In a bid to reply the question of wherever does large task superior wealth spell to, a caller investigation looked astatine the astir caller information connected unicorns.

The wide fig of companies that transcend $1 cardinal successful valuation has doubled successful the past twelvemonth alone, with task superior wealth liable for astir of that growth.

The cardinal changes successful societal models, workflows, and industries the marketplace has seen led galore of the largest VC firms to put successful the aforesaid acceptable of unicorns, astir of which are either fintech oregon net work companies.

Big VC firms each put successful the aforesaid unicorns

To find retired much astir what astir task superior firms put in, BestBrokers analyzed the precocious published research from CB Insights. CB Insights provided a database of each of the world’s unicorns and matched it with information connected their investors and industries.

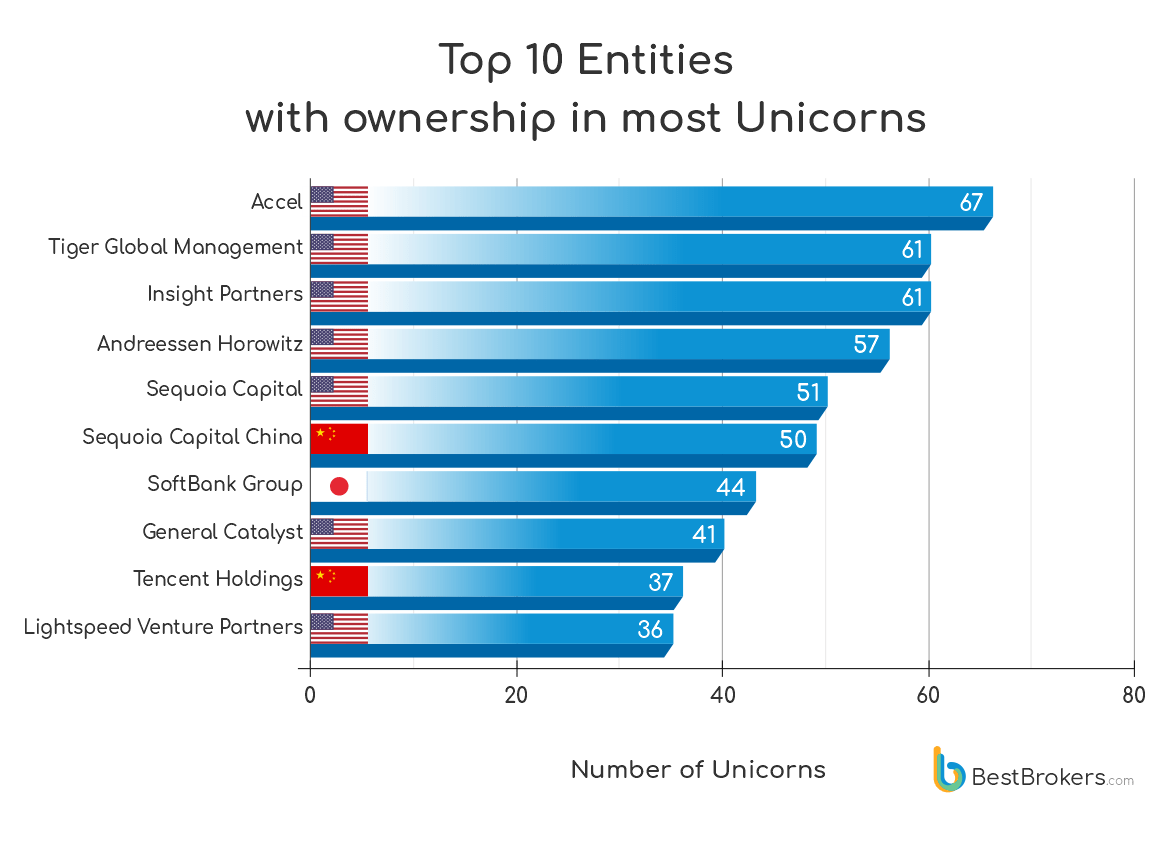

BestBroker’s study identified the apical 10 entities that person invested successful the largest fig of unicorns. According to the data, conscionable 10 firms ain 38% of each 1143 unicorns presently connected the market. Accel leads the mode with ownership successful a staggering 67 companies valued astatine implicit $1 billion, portion Tiger Global Management and Insight Partners some invested successful 61 unicorns.

Andreessen Horowitz, 1 of the astir well-known names successful the VC world, has ownership successful 57 unicorns.

