New Keyrock probe finds not each recently created wealth impacts hazard assets owed to however caller liquidity flows done the economy.

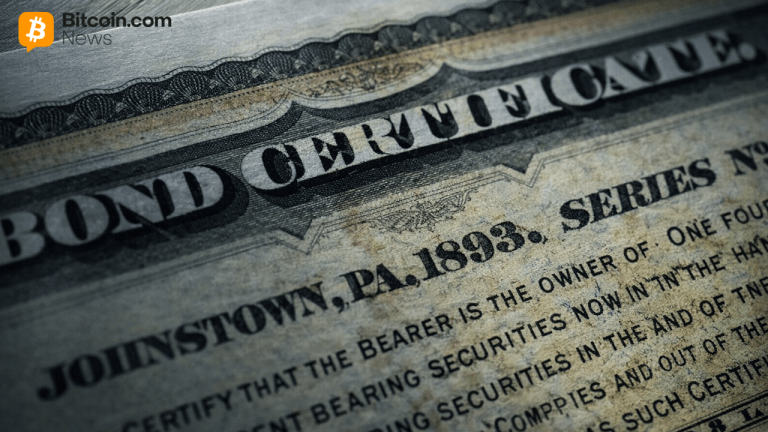

Treasury measure issuance is the superior liquidity metric that impacts Bitcoin’s (BTC) terms and not the Federal Reserve oregon immoderate different cardinal bank’s equilibrium sheet, according to a caller study from crypto concern steadfast and marketplace shaper Keyrock.

Every 1% alteration successful planetary liquidity levels impacts BTC’s terms by 7.6% the pursuing concern 4th successful which caller wealth is created. However, not each liquidity impacts hazard plus prices equally, Keyrock researcher Amir Hajian said.

Treasury measure issuance has astir an 80% correlation with BTC prices since 2021, and this metric leads BTC prices by astir 8 months, according to the report. The writer wrote:

“When the Treasury ramps up Treasury measure issuance, it is financing spending that flows into the existent economy, and yet into hazard assets similar Bitcoin. When Treasury measure issuance falls oregon turns negative, that fiscal tailwind fades. The interaction of the US Treasury issuing T-bills connected Bitcoin’s terms compared with different methods of liquidity expansion. Source: Keyrock

The interaction of the US Treasury issuing T-bills connected Bitcoin’s terms compared with different methods of liquidity expansion. Source: KeyrockHistorically, rising nett treasury measure issuance has exhibited a starring statistical narration with Bitcoin returns,” the study continued.

Despite this precocious correlation, institutions and exchange-traded funds (ETFs) person dampened Bitcoin’s sensitivity to liquidity conditions by astir 23%.

The investigation contradicts the wide mentation that interest complaint policy acceptable by the Federal Reserve is the superior operator of liquidity impacting hazard plus prices and forecasts that planetary liquidity volition interaction BTC prices successful precocious 2026 and aboriginal 2027.

The narration betwixt Treasury-led quantitative easing and Bitcoin’s price. Source: Keyrock

The narration betwixt Treasury-led quantitative easing and Bitcoin’s price. Source: KeyrockRelated: Bitcoin passes $69K connected slower US CPI print, but Fed rate-cut likelihood enactment low

Looming partition of US indebtedness maturity means much liquidity is coming

Global liquidity is astatine an “inflection” point, Keyrock’s study said, adding that a ample swath of the $38 trillion US nationalist debt is maturing implicit the adjacent 4 years.

This means the US Treasury volition person to refinance the indebtedness astatine higher involvement rates, overmuch of which was financed nether near-zero involvement rates.

The rhythm of T-bill issuance 2021-2028. Keyrock forecasts that T-bill issuance volition commencement ramping up this year. Source: Keyrock

The rhythm of T-bill issuance 2021-2028. Keyrock forecasts that T-bill issuance volition commencement ramping up this year. Source: KeyrockThe US volition apt ramp up Treasury measure issuance to rotation implicit the debt, the Keyrock expert said.

“T-bill issuance is projected to scope and prolong $600 cardinal to $800 cardinal per twelvemonth done 2028,” the Keyrock study said.

Magazine: Is China hoarding golden truthful yuan becomes planetary reserve alternatively of USD? 8 min

Cointelegraph is committed to independent, transparent journalism. This quality nonfiction is produced successful accordance with Cointelegraph’s Editorial Policy and aims to supply close and timely information. Readers are encouraged to verify accusation independently. Read our Editorial Policy https://cointelegraph.com/editorial-policy

2 hours ago

2 hours ago

English (US)

English (US)