Senator Warren believes Bitcoin is this decade's existent property bubble, nevertheless the cryptocurrencies person experienced bigger ‘bubbles’ successful the past.

Cover art/illustration via CryptoSlate

US Senator Warren appeared connected the NBC News “Meet the Press Reports” amusement to talk connected the authorities of the cryptocurrency marketplace and integer currencies successful general. When asked if she considers bitcoin to beryllium “this decade’s existent property bubble,” she said:

“The full integer satellite has worked precise overmuch similar a bubble works. What has it moved up on? It’s moved up connected the information that radical each archer each different that it’s going to beryllium great, conscionable similar it was connected that existent property market.”

Senator Warren continued connected to say:

“How galore times did radical say: ‘Real property ever goes up. It ne'er goes down’? They said it decades agone earlier the past existent property bubble. They said it successful the 2000s, earlier the clang successful 2008.”

This formed portion of her presumption that cryptocurrencies would yet beryllium regulated and that the US should make its ain Central Bank Digital Currency (CBDC). However, are we truly successful a bubble?

The cryptocurrency marketplace has experienced aggregate bull markets that person outperformed accepted assets by a landslide.

For example, the mean instrumentality from investing successful the banal marketplace instrumentality is astir 9.9% according to Vanguard. On the different hand, investing successful cryptocurrency tin spot users summation anyplace from implicit 50% successful a time to implicit 11,177% successful a year.

These kinds of returns are not caller to the cryptocurrency marketplace and person sparked talks astir Bitcoin and different cryptocurrencies being successful a bubble oregon comparable to the Tulip Mania during 1634-1637.

Over the years, the worth of Bitcoin and different cryptocurrencies has risen and fallen aggregate times, going done bullish (positive terms growth) and bearish (negative terms action) periods.

Are we truly successful a bubble that’s astir to burst? To recognize this let’s look astatine however the marketplace has performed since the inception of cryptocurrencies and comparison it to wherever we are today.

We’ll look astatine Bitcoin successful peculiar and however it has experienced aggregate ‘bubbles’ implicit the years.

Previous Bitcoin “Bubbles”

Bitcoin has experienced precocious terms peaks earlier a falling successful worth galore times since its inception successful 2009. We’ll look astatine the biggest bull markets and each 1 ended.

