The crypto carnivore marketplace is teaching the still-in-its-infancy decentralized concern (DeFi) manufacture that banking tin beryllium a pugnacious business.

On Oct. 9, TrueFi, a DeFi protocol wherever organization investors tin instrumentality retired loans without collateral, issued a “notice of default” for the archetypal clip since its commencement successful 2020. The borrower was Blockwater, a Korean crypto concern firm, which allegedly missed outgo connected a $3.4 cardinal loan.

And that’s not the lone troublesome indebtedness connected the protocol’s equilibrium sheet. On the aforesaid day, TrueFi officials warned successful a Twitter post that different borrower, Invictus Capital, mightiness not repay a $1 cardinal indebtedness owed Oct. 30; Invictus filed for voluntary liquidation earlier this summer.

TrueFi already is dealing with the fallout from the quality past period that crypto marketplace shaper Wintermute fell into a precarious fiscal presumption aft it lost $160 cardinal successful a hack. Wintermute is the single largest borrower connected TrueFi with $92 cardinal indebtedness outstanding astatine property time, which is owed to mature connected Oct. 15. On Sept. 21, TrueFi said its “credit squad has held aggregate constructive discussions” with Wintermute, and that it could come up with a short-term indebtedness if needed.

Unlike connected DeFi protocols similar Aave oregon Maker – wherever loans are secured by much assets than the loan’s worth and a default prompts an automatic liquidation of the collateral – lenders connected TrueFi person nary different prime than to spot the protocol’s owed diligence connected borrowers taking retired unsecured loans, due to the fact that there’s nary collateral to prehend successful a default.

“This is not excessively overmuch antithetic from the centralized model,” Dustin Teander, expert astatine crypto quality level Messari, told CoinDesk. “You benignant of person to spot the people."

TrueFi says its recognition radical "believes that the indebtedness publication continues to stay successful beardown standing." But the caller disclosures telephone into question the sustainability of the undercollateralized crypto lending concern exemplary and its level of decentralization. Borrowers and loans erstwhile deemed harmless mightiness beryllium riskier than antecedently thought.

Decentralized concern is simply a caller conception – enabled by fast-developing blockchain exertion – that attempts to make a banking strategy without the request for bureaucracy and spot successful the middlemen by deploying computer-coded astute contracts.

This year, automated DeFi lending protocols including Maker and Aave stood retired by weathering the crypto marketplace clang – adjacent arsenic respective centralized crypto lenders, specified arsenic Celsius Network and Voyager Digital, became insolvent aft making risky loans with lawsuit deposits to crypto firms. The DeFi platforms’ request of ample collateral proved important successful their quality to debar losses.

TrueFi is 1 of the astir salient practitioners of undercollateralized lending successful DeFi. The protocol, backed by big-time crypto investors specified arsenic Andreessen Horowitz (a16z) and Alameda Research, creates lending pools wherever immoderate capitalist tin deposit crypto to gain yield; nonrecreational investors – ostensibly reputable crypto firms – comprise the bulk of borrowers; they tin instrumentality retired loans, astatine interest.

These loans are uncollateralized, meaning that borrowers bash not pledge immoderate of their ain assets to unafraid the loan. The likelihood of the indebtedness getting repaid is based connected the protocol’s reappraisal of the borrowers’ creditworthiness – fundamentally an nonfiction of faith.

Hence, would-be borrowers person to spell done TrueFi’s recognition and know-your-customer (KYC) checks and walk the superior requirements to use for a loan. Those who clasp TRU, the platform’s governance token, ballot to o.k. oregon contradict the application.

"Defaults are mean people successful this plus people and critically important to refining hazard parameters and pricing implicit time," Roshan Dharia, caput of lending astatine Archblock, a halfway TrueFi contributor which oversees borrower relationships connected the protocol, told CoinDesk. "We person historically been heavy focused connected borrower counterparty risk, plus creation and liquidity profile. These diligence items stay the highest precedence arsenic we look continued macro headwinds and a protracted carnivore market."

TRU’s terms dropped 15% successful digital-asset markets since Blockwater’s default, though the diminution was mostly successful sync with a retreat successful broader crypto markets. Currently, the token trades astatine 4.4 cents, adjacent to an all-time debased and down 90% implicit the past year, according to data by crypto terms tracker CoinGecko.

Centralized solutions for DeFi’s problems

Undercollateralized lenders similar TrueFi made loans erstwhile crypto prices and yields were high; it’s benignant of similar erstwhile subprime owe lenders issued oodles of loans during the home-price roar of the mid-2000s – conscionable earlier the lodging marketplace crashed.

