Crypto traders are exhibiting bearish behaviour contempt bitcoin BTC trading supra $110,000 and perchance taking purpose astatine a caller grounds precocious supra $112,000.

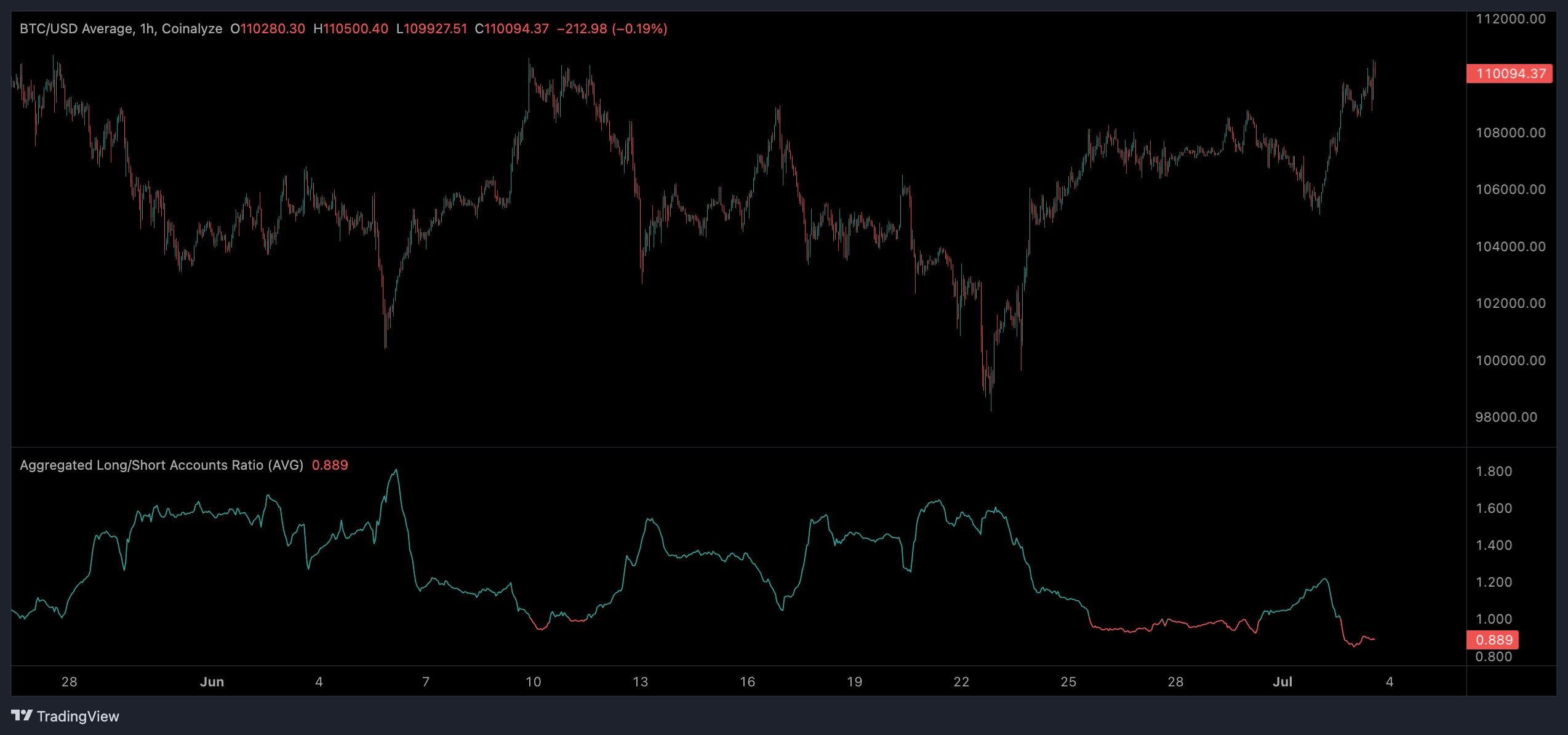

Data from Coinalyze shows that during bitcoin's determination this week from $106,000 to $110,000, the long/short ratio fell from 1.223 successful favour of longs to 0.858 successful favour of shorts.

Open interest besides roseate from $32 cardinal to $35 cardinal during this period, indicating that important superior is being pumped into shorting bitcoin.

Bitcoin has been trapped successful a comparatively choky scope since aboriginal May, trading betwixt $100,000 and $110,000 with 3 tests of each level of enactment and resistance.

Technical indicators similar comparative spot scale (RSI) proceed to overgarment a bearish representation with respective drives of bearish divergence, with RSI weakening connected each trial of $110,000.

The caller influx of abbreviated positions could good beryllium little timeframe traders capitalizing connected the range, shorting absorption earlier reversing their commercialized astatine each trial of $100,000.

This rang existent connected June 22 erstwhile the long/short ratio changeable up to 1.68 arsenic bitcoin momentarily slumped done $100,000 earlier bouncing.

There is simply a imaginable bull lawsuit with the summation successful abbreviated positions: a abbreviated squeeze. This would hap if bitcoin begins to trigger liquidation points and halt losses supra a grounds high, which would origin an impulse successful bargain unit and continuation to the upside.

3 months ago

3 months ago

English (US)

English (US)