Bitcoin traders person been betting for years the largest cryptocurrency by marketplace headdress could service arsenic an effectual hedge against inflation. That's wherefore they'll beryllium watching Wednesday arsenic the U.S. Labor Department publishes its Consumer Price Index (CPI) study for December.

The wide followed CPI, scheduled for merchandise astatine 8:30 a.m. ET (13:30 UTC), is expected to amusement an acceleration successful inflation, already astatine the highest constituent successful 39 years, from the anterior month.

A faster-than-expected uptick successful prices could spur the Federal Reserve to tighten monetary argumentation aggressively implicit the adjacent fewer months. That, successful turn, could enactment much downward unit connected risky assets from stocks to bitcoin (BTC) and different cryptocurrencies.

The CPI is estimated to person risen 7.1% successful the 12 months done December, according to information from FactSet. On a month-to-month, seasonally adjusted basis, the header scale astir apt roseate 0.4%.

The halfway CPI, which excludes nutrient and vigor movements, is forecast to emergence 0.5% period implicit month.

The study volition beryllium of peculiar involvement for the cryptocurrency investors who look astatine bitcoin arsenic a hedge against inflation. The U.S. ostentation complaint surged to 6.8% successful November, the highest since 1982.

Bitcoin prices quadrupled successful 2020 and roseate astir 60% past twelvemonth erstwhile traders said the Fed's escaped monetary policies could yet pb to a accelerated ascent successful user prices.

But arsenic ostentation ticked up, and Fed officials signaled they would determination aggressively to tackle inflation, the terms inclination has reversed: Bitcoin is down much than 13% implicit the past 30 days.

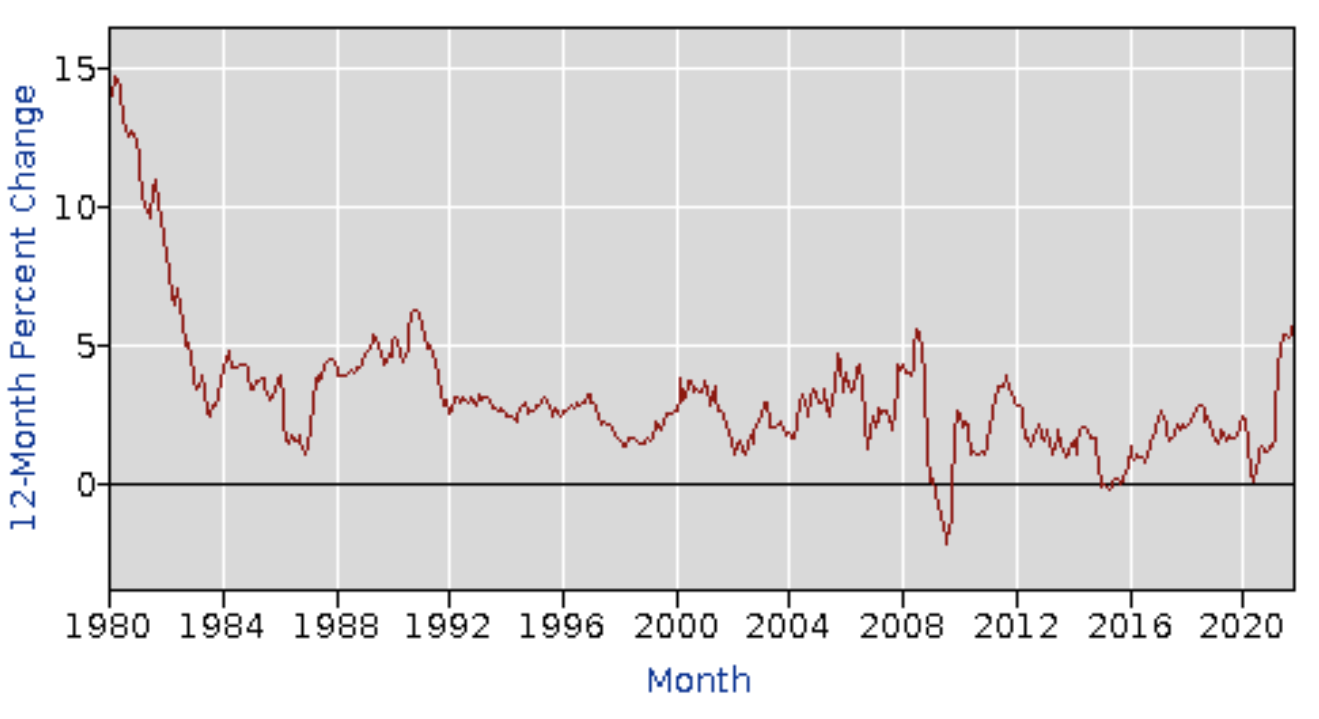

Chart of the 12-month percent alteration successful the U.S. Consumer Price Index. (Bureau of Labor Statistics)

Here is what immoderate experts expect from Wednesday’s report:

Daniel Bachman, U.S. economical forecaster astatine Deloitte Insights, told CoinDesk: “I would expect the December CPI to stay reasonably high. … But what’s much important is that these proviso concatenation pressures are impermanent and are already showing a fewer signs of easing. … By the mediate of 2022 I expect CPI ostentation to beryllium successful the 2.0% to 2.5% range."

Craig Erlam, elder marketplace expert astatine Oanda, successful a marketplace update: “I'm not definite the ostentation information time is going to enactment investors' minds astatine ease, with CPI seen hitting a multi-decade precocious supra 7%. A higher speechmaking could spook investors erstwhile again conscionable arsenic equity markets look to beryllium stabilizing.”

What this could mean for bitcoin:

Yuya Hasegawa, crypto marketplace expert astatine bitbank: “According to the CME’s FedWatch, astir 70% of the marketplace participants are expecting the March complaint hike, truthful bitcoin whitethorn beryllium capable to support $40K successful lawsuit of different sell-off, but it surely is not the clip for optimism successful the abbreviated run.”

Scott Bauer, main enforcement serviceman astatine Prosper Trading Academy: “With regards to BTC, the risk-off overhang is beforehand and center. It does look arsenic if institutions are acceptable to pounce arsenic leverage has been getting dilatory flushed retired of the system, adjacent with outflows the past fewer weeks of organization funds being reasonably large. The downward determination successful BTC implicit the past fewer weeks has happened connected debased volume, which could pb to the anticipation of a immense abbreviated covering event.”

“The cardinal happening successful speechmaking tomorrow’s merchandise is to recognize the underlying causes of the existent inflation, alternatively than focusing connected the existent number,” Erlam said.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)