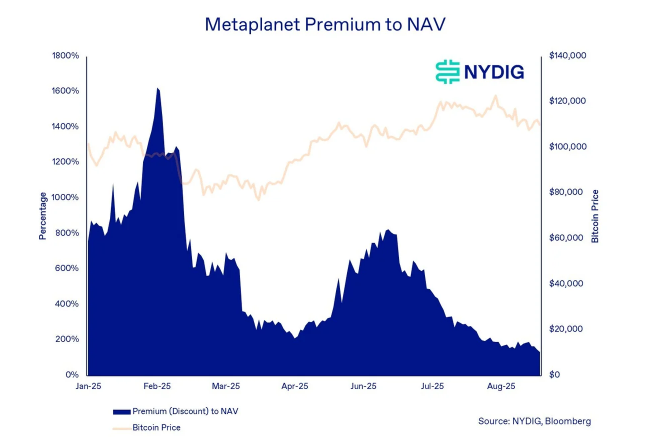

Greg Cipolaro, the firm’s planetary caput of research, said the disparity betwixt stock prices and nett plus worth (NAV) for large buyers is narrowing adjacent arsenic Bitcoin reached highs earlier this year.

He pointed to respective forces pushing those premiums down, from looming proviso unlocks to accrued stock issuance.

Premiums On The Slide

Investor interest implicit aboriginal token unlocks is weighing connected prices. Cipolaro listed different drivers: shifting firm aims among digital-asset treasuries, caller stock sales, capitalist profit-taking, and a deficiency of wide differences betwixt companies that simply clasp Bitcoin.

Companies often utilized arsenic proxies for Bitcoin gains — names similar Metaplanet and Strategy — person seen that spread compress. In plain terms, stocks that erstwhile traded astatine a steadfast premium to the coins they ain are present overmuch person to their NAVs.

Buying Activity Slows Sharply

Reports person disclosed that the combined holdings of publically disclosed Bitcoin-buying companies peaked astatine 840,000 BTC this year.

Strategy accounts for a 3rd of that total, oregon astir 637,000 BTC, portion the remainder is dispersed crossed 30 different entities.

Data shows a wide slowdown successful acquisition size. Strategy’s mean bargain successful August fell to 1,200 BTC from a 2025 highest of 14,000 BTC. Other companies bought 86% little than their March 2025 precocious of 2,400 BTC per transaction.

Monthly maturation has cooled too: Strategy’s monthly summation slid to 5% past period from 40% astatine the extremity of 2024, and different firms went from 160% successful March to 7% successful August.

Share Prices And Fundraising Values Are Coming Under Pressure

A fig of treasury companies are trading astatine oregon beneath the prices of caller fundraises. That spread creates risk. If recently issued shares statesman trading freely and owners determine to currency out, a question of selling could follow.

Cipolaro warned a unsmooth spot whitethorn beryllium up and advised companies to see measures that enactment their stock price.

Stocks May Face A Bumpy Ride

One straightforward determination suggested was banal buybacks. According to Cipolaro, crypto focused companies should acceptable speech immoderate superior raised to bargain backmost shares if needed. That attack tin assistance prices by shrinking the fig of outstanding shares.

Meanwhile, Bitcoin itself has not been immune to swings. Based connected CoinMarketCap quotes, BTC was trading astir $111,550, down astir 7% from a mid-August highest supra $124,000.

The terms determination tightens the borderline for mistake for treasury firms: their fortunes are linked to the coin, but their banal prices tin determination independently and sometimes much harshly.

Featured representation from Unsplash, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)