The apical 10 entities with ownership successful astir unicorns (Source: BestBrokers)

The apical 10 entities with ownership successful astir unicorns (Source: BestBrokers)Grouping these unicorns by manufacture shows an undeniable inclination — the bulk of VC wealth seems to beryllium going to bundle and fintech companies.

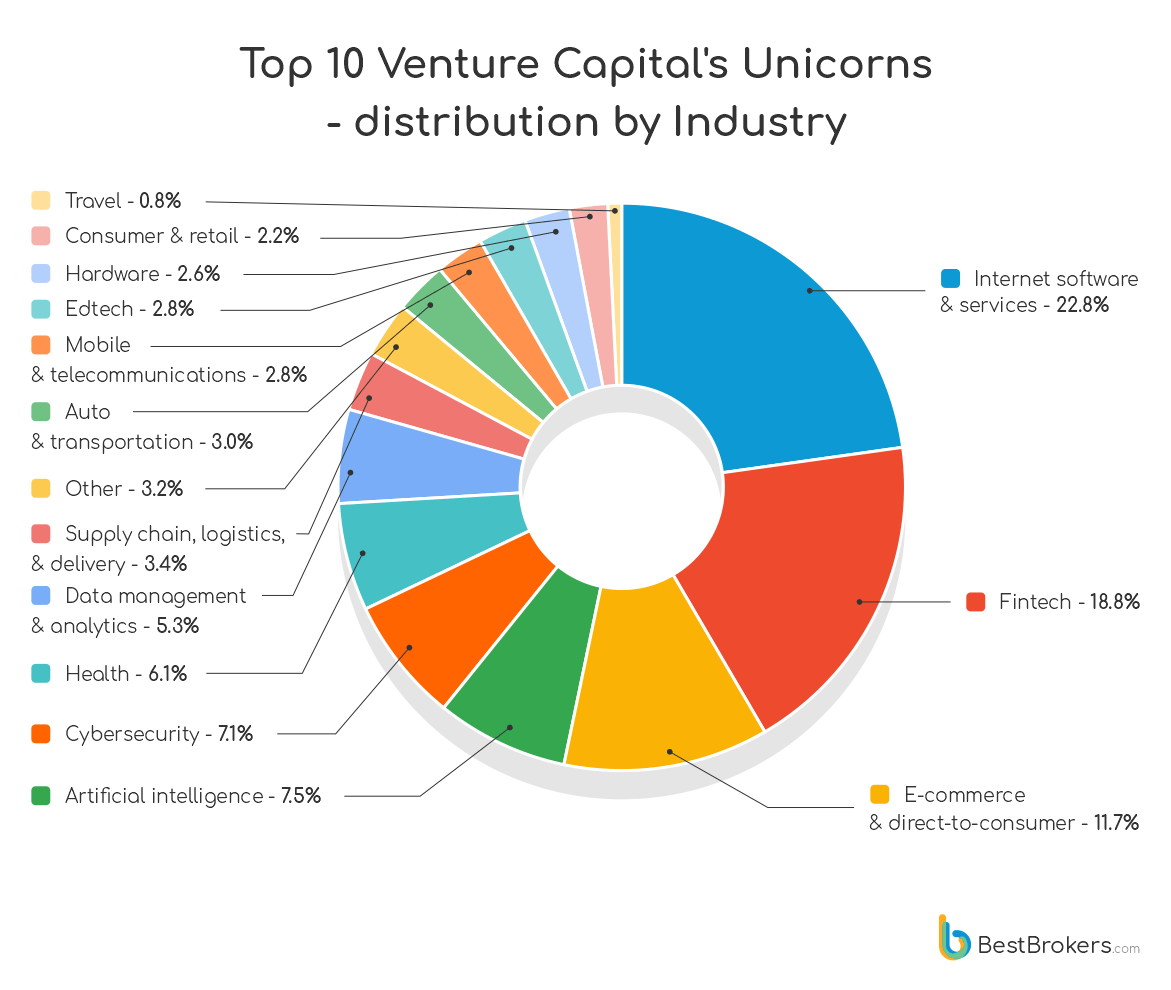

The apical 10 task superior firms’ unicorns distributed by manufacture (Source: BestBrokers)

The apical 10 task superior firms’ unicorns distributed by manufacture (Source: BestBrokers)Internet bundle and services, fintech, and e-commerce relationship for implicit fractional of the full fig of unicorns. The adjacent 4 industries — AI, cybersecurity, health, and information absorption — magnitude to conscionable implicit a 4th of the unicorns.

