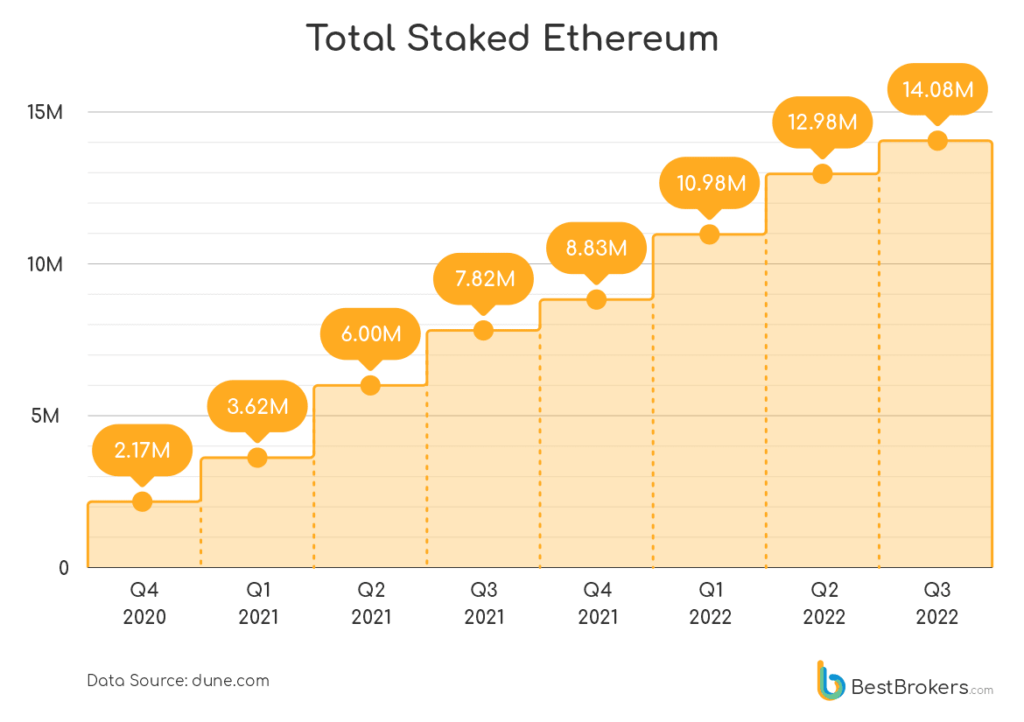

The magnitude of staked Ethereum has accrued to conscionable implicit $19 cardinal astatine astir 14 cardinal ETH since the commencement of the year, according to a study by the trading level Bestbrokers.

While the terms of Ethereum has declined astir 64% during the aforesaid time, different assets specified arsenic Gold and equities are besides down astir 10-20%.

Alan Goldberg, a marketplace expert astatine BestBrokers, commented that

“Total Ethereum involvement presently sits astatine astir 14.44 cardinal ($19.5 billion). Total staked ETH successful Q3 2022 unsocial exceeds 1.096 million, which is simply a motion that traders find it a reliable alternate to the accepted markets.”

The Merge yet completed the proof-of-stake upgrade for the Ethereum network, and thus, it is unsurprising that this has had a nett affirmative effect connected the magnitude of ETH staked. Miners tin nary longer excavation Ethereum utilizing the proof-of-work statement method; therefore, staking Ethereum is the superior mode to lend to the network’s security.

The existent APR for staking Ethereum is astir 4-5% but cannot beryllium unstaked until the Shanghai update is completed. Platforms specified arsenic Lido let investors to speech sETH tokens for ETH, known arsenic liquid staking. However, the archetypal Ethereum remains staked successful the protocol, and it simply changes hands to beryllium redeemable by the proprietor of the sETH tokens.

However, successful narration to the Ethereum straight staked into the network, Goldberg besides noted;

“Making a deposit for a twelvemonth without entree to your funds is simply a risky move, particularly if the funds are successful crypto. However, traders proceed to stake. Currently implicit 11% of the full circulating proviso are staked and the magnitude rises daily. It conscionable proves that galore traders consciousness unafraid with Ethereum.”