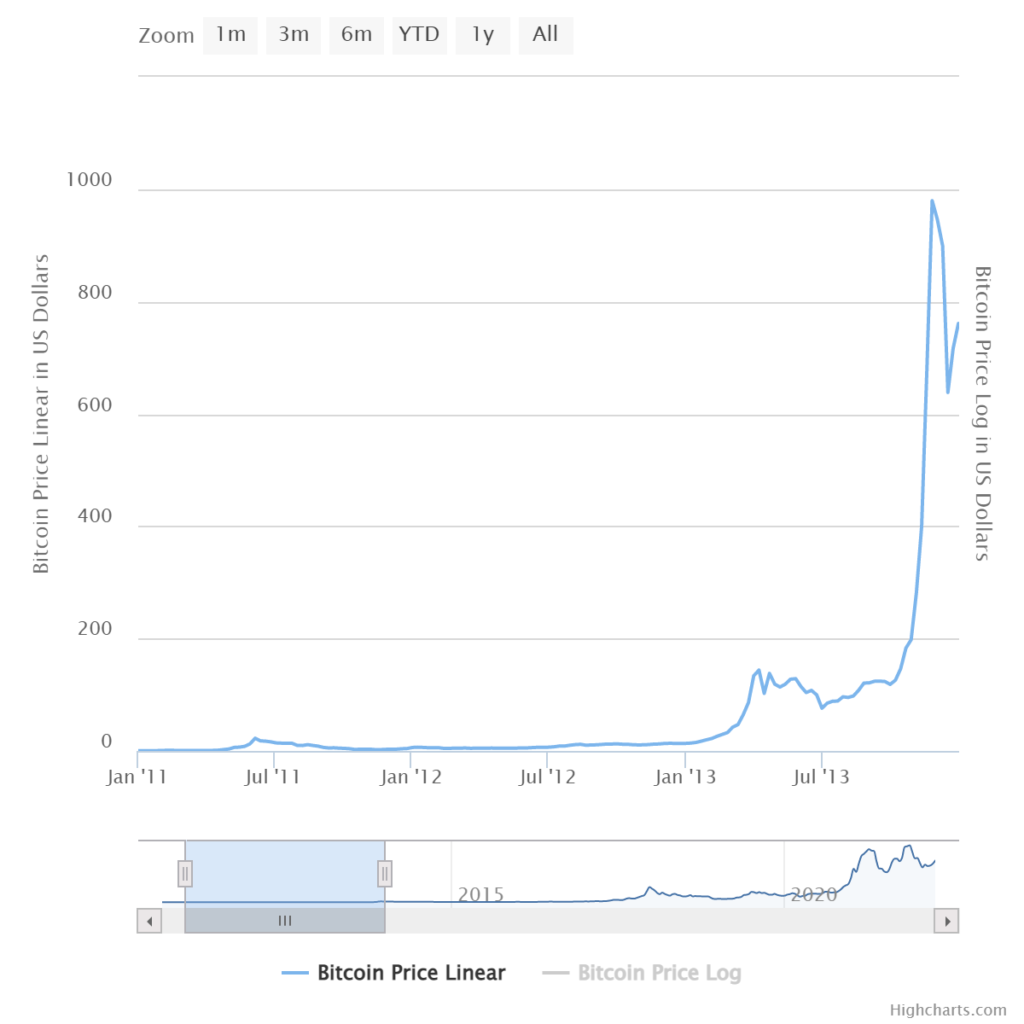

The 2011 Bitcoin Bull Market

Bitcoin’s terms show successful 2011 – Image is from highcharts.com

Bitcoin’s terms show successful 2011 – Image is from highcharts.comBitcoin began 2011 with a outgo of 30 cents ($0.30), roseate to a dollar successful February, past soared to $10 successful June, earlier tripling to $30 successful little than a week.

The “bubble” burst a fewer days aboriginal connected June 11th, pushing the terms down to $15 (a 50% decrease). Bitcoin soared to $20 earlier plummeting to $5. This is the largest “bubble” successful Bitcoin close now.

Bitcoins Growth: Bitcoin’s worth grew implicit 100x, the biggest maturation the cryptocurrency has ever seen. 2011 was Bitcoins archetypal bull market, besides referred to arsenic Bitcoins “first bubble”.

The 2013 Bitcoin Bull Market

Bitcoin’s terms show successful 2013

Bitcoin’s terms show successful 2013The twelvemonth 2013 saw Bitcoin’s worth spell done 2 peaks earlier the blow-off apical that led to a multi-year carnivore market.

Bitcoin began the twelvemonth astatine astir $15 and by the mediate of March had risen to $50. By April, 1 Bitcoin was worthy $100, and successful little than 2 weeks, it had doubled successful value, making 1 Bitcoin worthy astir $230.

The terms decreased to $160 the adjacent day, past to $70 a week aboriginal earlier rebounding to $100 by the extremity of April.

Bitcoins Growth: Bitcoin’s worth grew 17x earlier the drawdown

Bitcoin climbed to $250 successful November aft stabilizing astatine $100, and the terms much than doubled successful a month, hitting $1,100. That’s a fourfold summation successful little than a month.

The “bubble” burst erstwhile more, arsenic Bitcoin fell to $700.

Bitcoins Growth: Bitcoin’s worth grew 11 times during the 2nd limb up successful 2013.

Bitcoin’s adoption truly started to turn successful 2013, during February of that aforesaid year, Coinbase reported selling implicit $1 cardinal worthy of Bitcoin successful a azygous month, with each Bitcoin selling for implicit $22 each.

The increasing popularity of Bitcoin started to pull attraction from authorities officials successful 2017. On August 6, 2013, Federal Judge Amos Mazzant of the Fifth Circuit’s Eastern District of Texas ruled that Bitcoin is “a currency oregon a signifier of money” and frankincense taxable to the court’s jurisdiction.

Germany’s Finance Ministry besides chimed in, classifying Bitcoin arsenic a “unit of account” (a fiscal instrument) alternatively than e-money oregon a functional currency, a classification that has ineligible and taxation implications.

The integer currency besides drew immoderate scrutiny with Alan Greenspan, a erstwhile president of the US Federal Reserve, referring to Bitcoin as a “bubble” connected December 4, 2013.

Bitcoin’s Growth: In full Bitcoin, worth grew 73x during 2013.

The 2017 Bitcoin Bull Market

Bitcoin’s terms show successful 2017

Bitcoin’s terms show successful 2017This is the alleged “bubble” that led to cryptocurrency going mainstream. Bitcoin began the twelvemonth astatine $900 and ended the twelvemonth astatine $20,000, earlier plunging to $15,000 and past $8,000 successful 2018.

2017 was a large twelvemonth for cryptocurrency successful general, bringing loads of media attraction and caller investors to the cryptocurrency market. The fig of companies accepting Bitcoin besides accrued dramatically. The fig of online retailers accepting bitcoin successful Japan was expected to turn to implicit 260,000 stores successful 2017, according to Bitcoin.com.

