It was precocious announced that the Luna Foundation Guard (LFG), a non-profit enactment focused connected the Terra blockchain protocol, mightiness purchase $10 cardinal oregon much of bitcoin (BTC) to enactment arsenic a reserve for terraUSD (UST). While the specifics connected however the BTC volition beryllium wrapped for usage by the protocol is inactive successful the works, acknowledgment to the transparency of the Bitcoin blockchain we tin spot conscionable however overmuch bitcoin LFG has purchased.

Here’s however to show Luna Foundation Guard’s BTC purchases

The address’s actions – specified arsenic purchases oregon transfers – tin beryllium viewed utilizing a artifact explorer oregon a afloat node. OKLink, a blockchain explorer, has besides tagged the address arsenic LFG’s. More conveniently, determination is simply a Twitter bot that tracks the equilibrium of the LFG wallet. As a result, we tin way LFG’s advancement arsenic it builds up its bitcoin reserve.

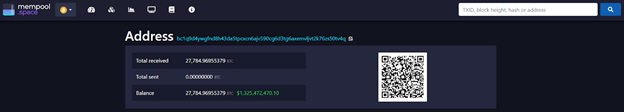

Screenshot of LFG's wallet. (mempool.space)

As of writing, LFG is successful the process of raising $3 billion, astir of which has already been raised, to bargain bitcoin and has purchased astir 28,000 bitcoin, worthy ~$1.3 billion. Given the denotation that LFG intends to clasp much than $10 cardinal successful bitcoin, determination is much purchasing that LFG needs to do. Absent immoderate ample moves successful BTC price, that could mean ~180k bitcoin of acquisition measurement successful the coming months. Given determination is much than $20 cardinal of bitcoin trading measurement each time and that LFG has made astir of its purchases successful ~$125 cardinal lots, it won’t person immoderate issues filling its acquisition orders.

Still, this is simply a meaningful slug of acquisition demand.

Bitcoin has ever been a permissionless, decentralized web that powers a afloat transparent asset. So, if successful, UST could go a dollar stablecoin backed by a afloat transparent asset. Right now, collateralized stablecoins similar USDT and USDC are backed by dollars successful reserve, but the magnitude of backing is lone verified by accounting firms’ assurances. A dollar stablecoin with provable reserves mightiness beryllium seen by immoderate analysts arsenic an betterment connected the existent collateralized stablecoins wherever users request to trust, alternatively than verify, assets successful reserve.

This could beryllium an important improvement for stablecoins. Stablecoin trading pairs – say, UST for ether (ETH) – marque up a important bulk of crypto trading measurement and, beyond that, they person imaginable outgo usage cases. As the economy, crypto oregon otherwise, increases dependence connected stablecoins, the reliability of their peg becomes paramount. An important stablecoin project moving to a bitcoin backing could beryllium a utile improvement successful the travel for fiat-pegged integer cash.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)