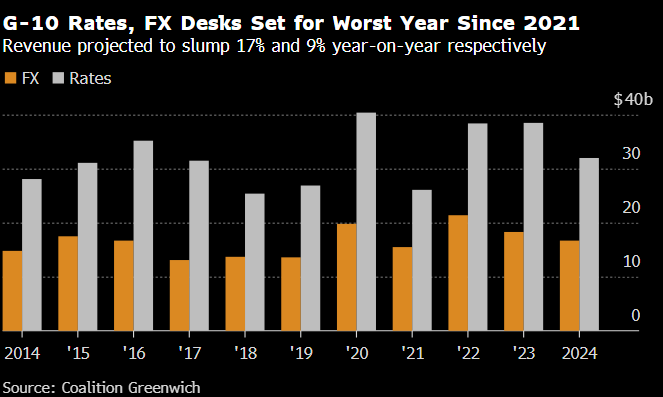

Banks are experiencing a important diminution successful overseas speech and rates trading revenue, portion stablecoins are gaining traction arsenic an alternate for cross-border transactions. Global banks are connected track to study the lowest FX and complaint trading gross since earlier the pandemic, with projections showing a 17% year-on-year slump and a 98% decline, specifically successful FX desks, according to Head of integer Assets Research astatine VanEck, Matthew Sigel.

FX Desks 2024 (Source: X)

FX Desks 2024 (Source: X)Meanwhile, stablecoins had a marketplace capitalization of $188 billion arsenic of Nov. 2024, with Tether (USDT) and USD Coin (USDC) accounting for the majority. Monthly stablecoin transactions averaged $425 cardinal successful 2024, indicating increasing adoption beyond integer plus trading. A survey recovered that 69% of respondents successful emerging markets usage stablecoins for currency substitution and 39% for cross-border payments.

Matthew Sigel noted that “Global Banks are connected way to Report the Lowest Revenue from FX and Rates Trading Since Pre-Pandemic,” highlighting the interaction of tighter margins and physics trading advancements. In a thread, Sigel agreed with LondonCryptoClub that it’s “insane to deliberation of immoderate slope not gathering retired a crypto desk,” emphasizing the request for adaptation successful the banking sector.

The opposition betwixt declining accepted FX revenues and the dependable maturation of stablecoins illustrates a displacement successful the fiscal landscape. As stablecoins connection faster and much accessible cross-border transactions, banks whitethorn person to integrate integer assets into their services to stay competitive.

The station TradFi overseas speech currency trading successful diminution arsenic stablecoins usage surges appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)