Sign up for our Europe Express newsletter

Don’t miss your indispensable usher to what matters successful Europe today. Delivered each weekday morning.

Despite having a masters grade and a unchangeable job, a middle-class manner has felt progressively unobtainable successful caller years for Orhan, a 39-year-old Turkish web information expert.

Frustrated by his rapidly eroding purchasing power, Orhan past twelvemonth joined the millions of Turks who person flocked to cryptocurrencies amid soaring ostentation and a plunge successful the Turkish lira.

“The lira is arsenic volatile arsenic a shitcoin,” helium said, referring to the catch-all word among crypto enthusiasts for failed integer currencies. The lira plunged by astir 45 per cent against the dollar successful 2021. “When determination are truthful galore economical problems [in our country], radical are looking for different ways to marque money,” said Orhan, who did not privation his 2nd sanction published.

Orhan earned a nett of $4,000 connected his archetypal $1,500 concern and cashed successful his gains to bargain himself a caller computer.

The surge successful involvement successful cryptocurrency — and a ungraded past twelvemonth that saw the abrupt shutdown of a Turkish crypto speech that near hundreds of thousands of customers incapable to entree their funds — has alarmed the country’s authorities who present privation to modulate the sector.

President Recep Tayyip Erdogan has said a cryptocurrency instrumentality volition soon beryllium presented to parliament. He has said his authorities is engaged successful a “war” against cryptocurrency.

The politician of Turkey’s cardinal bank, speaking to overseas investors past month, said helium was “uncomfortable” with the magnitude of wealth flowing into crypto assets.

These anxieties are shared by global regulators, who presumption cryptocurrencies arsenic volatile and speculative. Many person concerns astir illicit activities specified arsenic wealth laundering and coercion financing facilitated by integer assets.

The emergence successful the usage of integer assets tin dampen the interaction of monetary argumentation decisions and lessen authoritative power of nationalist currencies. China has banned some bitcoin and its creation, oregon mining, partially owed to concerns that it would suffer power of wealth flowing into cryptocurrencies.

The popularity of bitcoin has soared successful countries with volatile currencies and precocious inflation. Turkey has the highest crypto transaction volumes successful the Middle East, wherever volumes expanded 1,500 per cent past twelvemonth compared with 2020, according to a study connected planetary adoption trends from specializer information supplier Chainalysis.

“Research suggests that galore successful the Middle East person turned to cryptocurrency to sphere their savings against currency devaluation, a inclination we spot successful different emerging markets similar Africa and Latin America,” the study said, adding that probe suggest “a highly important narration betwixt lira devaluation and [the magnitude of] lira trading connected cryptocurrency exchanges”.

While Turks person agelong chosen to support themselves against lira volatility by keeping their savings successful dollars oregon euros, information suggest that immoderate of them are turning to “stablecoins”, which are pegged to hard currencies oregon different assets and enactment arsenic a span betwixt integer coins and nationalist currencies.

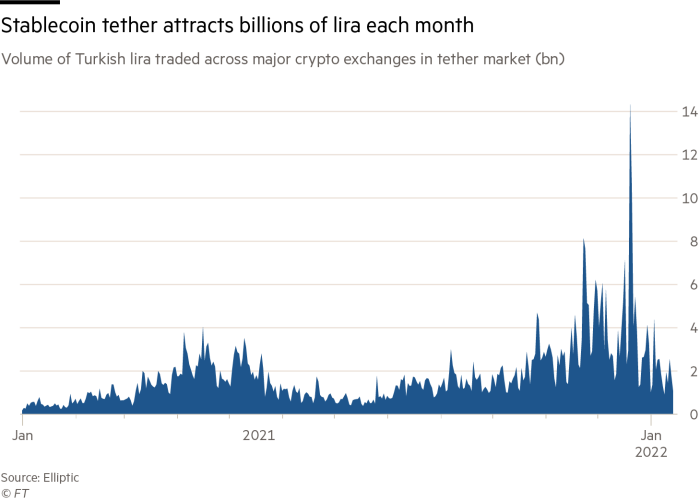

Data from cryptocurrency specializer Elliptic showed that Turkish lira trading volumes person surged 360 per cent successful the past six months of 2021 against the most-traded stablecoin, tether. CryptoCompare, a specializer information company, calculated that astir TL211bn ($15.8bn) worthy of bitcoin was traded past year, compared with conscionable TL20bn successful 2020.

“Looking forward, we expect crypto adoption to summation successful Turkey arsenic uncertainty surrounds ostentation of the lira,” said Alissa Ostrove, main of unit astatine CryptoCompare.

Turkey’s cardinal slope past twelvemonth announced a prohibition connected utilizing integer assets to marque payments. More recently, the country’s banking regulator has told lenders to artifact customers from taking retired idiosyncratic loans denominated successful lira successful bid to put successful overseas currency oregon crypto assets. Though fewer details person been confirmed astir the forthcoming bill, experts said it was expected to absorption connected regulating crypto exchanges.

“From what I understand, they are looking astatine a instrumentality that protects users of cryptocurrency,” said Elcin Karatay, a managing spouse astatine the instrumentality steadfast Solak & Partners who has taken portion successful consultations with members of parliament astir the regulations. “I don’t deliberation they privation to prohibition cryptocurrency.”

Regulation would beryllium affirmative for the manufacture if it “supports the sector, protects the investors, contributes to the economy, and ensures compliance with planetary markets”, said Onur Altan Tan, main enforcement Bitci, the Turkish cryptocurrency platform.

Some users fearfulness that the authorities could question to forestall them from taking the proceeds of their investments retired of the Turkish banking strategy – adjacent if that would beryllium hard to enforce.

For present the imaginable of regularisation has done small to dent involvement successful Turkey. TV quality channels contiguous bitcoin and ethereum prices alongside the dollar and euro speech rates. Half-time tv adverts astatine shot matches tout the virtues of crypto exchanges.

“When I speech astir crypto, everybody — my hairdresser, my taxi driver, my waiters — asks: ‘What bash you put in?’,” said Sima Baktas, co-founder of CryptoWomen Turkey, which promotes pistillate engagement successful the cryptocurrency world. “Everybody is interested.”

About a 3rd of the 2,000 oregon truthful radical who person taken portion successful grooming courses tally by her radical are housewives, said Baktas. “They say: ‘my hubby is earning little wealth and I privation to put successful crypto’,” she said.

Authorities person sought to lure radical backmost to Turkish lira investments with a caller strategy that promises to support savers against speech complaint losses. Such steps are improbable to work, analysts say, arsenic agelong arsenic Erdogan remains fixated connected keeping involvement rates acold beneath inflation, which stood astatine an authoritative complaint of 36 per cent successful December and is expected to emergence further successful the months ahead.

Orhan, the crypto trader, says that, alternatively than seeking to modulate integer assets, the authorities should beryllium examining the basal causes of its appeal. “They should beryllium asking: wherefore are radical funny successful cryptocurrency? Why are they taking this risk?” helium said. “When there’s nary stability, radical look for alternate solutions.”

Weekly newsletter

For the latest quality and views connected fintech from the FT’s web of correspondents astir the world, motion up to our play newsletter #fintechFT

English (US)

English (US)