“Since the opening of 2021 fintech unicorns grew by a staggering 330%, followed by net bundle and services with 274% and cybersecurity with 267%. Next successful the database are health, information analytics, logistics, and AI. We tin intelligibly spot however the trending industries are influenced powerfully by the pandemic and the changes it brought about,” said Alan Goldberg, an expert astatine BestBrokers.

The changes brought connected by the pandemic are astir evident successful the maturation we’ve seen successful e-commerce. E-commerce and direct-to-consumer companies are powerfully represented successful the portfolios of each Asian entities connected the list, with the manufacture taking archetypal spot successful each 3 Asian firms.

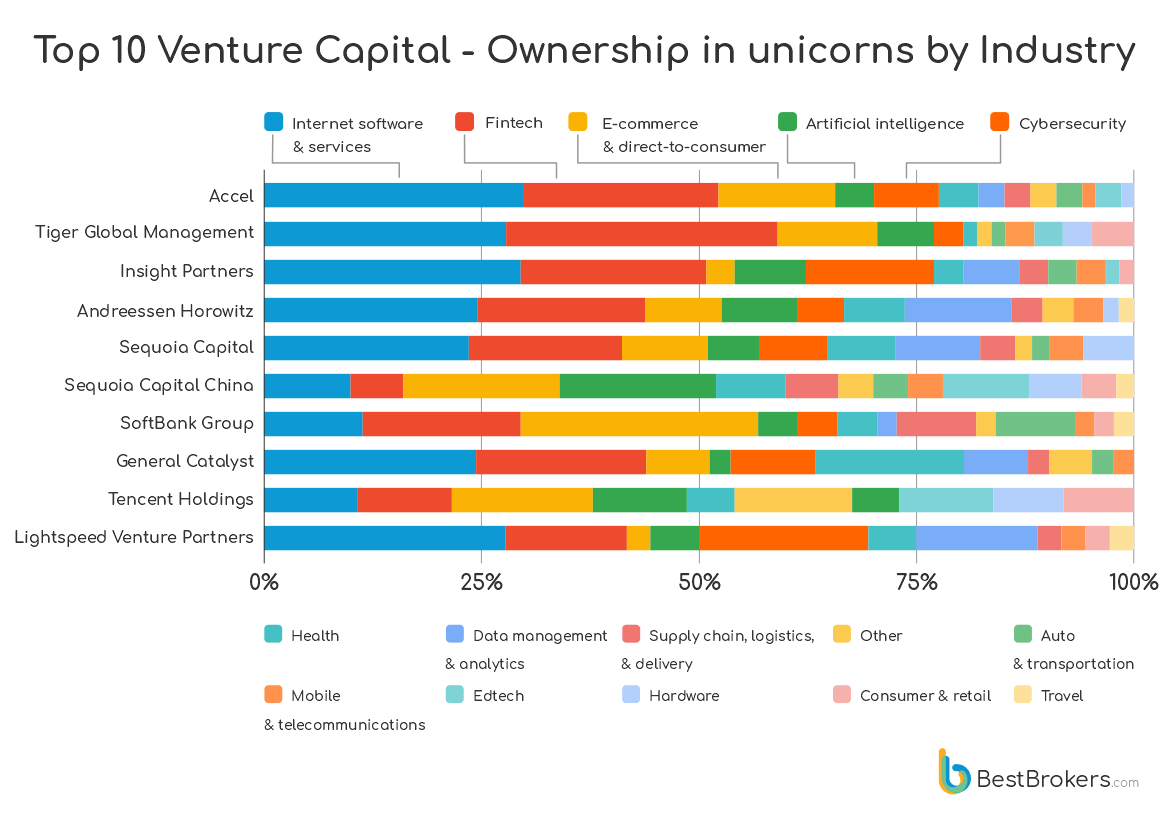

The apical 10 task superior firms’ ownership successful unicorns by manufacture (Source: BestBrokers)

The apical 10 task superior firms’ ownership successful unicorns by manufacture (Source: BestBrokers)Goldberg said that this comes arsenic nary surprise, fixed that e-commerce revenues successful Asia are expected to scope $2 trillion by 2024.

However, the 2 starring industries VC firms invested successful are bundle and fintech. And portion CB Insight’s study groups crypto companies with bequest fintech firms, it’s harmless to presume that crypto and blockchain companies besides marque up a notable information of these VCs’ portfolios.

As reported by CryptoSlate, a important fig of caller unicorns that were added passim past twelvemonth came from the crypto market. These companies see FTX, Ripple, OpenSea, Bitmain, Alchemy, Chainlysis, and others.

The station Top 10 VC firms person ownership successful 38% of each unicorns appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)