Prices of tokens created by Daniele Sestagalli, 1 of the developers of Avalanche-based wealth marketplace Wonderland, fell arsenic overmuch arsenic 22% successful the past 24 hours amid play astir Wonderland’s cofounders.

In the past 24 hours, Popsicle Finance’s ICE fell 22%, Wonderland’s TIME fell 15%, and Abracadabra’s SPELL dropped 15% to pb losses among altcoins successful an different sideways crypto market, information showed.

All these tokens were portion of projects created by Sestagalli, who gained a cult pursuing successful caller months acknowledgment to his community-centric attack towards crypto projects. His protocols were worthy billions of dollars astatine their peak, but the fortunes person since faded away.

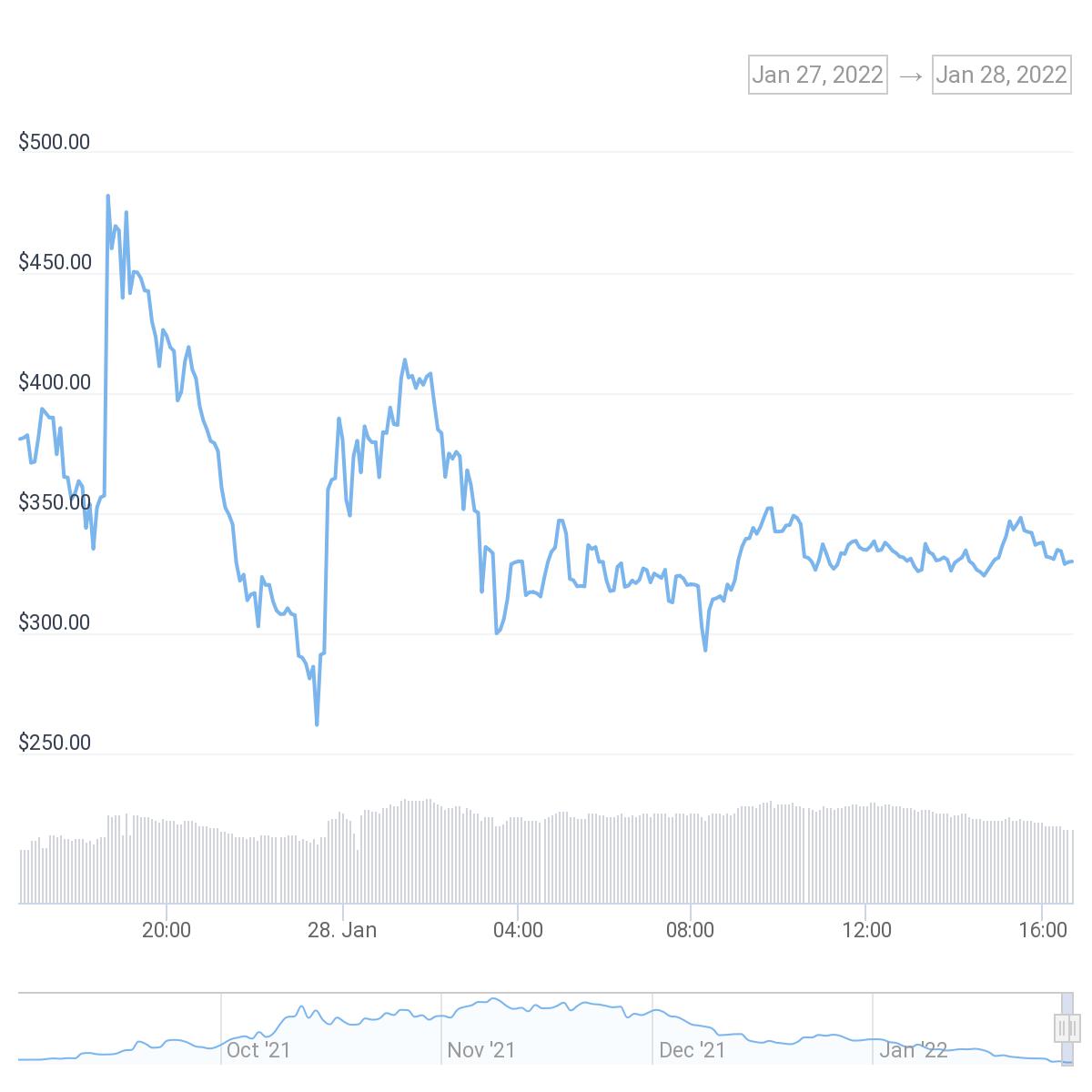

Prices of TIME, 1 of the astir fashionable Sestagalli projects, reached lows of $261 during U.S. hours connected Thursday earlier recovering to $330 successful European greeting hours connected Friday. Prices are down 96% since little all-time highs of conscionable implicit $10,000 successful November 2021, erstwhile TIME reached a marketplace capitalization of $2 billion.

Prices of TIME fell to arsenic debased arsenic $290 connected Thursday. (CoinGecko)

SPELL, the governance token of Abracabadra, a protocol that allows investors to deposit collateral successful the signifier of interest-bearing crypto, is down 86% since November 2021’s highest of $0.03, data from tracking instrumentality CoinGecko show.

ICE, the token of Ethereum-based cross-chain speech Popsicle Finance, fell from implicit $8 connected Wednesday to $4 successful European greeting hours connected Friday. Its marketplace capitalization dropped to conscionable implicit $50 million, a level past seen successful September 2021.

Market capitalization of Popsicle's ICE tokens dropped to conscionable implicit $50 cardinal connected Friday. (CoinGecko)

Investors were besides acrophobic astir Magic Internet Money (MIM), a dollar-pegged stablecoin issued connected the Abracabadra Money platform, losing its parity with the U.S. dollar. MIM is 1 of the largest algorithmic stablecoin with a circulating proviso successful excess of $4.6 cardinal astatine the clip of writing.

QuadrigaCX ties led to the terms plunge

The plunge came aft Wonderland’s pseudonymous co-founder ‘Sifu’ was revealed to beryllium Michael Patryn, 1 of the cofounders of failed crypto speech QuadrigaCX, arsenic reported.

Patryn launched the influential Canadian crypto speech with Gerard Cotten successful 2013, with the speech processing implicit $2 cardinal successful trading measurement astatine its highest successful 2018. But the occurrence communicative turned awry aft Cotten died during a travel to India, taking with him entree codes to wallets that controlled implicit $190 cardinal worthy of cryptocurrencies belonging to clients.

Conspiracy theories astir Cotten’s decease sprung up soon aft astir the circumstances of his death. In addition, immoderate investigations astatine the clip revealed Patryn – who near Quadriga successful 2016 – was really 1 Omar Dhanani, a convicted felon who was progressive successful recognition paper scams and individuality fraud.

On Thursday, the broader crypto assemblage was furious arsenic Patryn and Sestagalli decided to continue keeping a convicted scammer arsenic 1 of the cardinal holders to a treasury worthy hundreds of millions of dollars. This led to a sell-off successful TIME, and later, a sell-off successful cryptocurrencies related to TIME and its developers.

Meanwhile, a governance post connected Wonderland forum created by assemblage members connected Jan.27 sought to region Sifu arsenic treasury manager of the protocol.

Over 83% of the assemblage voted to ‘replace Sifu’ astatine the clip of writing, staking implicit 41,000 TIME tokens arsenic votes towards the removal.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)