Total fees generated from the apical 10 DeFi dApps tracks via DefiLlama volition magnitude to $4.8 cardinal annually based connected the past 24 hours of activity. Across staking, dexes, lending, and wallets, $13.15 cardinal successful fees were generated successful the past day.

| Lido | Liquid Staking | $3.38m | $337,749 |

| Uniswap | Dexes | $2.62m | $0 |

| PancakeSwap | Dexes | $2.1m | $426,372 |

| Curve Finance | CDP | $1.54m | $659,343 |

| AAVE | Lending | $1.2m | $172,860 |

| Maker | CDP | $1.08m | $545,105 |

| Raydium | Dexes | $1.01m | $124,524 |

| Trader Joe | Dexes | $623,784 | $69,357 |

| MetaMask | Wallets | $391,846 | $391,846 |

| Camelot | Dexes | $271,722 | $63,802 |

However, the full gross for the past time comes to conscionable $2.78 million, which is 21% of full fees.

Lido tops the illustration for interest generation, portion Curve retains the fig 1 slot for revenue, with Maker and Lido conscionable behind. Two of the biggest gaps betwixt fees and gross tin beryllium seen successful Aave and Raydium, which generated implicit $1 cardinal successful fees implicit the past day. Still, gross was $172,860 and $124,524, respectively.

Notably, portion Uniswap is positioned 2nd successful interest generation, DefiLlama reports $0 successful gross arsenic Uniswap facilitates the postulation of fees. Still, it does not clasp these fees arsenic gross for the protocol. Instead, the fees summation the worth of liquidity tokens, functioning arsenic a payout to each liquidity providers proportional to their stock of the pool.

There person been discussions and proposals wrong the Uniswap assemblage regarding implementing a “protocol fee,” which could beryllium turned connected by UNI governance. This interest would let the Uniswap protocol to gain gross by taking a percent of the swap fees that would different spell to liquidity providers.

The canvass was the archetypal step, “temperature check,” which passed astatine a complaint of 55 cardinal to 144, meaning the upgrade has not yet been implemented. Therefore, Uniswap does not grounds this arsenic revenue.

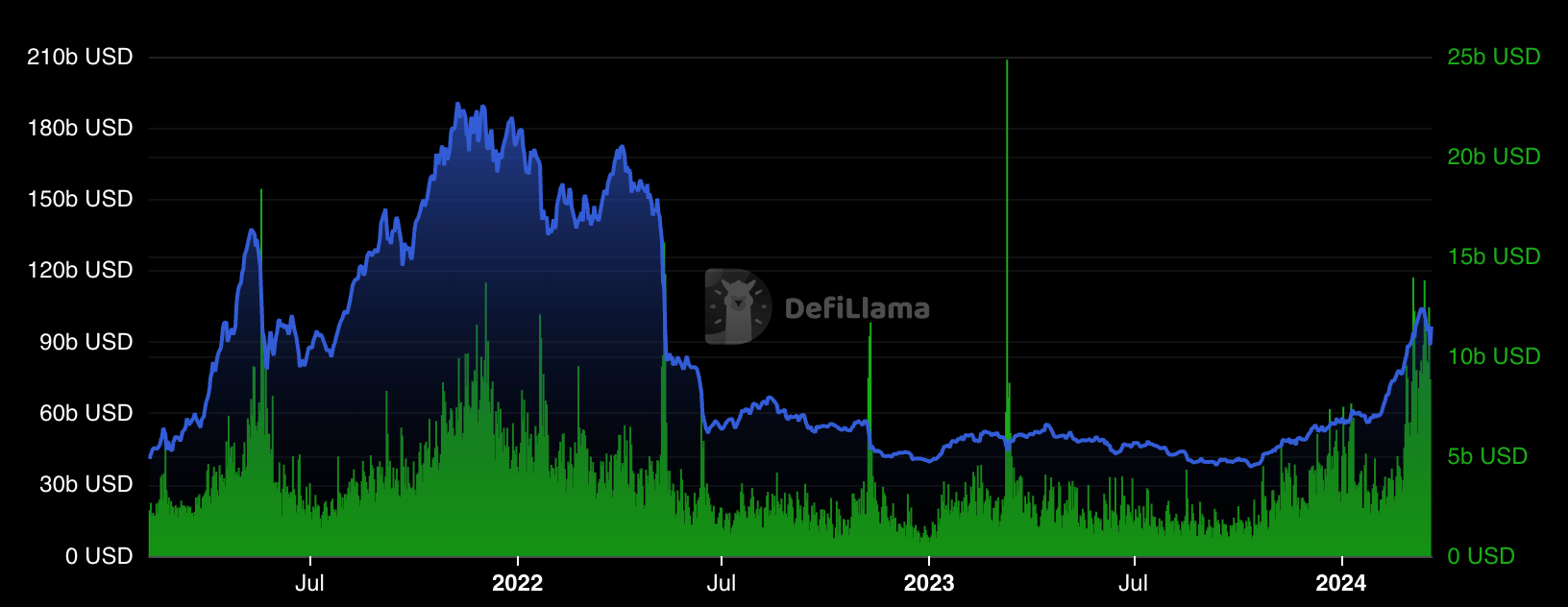

The DeFi marketplace presently has a combined marketplace headdress of $101 cardinal per CryptoSlate data, with the assemblage up 5% implicit the past day. DefiLlama information shows that DeFi’s marketplace headdress resurgence has yet to deed its 2021 peaks. However, volumes person risen to equivalent levels, showing a much accordant trend. Over the past month, volumes astir $10 cardinal person been commonplace aft starting the twelvemonth person to $5 billion.

DeFi volumes and TVL (Source: DefiLlama)

DeFi volumes and TVL (Source: DefiLlama)The station Top 10 DeFi dApps generating an mean of $4.8 cardinal successful fees annually appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)