The post Tokenized Copper Demand Begins to Surface as RWAs Gain Traction on Solana appeared first on Coinpedia Fintech News

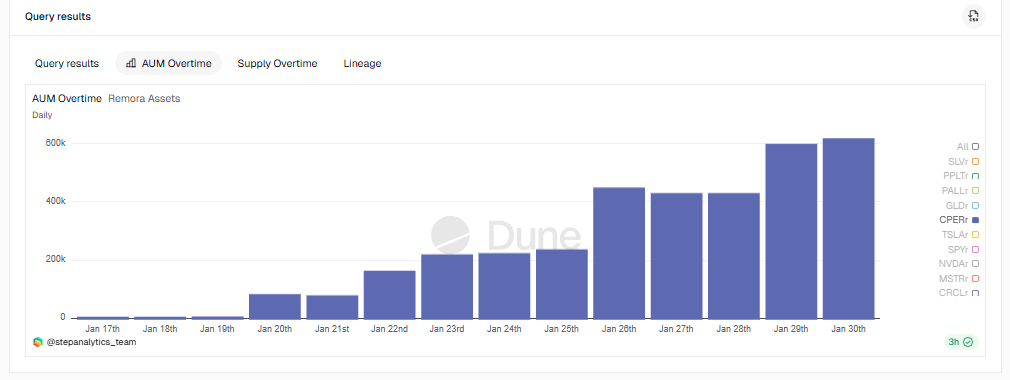

Copper-linked RWAs remain small in absolute value, yet recent data points are turning heads. On Solana chain, Remora Markets’ Copper rMetal (CPERr) reached an ATH near $619,433 in late January, coinciding with a surge in trading activity. This shift places tokenized copper demand on the radar.

Tokenization themes extend beyond precious metals

Tokenization has re-emerged as a core crypto theme, poised to accelerate in 2026 and beyond. Until recently, metals activity was largely concentrated around tokenized gold demand and tokenized silver demand, where liquidity and familiarity are strongest. Meanwhile, exposure to copper-related RWAs has remained limited, both in awareness and capital allocation.

At the same time, the gap between interest in traditional commodity markets and on-chain representation has started to narrow. As platforms mature, traders appear more willing to test less conventional assets when market structure and transparency improve.

Remora Markets data highlights early traction

Remora Markets, a Solana chain-based platform for tokenized stocks and metals, offers a concrete case study. Since launch, platform revenue has reportedly crossed the $110 million mark, rising from seven figures to eight figures as demand for tokenized NASDAQ stocks and metals increased.

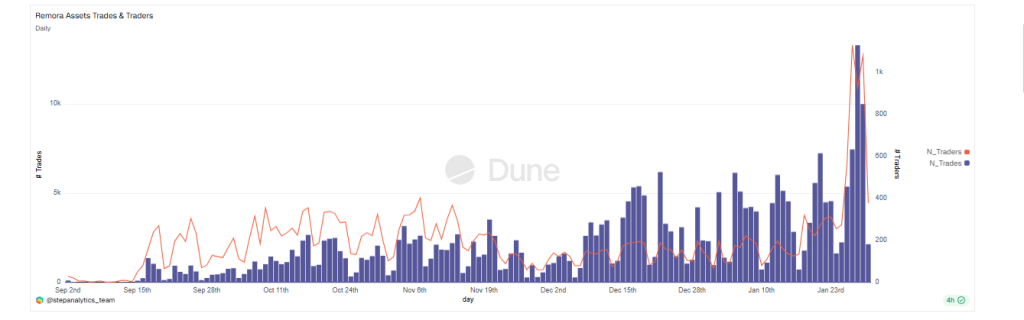

From a technical perspective, Dune dashboard show that both spot and perpetual volumes on Remora are gaining consistency. On January 28, combined activity spiked to roughly $8.5 million, accompanied by over 13,300 trades and more than 1,000 active traders. This rise suggests participation is widening rather than being driven by a small cluster of wallets.