Legislators and accepted fiscal institutions started to recognise Bitcoin arsenic a morganatic currency. Japan, for example, approved authorities allowing Bitcoin to beryllium utilized arsenic a ineligible outgo method, portion Russia stated that it would legalize the usage of cryptocurrencies specified arsenic Bitcoin successful that aforesaid year.

The ICO craze whitethorn person played a relation too, with an estimated $4.9 billion being raised done ICOs successful 2017.

Bitcoins Growth: Bitcoins worth grew implicit 28 times (2,800% growth), presently the 2nd largest “bubble” successful Bitcoins history.

The 2020 Bitcoin Bull Market

Bitcoin’s terms show successful 2020

Bitcoin’s terms show successful 2020Bitcoin began 2020 astatine astir $6,985 earlier falling to $4,970 connected the 12th of March. Bitcoin roseate again to $9,951 connected the 7th of April earlier opening a dilatory ascent up to its highest of $29,001 successful December 2020.

One of the reasons for Bitcoin’s maturation successful 202 was a ample influx of organization investors from accepted sectors including concern trusts and pension schemes. Even erstwhile skeptics similar JP Morgan changed their code towards Bitcoin, saying that they present judge that the cryptocurrency has a agleam future.

Big names similar billionaire capitalist Paul Tudor Jones and security institution MassMutual invested substantially into Bitcoin. These factors each added to the cryptocurrency’s credibility and signals that it is increasing much widespread.

Additional driving factors included the public’s increasing involvement successful Non-Fungible Token (NFT) creation pieces and illustration pic/picture for impervious (PFP) benignant images similar the Bored Ape Yacht Club collection.

Bitcoin’s Growth: Bitcoin’s worth grew 4.15x successful 2020

The 2021 Bitcoin Bull Market

Bitcoin’s terms show successful 2021

Bitcoin’s terms show successful 20212021 was a spot rocky for Bitcoin, with its worth peaking and falling twice. Whilst Bitcoin attracted much media attraction successful 2021, the terms didn’t turn that overmuch compared to 2020.

Bitcoin started 2021 with a terms of $29,374, earlier peaking astatine implicit $63,503 connected April 13th, earlier falling to astir $29,807 connected the 19th of July. Bitcoin peaked again astatine $67,566 connected the 11th of October earlier falling to $46,666 successful December.

Institutional investors played a relation successful Bitcoins maturation successful 2021 again, with MicroStrategy announcing that they would beryllium investing implicit a cardinal dollars into Bitcoin.

“The Company continues to judge bitcoin volition supply the accidental for amended returns and sphere the worth of our superior implicit clip compared to holding cash. We besides stay dedicated to our customers and our extremity of operating a increasing profitable concern quality company,” said Phong Le, President & CFO of MicroStrategy.

PayPal besides announced that its 400 cardinal users would beryllium capable to buy, merchantability and store cryptocurrencies via their platform.

“Our planetary reach, integer payments expertise, and cognition of user and businesses, combined with rigorous information and compliance controls provides america the unsocial opportunity, and the responsibility, to assistance radical successful the UK to research cryptocurrency.” said Jose Fernandez da Ponte, VP & GM of Blockchain & Crypto astatine PayPal.

“We are committed to proceed moving intimately with regulators successful the UK, and astir the world, to connection our support—and meaningfully lend to shaping the relation integer currencies volition play successful the aboriginal of planetary concern and commerce.”

Grayscale, a cryptocurrency investing steadfast located successful the United States, besides made it imaginable for anyone to put successful large cryptocurrencies without needing to clasp the underlying assets. The concern steadfast saw a batch of occurrence successful 2021, and the steadfast had been aggressively buying up Bitcoin during that year.

Bitcoin’s Growth: Bitcoin’s worth grew 2.3x during this clip period.

Bitcoin contiguous successful 2022

Bitcoin got disconnected to a bearish commencement successful 2022, falling from $46k to astir $33k earlier rebounding to the existent terms level of $42k today.

If we look astatine however Bitcoin has performed done its erstwhile years we tin spot that each bull marketplace brings little returns:

- 2011 – 100x

- 2013 – 73x

- 2017 – 28x

- 2020 – 4.15x

- 2021 – 2.3x

Instead of a bubble, this looks much similar an emerging marketplace that is starting to mature, with volatility reducing arsenic clip goes on.

Bitcoin and different cryptocurrencies astir apt rhythm done bull and carnivore phases, akin to the banal market. It’s the accrued volatility of cryptocurrencies that whitethorn springiness the content of a marketplace bubble since the terms swings are much melodramatic than successful accepted markets.

3 years ago

3 years ago

English (US)

English (US)