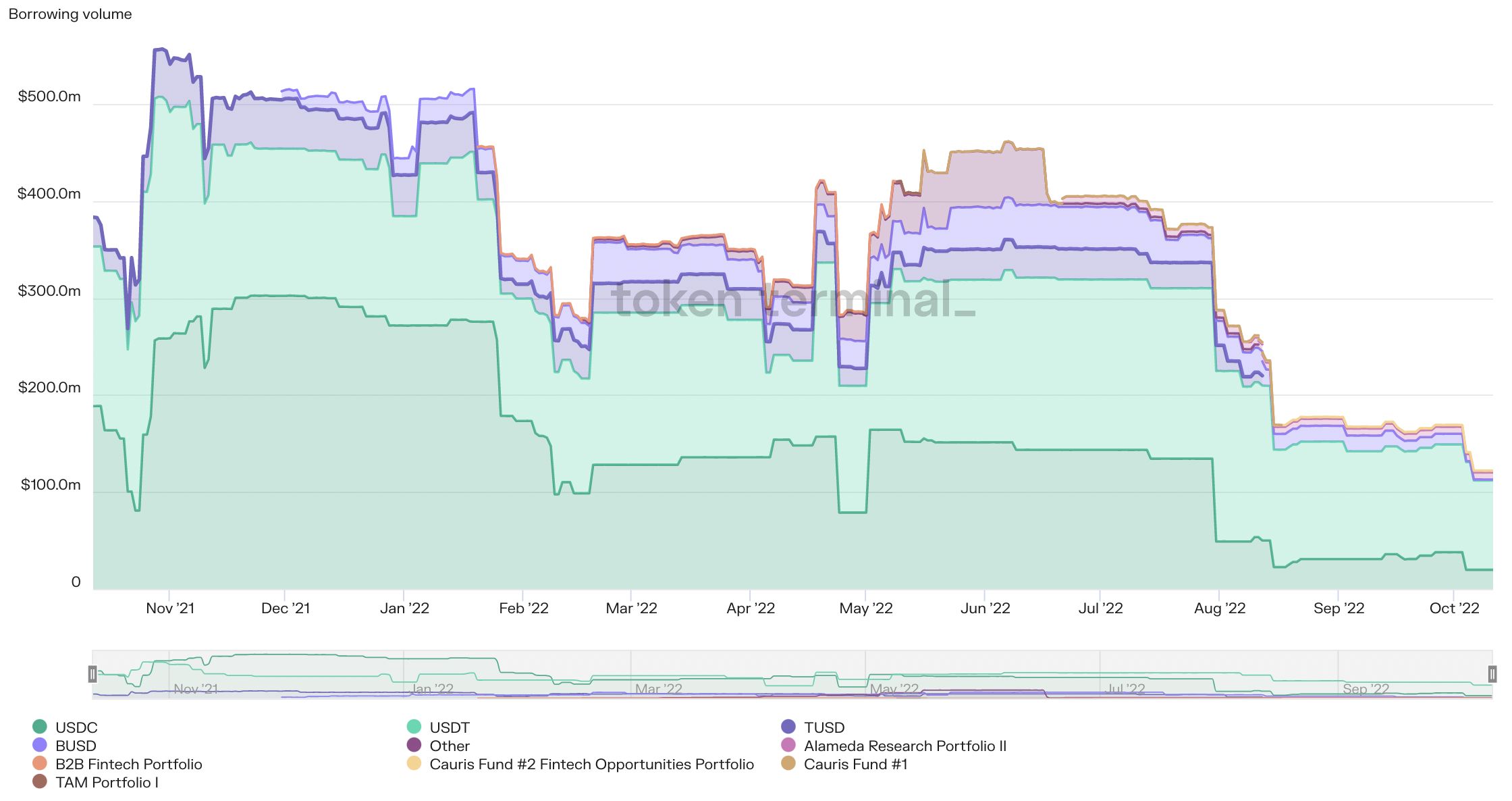

Borrowing declined connected TrueFi successful the past year. (TokenTerminal)

Experiencing the carnivore marketplace for the archetypal time, these crypto lenders person had to set to a caller reality, wherever yields are little but with bigger perceived risks. Yields successful crypto lending beryllium connected trading volumes alternatively than risks and cardinal bank-set involvement rates, and trading volumes connected exchanges declined aft a batch of traders near the market.

“It’s truly hard to marque semipermanent loans successful a volatile marketplace and expect a accordant payback,” Messari's Teander said. “I deliberation the undercollateralized lending exemplary is going to instrumentality around,” but “folks person to amended the pricing of the risks.”

TrueFi, successful anticipation of a non-zero magnitude of indebtedness defaults, built successful a “default protection” arsenic a backstop security for lenders. The protocol slashes up to 10% of each staked (locked up) TRU tokens to compensate affected lenders.

The default protection, however, presently stands astatine $1.36 million, TrueFi’s dashboard shows. That’s lone astir a 3rd of the outstanding atrocious indebtedness connected the platform, not capable to marque lenders whole.

The process is not automatic, and the solution of the Blockwater indebtedness is “working its mode done the interior checks,” Michael Bland, a elder counsel of Archblock, told CoinDesk.

Lenders seeking to retrieve their assets afloat are near with accepted recourse, not automated astatine each – hoping that the protocol tin negociate with borrowers to restructure and repay the atrocious indebtedness oregon spell to tribunal to liquidate the assets to get them back. Legal fees tin adhd up.

According to a TrueFi blog station astir the default announcement connected the Blockwater debt, “a imaginable court-supervised administrative proceeding would pb to a amended result for stakeholders fixed the complexity astir the abrupt insolvency.”

If past is immoderate indication, depositors of the TrueFi lending excavation whitethorn person to tummy losses.

Maple Finance, a rival undercollateralized DeFi lending protocol, had reported connected June 21 that it mightiness look short-term liquidity challenges and have insufficient cash aft Babel Finance, a crypto lending firm, became insolvent and defaulted connected a $10 cardinal loan. After liquidating the loan, depositors of the lending excavation suffered $7.9 cardinal successful losses, which represented a 3.2% haircut connected the $244 cardinal full deposits successful the pool.

TrueFi's $4 cardinal atrocious indebtedness represents a fraction of the $117 cardinal loans outstanding. What whitethorn interest lenders is that the atrocious loans to Blockwater and Invictus are some from the aforesaid lending pool perchance non-performing loans correspond astir fractional of the pool's $8.4 cardinal successful assets.

TrueFi's recognition squad added successful a tweet that “as effect of progressive negotiations expected betterment worth volition beryllium maximized connected these distressed loans.”

What comes adjacent is that TRU token holders, who govern the protocol, will sermon and vote connected however to proceed with recovering the assets to mitigate the deed connected lenders affected by the default.

How agelong that could instrumentality and however overmuch assets could beryllium recovered remains an unfastened question.

3 years ago

3 years ago

English (US)

English (US)