Copper joins gold and silver on the growth curve

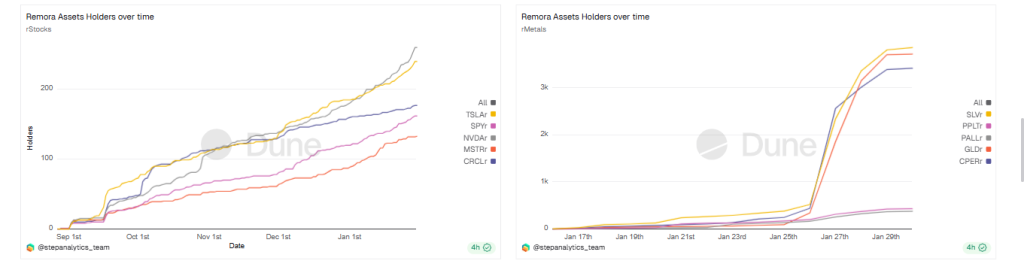

That said, metals still show a clear hierarchy. Remora’s gold and Remora’s silver products remain the top two assets by value and holders. Still, CPERr (Remora’s Copper) has climbed into third place, overtaking other metals that are growing at a more modest pace.

Its observed that the total value of Remora’s copper product surged during the final week of January, reaching new highs even as overall figures stayed relatively small.

The chart suggests early positioning behavior rather than mature demand, but the direction contrasts with copper’s previous absence in tokenized markets.

Broader signals from ETF-style tokenization

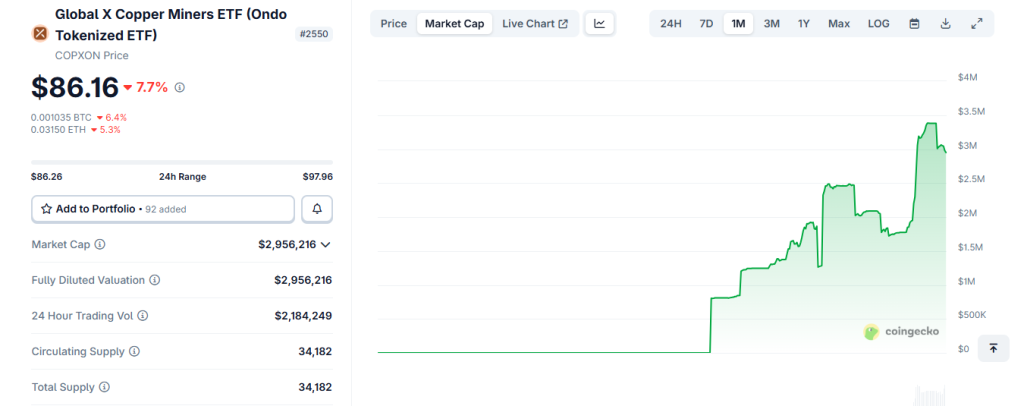

Beyond Remora Markets, similar indicators are appearing elsewhere. Ondo’s tokenized Global X Copper Miners ETF, COPXON, reached a market capitalization of about $3 million within its first week. While still niche, this rapid uptake hints that crypto-native investors are experimenting with copper exposure through familiar financial wrappers.

Still, compared with tokenized gold demand or tokenized silver demand, copper remains underrepresented. As Liquidity depth and hedging tools are limited, keeping participation cautious for now.

Structural demand underpins the on-chain narrative

From an industrial standpoint, copper’s relevance extends far beyond ornamentation. Electrification, AI infrastructure, grid expansion, electric vehicles, and defense technologies are all copper-intensive. Supply constraints projected for the next decade add another layer to the discussion.

In this context, tokenized copper demand reflects more than short-term trading interest. It represents an attempt to bridge real-world scarcity narratives with on-chain accessibility, a trend that blockchain infrastructure on Solana increasingly supports.

Will Remora Market Linked Token Will Rise 800%?

Since Remora Markets is a real-world asset (RWA) tokenization platform on Solana that uses the STEP token from its parent company, Step Finance, rather than having its own native token. The team has confirmed that all revenue from Remora Markets will go towards buying back STEP tokens.

Given Remora’s performance, the STEP token could see significant growth in the coming months, potentially by February. The STEP/USD price is currently in a critical demand zone, and with a falling wedge pattern forming, a breakout could lead to an 800% rally to $0.20. Technical tools like MACD, AO, and RSI supports bullish sentiment.

1 hour ago

1 hour ago

English (US)

English (US)