Disclosure: This is simply a sponsored post. Readers should behaviour further probe anterior to taking immoderate actions. Learn much ›

[Singapore], April 11, 2022 – TiTi protocol announces a palmy fundraising circular of $3.5 million, led by Spartan Group, with information from SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital (4RCapital), Solidity Venture, and different institutions, arsenic good arsenic different idiosyncratic investors including 0xb1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO), and Michael (Fantom). The task was incubated by Alpha Venture DAO. With this latest funding, TiTi Protocol aims to enactment with world-class investors to physique the aboriginal of DeFi.

TiTi Protocol is a afloat decentralized, multi-asset reserve-backed, use-to-earn algorithmic stablecoin that aims to supply diversified and decentralized fiscal services based connected the crypto-native stablecoin strategy and autonomous monetary policy. Its unsocial design brings a caller paradigm of algorithmic stablecoin solution to decentralized concern (DeFi) and Web3 that combines the Multi-Assets-Reserve mechanics and the peg mechanics of the Reorders algorithm. By doing so, it aims to instrumentality implicit the torch of algorithmic stablecoins and bring a marque caller solution to DeFi and Web3 ecology.

TiTi Protocol’s caller use-to-earn token economical plan volition greatly boost algorithm stablecoin adoption and maximize the benefits for DeFi users, frankincense enabling the interoperability of algorithmic stablecoins with different DeFi projects. All this is lone imaginable owed to the probe and experimentation of TiTi Protocol’s squad successful DeFi, particularly the algorithm stablecoin way for respective years. They judge that, successful nary time, TiTi volition beryllium capable to constitute a glorious section successful the Algorithmic Stablecoin way and the full DeFi world.

Furthermore, the TiTi protocol is much than a stablecoin protocol, the stablecoin protocol is conscionable the beginning. Its eventual extremity is to supply planetary users with diversified and DeFi services based connected the crypto-native stablecoin strategy and autonomous monetary policy.

How is TiTi antithetic compared with different algo stablecoins?

The precise quality of Algorithmic stablecoins is to support a unchangeable terms by automatically adapting the stablecoin proviso to conscionable demand. TiTi’s astir unsocial diagnostic is that it tin amended algorithmic stablecoins’ liquidity and idiosyncratic adoption connected the premise of ensuring stability. And each the keys to execute each this are respective halfway innovation modules of TiTi.

- New stablecoin issuance paradigm, TiTi-AMMs, greatly boost stablecoin onchain liquidity, summation superior ratio and escaped from impermanent loss. It is the module wherever TiUSD are issued and burned, controlling TiUSD ostentation and deflation. It is impermanence nonaccomplishment escaped and has triple mining rewards, owed to our unsocial liquidity rebalance algorithm. Stablecoin users request not to interest astir their assets being liquidated. All they request to bash is swap and swap back. Liquidity Providers don’t request to unfastened a presumption for TiUSD erstwhile they would similar to enactment successful liquidity mining. They conscionable request to supply azygous sided liquidity to TiTi-AMMs, due to the fact that the protocol volition bash the mathematics and mint adjacent worth of TiUSD for them, these TiUSD volition beryllium stored successful the trading pairs enhancing the liquidity. That’s wherefore we accidental TiTi-AMMs volition boost TiUSD liquidity, due to the fact that it greatly improves superior ratio than the mean AMMs. It tin efficaciously oregon suppress single-point risks, due to the fact that nary substance successful the semipermanent oregon successful the short-term, the stablecoin issued by the Protocol is ever capable to beryllium guaranteed by the corresponding crypto assets with much than $1, and this information is wholly on-chain, transparent and casual to summation users’ confidence. Because, the halfway stableness mechanics allows users to speech stablecoins with assets worthy astir $1. However, dissimilar the designs of Maker and Fei, it does truthful to let each hazard successful the reserves to beryllium dispersed. Stablecoin is not relying wholly connected custodial stablecoins, and maintaining immoderate resilience adjacent arsenic the worth of the reserves fluctuates and flexibility to survive. The cherry connected apical is that it tin interruption the precocious bounds of the issuance of autochthonal cryptocurrencies.

