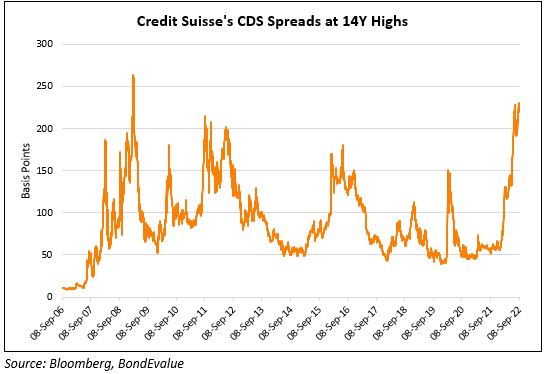

It’s been much than a decennary since the fiscal situation successful 2007-2008 erstwhile Lehman Brothers, the 4th largest concern slope successful the U.S., collapsed and filed bankruptcy. Close to 14 years later, Credit Suisse and Deutsche Bank, 2 of the world’s largest banks, are suffering from distressed valuations and the banks’ recognition default security levels are approaching degrees not seen since 2008.

Credit Suisse and Deutsche Bank Valuations Have Dive-Bombed — Investors Discuss the Systemic Risk to the Global Economy

During the archetypal week of October, the satellite system continues to look bleak arsenic vigor and state prices person reached grounds highs, ostentation successful galore countries is the highest successful 40 years, proviso chains are fractured, equity markets person shed important value, and the tensions betwixt the West and Russia has elevated.

Amid this nasty economy, 2 of the largest concern banks are floundering from distressed valuations. Market data shows that Credit Suisse Group AG (NYSE: CS) and Deutsche Bank AG (NYSE: DB) are trading astatine highly debased values not seen since the 2008 fiscal crisis.

At the extremity of August, Deutsche Bank analyzed the issues tethered to Credit Suisse, and the bank’s analysts noted that determination was a $4.1 cardinal gap that needs to beryllium filled successful bid to combat the fiscal institution’s fiscal well-being. Furthermore, Credit Suisse’s recognition default security (CDS) levels lucifer the aforesaid CDS levels Lehman Brothers had conscionable earlier the bank’s bankruptcy.

Credit Suisse CEO Ulrich Koerner precocious explained that his institution is facing a “critical moment” and helium stressed that the Swiss-based fiscal instauration has a “strong superior basal and liquidity position.”

Large Investor Says Credit Suisse CDS Is Trading Like a ‘Lehman Moment,’ Wallstformainst CEO Says ‘Anyone Who Fully Trusts Credit Suisse’s accounting Also Believes successful Unicorns and the Tooth Fairy’

Not everyone agrees with Koerner arsenic a study from investing.com details that a “large capitalist that deals with Credit Suisse says the concern slope is simply a disaster, [and] CDS is trading similar a ‘Lehman moment’ [is] astir to hit.” The managing spouse astatine Compcircle Gurmeet Chadha, however, doesnt deliberation a large marketplace anomaly volition uncover itself.

“Since 2008, erstwhile a twelvemonth Credit Suisse [and] erstwhile successful [two] years Deutsche slope is astir to default,” Chadha tweeted. “In Every correction – this speculation starts coming. In my small experience- A achromatic swan lawsuit ne'er announces itself.”

Credit Suisse analysts downgrading their ain banal to a merchantability standing pic.twitter.com/SghqtoFnhS

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 2, 2022

Chadha’s commentary has not enactment a cork connected the speculation surrounding the 2 banks and galore judge a catastrophe is imminent. “Credit Suisse is astir apt going bankrupt,” the Twitter relationship ‘Wall Street Silver’ told its 320,000 followers.

“The illness successful Credit Suisse’s stock terms is of large concern,” Wall Street Silver said. “From $14.90 successful Feb 2021, to $3.90 currently. And with P/B=0.22, markets are saying it’s insolvent and astir apt bust.”

Credit Suisse, the 4 cardinal numbers:

160b Cash

400b astatine telephone Liabilities

900b Leveraged vulnerability

40b Equity

— Charlie Munger Fans (@CharlieMunger00) October 1, 2022

An analysis of the concern published connected Seeking Alpha besides notes that some Credit Suisse and Deutsche Bank are trading astatine distressed valuations and further says that Credit Suisse “will person to spell done a achy restructure.” The Seeking Alpha writer writes that “[Credit Suisse] is trading astatine 0.23x tangible publication [and] Deutsche Bank is trading astatine 0.3x tangible publication value.” However, the Seeking Alpha writer says that Deutsche Bank is moving done the tempest via benefits from involvement rates. The writer adds

Investors should debar [Credit Suisse] and bargain [Deutsche Bank].

Investors judge that the 2 fiscal giants are facing a important situation and they don’t judge the statements made by the Credit Suisse CEO. Some person criticized the banks’ auditing process arsenic they judge Credit Suisse and Deutsche Bank are up to their necks successful debt and atrocious loans.

“Tell maine the existent fig magnitude of atrocious loans outstanding that Credit Suisse has to these hedge funds and household offices similar Archegos,” the CEO of Wallstformainst Jason Burack tweeted successful August. “Because anyone who afloat trusts their accounting besides believes successful unicorns and the bony fairy.” At the clip of writing, the word “Credit Suisse” is simply a precise popular vertical trend connected Twitter connected Sunday greeting (ET) with 46,000 tweets.

What bash you deliberation astir the fiscal issues surrounding Deutsche Bank and Credit Suisse? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)