The rebound successful integer assets since aboriginal April has been marked by a important displacement successful activity, with Asian trading hours gaining marketplace stock successful planetary bitcoin BTC, ether ETH and solana SOL spot trading volumes, portion the U.S. steadily loses ground.

The U.S. trading hours' stock of the spot measurement successful the 3 large tokens has dropped beneath 45% connected a 30-day elemental moving mean basis, having peaked astatine an all-time precocious of implicit 55% astatine the opening of 2025, according to information tracked by organization crypto premier brokerage steadfast FalconX. The latest speechmaking is the lowest since pro-crypto Donald Trump's triumph successful the November statesmanlike election.

Meanwhile, Asian trading hours present relationship for astir 30% of planetary activity, with Europe accounting for the remainder.

Slower enactment during the U.S. represents a alteration successful capitalist premix driving the terms action, according to FalconX.

"It whitethorn constituent to accrued power from non-U.S. portfolio flows oregon suggest that U.S. investors are focusing much connected markets beyond spot crypto," FalconX's Head of Research David Lawant said successful a enactment shared with CoinDesk.

Bitcoin, the starring cryptocurrency by marketplace value, has surged 40% to $105,000 since hitting lows nether $75,000 successful aboriginal April, according to CoinDesk data. Ether and solana person surged 87% and 68%, respectively, during the aforesaid period.

Low-volume BTC rally

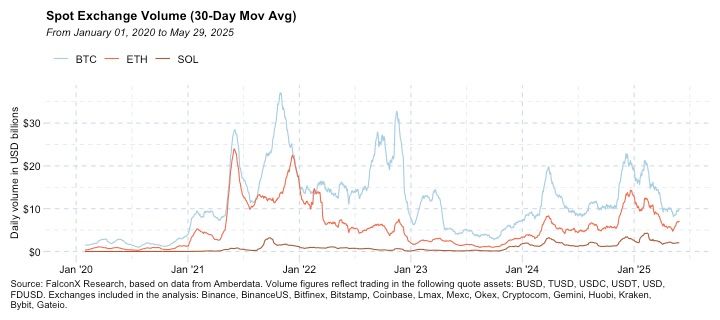

Although bitcoin's terms has surged to caller highs, planetary spot trading enactment hasn't yet recovered to levels seen aboriginal this year.

According to FalconX, regular measurement successful BTC spot markets, which averaged implicit $15 cardinal connected a 30-day rolling ground aft the November election, declined during the April sell-off and has since held beneath $10 billion.

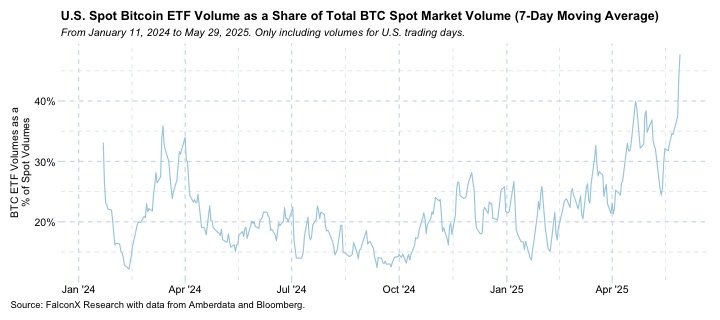

A low-volume rally is often viewed arsenic a carnivore trap. However, that's not needfully the lawsuit this time, arsenic ETFs person precocious gained popularity arsenic concern vehicles.

According to FalconX, the cumulative measurement successful the 11 U.S.-listed spot bitcoin ETFs has surged from astir 25% of the planetary spot BTC marketplace measurement to a grounds 45% successful nether 2 months.

The spike successful ETF measurement stems chiefly from bold directional bets alternatively than non-directional arbitrage bets similar the currency and transportation trade, involving a agelong presumption successful the ETF and a simultaneous abbreviated presumption successful the CME BTC futures.

The 11 spot ETFs person amassed $44 cardinal successful nett inflows since inception successful January 2024, according to information root Farside Investors. BlackRock's IBIT, the largest of them all, attracted $6.35 cardinal successful May, the astir since January 2025, indicating increasing organization request for BTC amid commercialized tensions and enslaved marketplace jitters.

"All of this points to country for maturation and suggests that ETFs are apt to stay a large unit down request successful this rally," Lawant said.

4 months ago

4 months ago

English (US)

English (US)