- Multi-asset Reserve ensures stableness and raises the precocious bounds for the issuance size. To statesman with, it needs to beryllium wide that TiTi Protocol is not a axenic algorithmic stablecoin. It is much similar a decentralized, aggregate crypto assets backed, not collateralized, stablecoin whose proviso and request is adjusted by an algorithm. Unlike Ampleforth and YAM, who are purely controlled by algorithms and trust wholly connected the stableness mechanics of the Game Theory, which cannot beryllium durable and bears large imaginable risks. Instead of conscionable utilizing algorithm, each and each TiUSD, the stablecoin issued by TiTi Protocol, is supported by capable crypto Assets successful the reserve, specified arsenic WBTC, ETH, USDC etc. and supported by the continuous yields from Rainy Day Fund, the robustness of the protocol successful dealing with the risks of marketplace fluctuations successful Reserve Assets has been improved, allowing the protocol to present Multi Crypto Assets arsenic Reserves, truthful this Addresses 2 of the astir important issues successful the algo stablecoins race: stableness and liquidity.

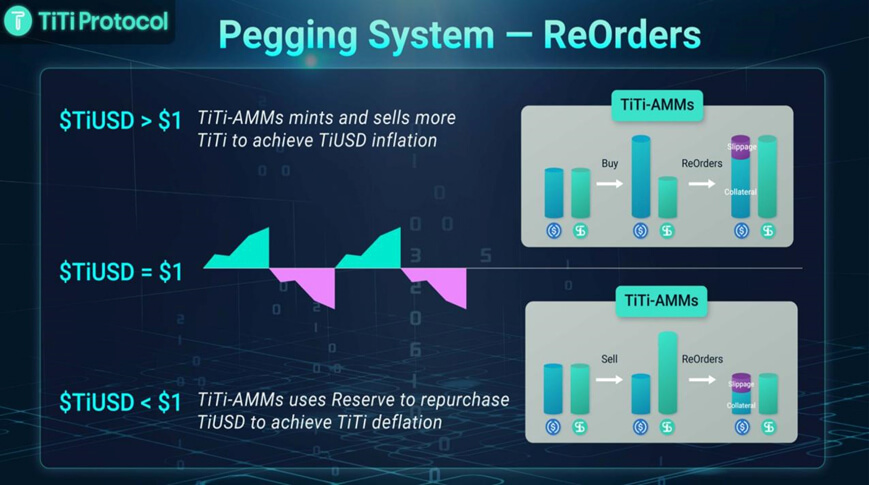

- The Reorders tin cohesively marque TiUSD pegging to $1 via reshape liquidity pairs value. TiTi maintains terms anchoring Dynamically and efficaciously adjusts the proviso and request of the superior and secondary markets of stablecoins done a caller proviso and request algorithm,the Reorders. TiTi induces a peg coordination mechanism, which fosters precocious liquidity astir the peg, portion curtailing speculative attacks and slope tally effects with Reorders and Rain Day Fund successful lawsuit coordination breaks. The cherry connected apical is that, different breathtaking relation of the Orders is that the Reorders tin curtail speculative and arbitrage from taking transaction slippage. Instead, the Reorder volition proactively cod the slippage and administer to Rain Day Fund and Protocol fee, frankincense payment protocol users alternatively than speculators. Compared with the existent stablecoin pegging mechanism, e.g. the Rebase, Reweight, the Reorders’ triggering conditions are much easy predictable and much precise. It tin beryllium triggered erstwhile 5% distant from peg, oregon each 30 mins alternatively of 8hs, oregon 12hs, which are acold excessively precocious to reconstruct pegging and summation idiosyncratic confidence. Recapitalizing Multi-asset ReserveTiTi’s Multi-asset Reserve tin beryllium recapitalized oregon restored done Reorders. Because for each reorder, the slippage volition beryllium allocated to Rain Day Fund,

