A crypto lobby radical claims that the US is backmost connected way to pb the cryptocurrency manufacture aft the White House’s latest crypto study called for the nation’s concern regulators to align connected integer assets.

The report, released past week, marks a imaginable extremity to the long-standing turf warfare betwixt the Securities and Exchange Commission and the Commodity Futures Trading Commission implicit however to classify and modulate cryptocurrencies.

“We’ve had ineligible precedent — Bitcoin, Ether and galore different integer assets are overmuch much akin to commodities,” said Ji Hun Kim, newly appointed CEO of the advocacy radical Crypto Council for Innovation, successful an exclusive interrogation with Cointelegraph.

“The President’s Working Group study reflects this, [and] I bash deliberation the CFTC volition person an important relation to play erstwhile it comes to the oversight of these assets, which are integer commodities — not securities.”Kim, who attended the report’s nationalist merchandise astatine the White House, said “the clip is now” for the US to instrumentality the pb successful the planetary crypto race. While different jurisdictions person a years-long caput start, the US is present successful a “crypto sprint,” with some the SEC and CFTC signaling plans to swiftly instrumentality the report’s recommendations.

US contention to the crypto capital

The SEC nether the erstwhile medication faced wide disapproval from the crypto manufacture for its regulation-by-enforcement approach, filing lawsuits against crypto firms based connected existing securities laws. That crackdown was coupled with what came to beryllium known arsenic “Operation Chokepoint 2.0,” a question of debanking that saw crypto firms suffer entree to accepted fiscal services.

“This is different illustration wherever the study is truthful explicit and beardown and affirmative — it clarifies that banks should beryllium allowed to prosecute successful assorted integer plus activities,” said Kim.

Past uncertainty successful the US regulatory situation pushed galore crypto companies offshore. Dubai rapidly emerged arsenic a apical destination, with a dedicated crypto regulator. Singapore and Hong Kong besides roseate successful popularity, offering favorable taxation attraction and ceremonial licensing regimes for cryptocurrency exchanges.

But the writer isn’t ever greener. Though regulatory clarity is improving globally, manufacture players are learning that clarity doesn’t ever mean crypto-friendly — thing the US is progressively becoming.

Earlier this year, Dubai’s Virtual Asset Regulatory Authority tightened supervision and gave firms 30 days to comply with updated rules. Singapore expelled unlicensed firms exploiting regulatory loopholes by serving lone overseas clients. And Hong Kong’s cautious gait successful issuing licenses has made it wide that it isn’t welcoming each applicants.

Hong Kong’s Stablecoin Ordinance, which took effect past Friday, created a caller licensing authorities for stablecoin issuers. The European Union has its ain stablecoin rules, portion of its broader Markets successful Crypto-Assets (MiCA) framework. The US’s effect came successful the signifier of the GENIUS Act, which has been touted arsenic a cardinal instrumentality for preserving the dollar’s dominance successful the planetary fiscal system.

Related: Singapore’s ousted crypto firms whitethorn not find structure elsewhere

This is wherever crypto enters the bosom of a wider geopolitical powerfulness struggle. China has been moving to supercharge the internationalization of its fiat currency, the renminbi, done its cardinal slope integer currency (CBDC). In contrast, US President Donald Trump signed an enforcement bid successful January banning immoderate US government-issued CBDC.

Kim supports the stance, arguing that CBDCs airs a nonstop menace to privacy. Instead, helium pointed to the GENIUS Act arsenic offering a viable, market-driven alternative.

“With GENIUS, you tin spot a batch of maturation and improvement [in backstage stablecoins]. I deliberation the superior absorption should beryllium connected these types of stablecoins,” helium added.

Meanwhile, Hong Kong’s stablecoin authorities is expected to play a strategical relation successful China’s CBDC ambitions. Chinese academics argue that Hong Kong’s stablecoin web could let Beijing’s integer currency to integrate into the planetary stablecoin ecosystem.

US SEC’s “Project Crypto” and CFTC’s “crypto sprint”

Shortly aft the White House’s crypto study was published, the SEC unveiled “Project Crypto,” an inaugural aimed astatine processing formal guidance for integer plus firms and attracting crypto companies backmost to the US arsenic a effect to the White House report.