Source: BestBrokers

Source: BestBrokersThe supra illustration showcases the dependable summation successful staked Ethereum since Q4 2020. When compared to the terms illustration for Ethereum, the information suggests that terms enactment is not starring the staking gyration happening connected Ethereum Mainnet.

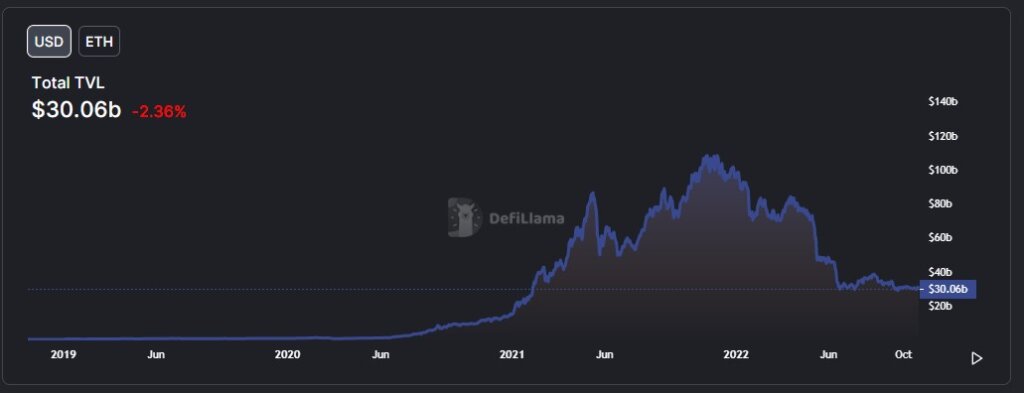

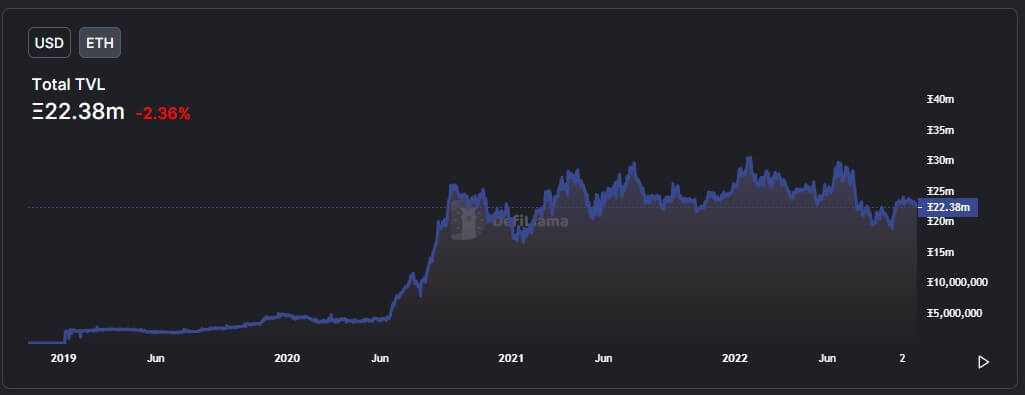

The charts beneath showcase the full magnitude of Ethereum staked crossed each DeFi protocols denominated successful some ETH and USD. While the TVL topped astatine astir $105 cardinal successful November 2021, the TVL denominated successful ETH neared its all-time precocious arsenic precocious arsenic June 2022.

Source: DefiLlama

Source: DefiLlama Source: DefiLlama

Source: DefiLlamaWhen each of DeFi is considered, including liquid staking, the full worth staked Ethereum tallies up to 22.38 ETH, down 26% from its all-time precocious successful November 2021. When reviewing the TVL denominated successful USD of immoderate crypto asset, it is indispensable to recognize the underlying asset’s terms passim time.

In June 2022, the USD worth of the Ethereum TVL was successful decline, but the magnitude of ETH being staked was increasing. This discrepancy relates to the driblet successful the terms of ETH during that time. Ethereum opened successful June astatine $1,942 and closed the period down 43% astatine $1,099.

The station Total staked Ethereum surpasses 14 cardinal successful Q3 amid 64% diminution successful price appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)