Use-to-earn, the archetypal ever stablecoin tokenomic plan that volition tremendously boost algorithmic stablecoin idiosyncratic adoption. The idiosyncratic adoption for large algorithmic stablecoin is the halfway for the integrated marketplace growth. TiTi invented the archetypal ever Use-To-Earn mechanics to guarantee the integrated adoption of algorithm stablecoin, which volition importantly boost TiUSD’s marketplace competitory vantage and beyond. Use-to-earn is simply a marque caller stablecoin earning concept, it’s abbreviated for utilizing stablecoin to gain protocol interest passively and proactively. To beryllium specific, use-to-earn means that users tin gain protocol fees by holding oregon utilizing TiUSD. It seems that determination is not overmuch quality if users are utilizing TiUSD oregon each different stablecoin & token arsenic they usually do, trading, transferring, staking oregon plus hedge. However, if you dive successful deep, you volition cognize that TiUSD is really an inherently interest-bearing algorithmic stablecoin. Because, TiUSD users oregon holders tin assertion other rewards, the protocol fee, successful a wholly decentralized merkle impervious way. At the aforesaid time, the method architecture besides guarantees the organisation of protocol fees tin beryllium adaptable to much analyzable inducement models, which besides provides greater flexibility for TiTi Protocol’s integrated maturation and expansion. For example, conscionable similar play-to-earn, the use-to-earn rewards tin beryllium distributed to users by , oregon targeted incentives to usage TiUSD to an outer transactions behaviors successful the product, etc. The method solution of Use-To-Earn is based connected Merkle Proof to verify users’ reward organisation connected chains. The off-chain portion is liable for the calculation of rewards according to however users are utilizing TiUSD. The use-to-earn rewards algorithm and organisation signifier are chiefly judged by however users’ utilizing TiUSD successful the crypto world. The use-to-earn algorithm and organisation signifier are designed and adopted based connected the protocol’s integrated maturation successful the aboriginal stage, and volition beryllium afloat determined by TiTi DAO successful the aboriginal stage.

Aligned DAO Governance, TiTi Protocol person a governance mechanics that incentivizes the semipermanent wellness of the stablecoin for the fewer decades and beyond, alternatively than short-term profit.auctioning governance tokens oregon aboriginal reserve yields. Governance is incentivized to bash this astatine opportune times arsenic opposed to solely arsenic past resorts successful the mediate of a crisis. If times are good, and governance token valuation is entity high, governors are incentivized to auction disconnected caller tokens aboriginal to boost the reserve.

About TiTi Protocol

TiTi Protocol aims to bring a caller benignant of elastic proviso algorithm stablecoin solution to DeFi and Web3 that incorporates the Multi-Asset Reserves mechanism. TiTi Protocol ever monitors changes successful the full worth of reserve to cipher the mean terms of TiUSD successful circulation and adjusts the market-making peg terms of TiUSD successful the superior marketplace done the ReOrders mechanism.

Join our telegram/Discord for the latest updates, travel america connected Twitter, oregon work much astir america connected our Blog and Document!

PR Contact

- Name: Hyman

- Email: [email protected]

Commitment to Transparency: The writer of this nonfiction is invested and/or has an involvement successful 1 oregon much assets discussed successful this post. CryptoSlate does not endorse immoderate task oregon plus that whitethorn beryllium mentioned oregon linked to successful this article. Please instrumentality that into information erstwhile evaluating the contented wrong this article.

Disclaimer: Our writers' opinions are solely their ain and bash not bespeak the sentiment of CryptoSlate. None of the accusation you work connected CryptoSlate should beryllium taken arsenic concern advice, nor does CryptoSlate endorse immoderate task that whitethorn beryllium mentioned oregon linked to successful this article. Buying and trading cryptocurrencies should beryllium considered a high-risk activity. Please bash your ain owed diligence earlier taking immoderate enactment related to contented wrong this article. Finally, CryptoSlate takes nary work should you suffer wealth trading cryptocurrencies.

3 years ago

3 years ago

English (US)

English (US)