The SEC projected to streamline licensing by allowing brokerages to run crossed assorted plus classes with a unified license. It besides aims to found a clearer part betwixt securities and commodities.

“It should not beryllium a scarlet missive to beryllium deemed a security,” Atkins said. “Many issuers volition similar the flexibility successful merchandise plan that the securities laws afford, and investors volition payment from the accidental to gain distributions, voting rights, and different features emblematic of securities.”

Related: The lessons learned astatine Operation Chokepoint 2.0 Congressional hearings

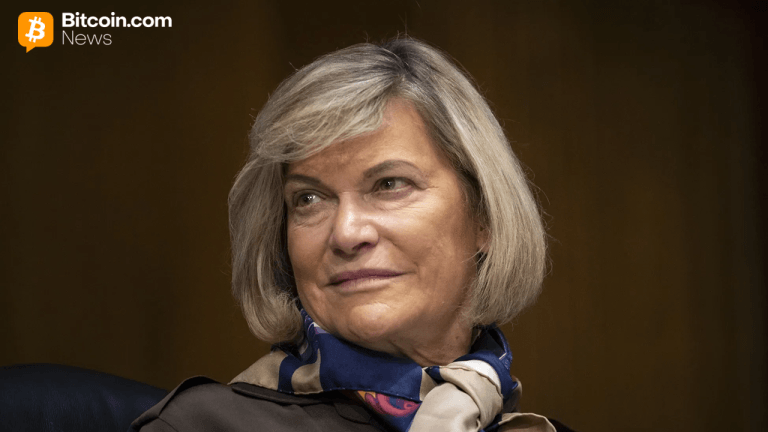

The CFTC, meanwhile, is positioning itself to play a much central relation successful regulating non-security integer assets. Acting CFTC Chair Caroline Pham said connected Aug. 1 that the CFTC volition footwear disconnected a “crypto sprint” to instrumentality the Presidential Working Group’s crypto recommendations.

That part of labour — with the CFTC regulating spot markets for integer commodities and the SEC focusing connected tokenized securities — is astatine the bosom of the CLARITY Act, which Kim described arsenic indispensable to ending the jurisdictional tug-of-war betwixt the 2 agencies. While the measure has passed successful the House, it inactive awaits movement successful the Senate.

“You’ll spot accrued collaboration betwixt the 2 agencies. That’s a taxable galore radical place successful this report. It was besides included successful the president’s enforcement bid backmost successful January, which directed the agencies to enactment unneurotic connected providing clarity, guidance and rulemaking,” Kim said.

US crypto clarity is not deregulation, CCI says

Bitcoin (BTC) proponents voiced however the White House’s crypto study missed the mark, arsenic it lacked an anticipated update to the Bitcoin reserve.

The interest echoes extracurricular the crypto manufacture arsenic well. A conjugation of implicit 80 organizations representing civilian rights and user groups opposed the CLARITY Act, claiming it “deregulates” the crypto manufacture by legitimizing risky businesses.

More recently, Senator Elizabeth Warren, joined by Senators Chris Van Hollen and Ron Wyden, has urged the Office of the Comptroller of the Currency to address imaginable conflicts of interest stemming from the Trump family’s cryptocurrency ventures.

But Kim disagrees with that framing. To him, the White House study and caller regulatory developments involving the GENIUS and CLARITY acts correspond a displacement successful regulatory philosophy, not deregulation.

“I don’t deliberation this is deregulation,” helium said. “I deliberation this is saying, ‘Hey, we admit the unsocial attributes of integer assets. We privation to enactment with the manufacture to marque definite that we champion combat illicit finance, support consumers and investors and springiness the manufacture wide rules of the road.’”

With 2 of the nation’s apical concern watchdogs present mostly aligned with the White House, the US appears acceptable to determination past infighting and ambiguity.

Magazine: Ethereum’s roadmap to 10,000 TPS utilizing ZK tech: Dummies’ guide

2 months ago

2 months ago

English (US)

English (US)