Quick Take

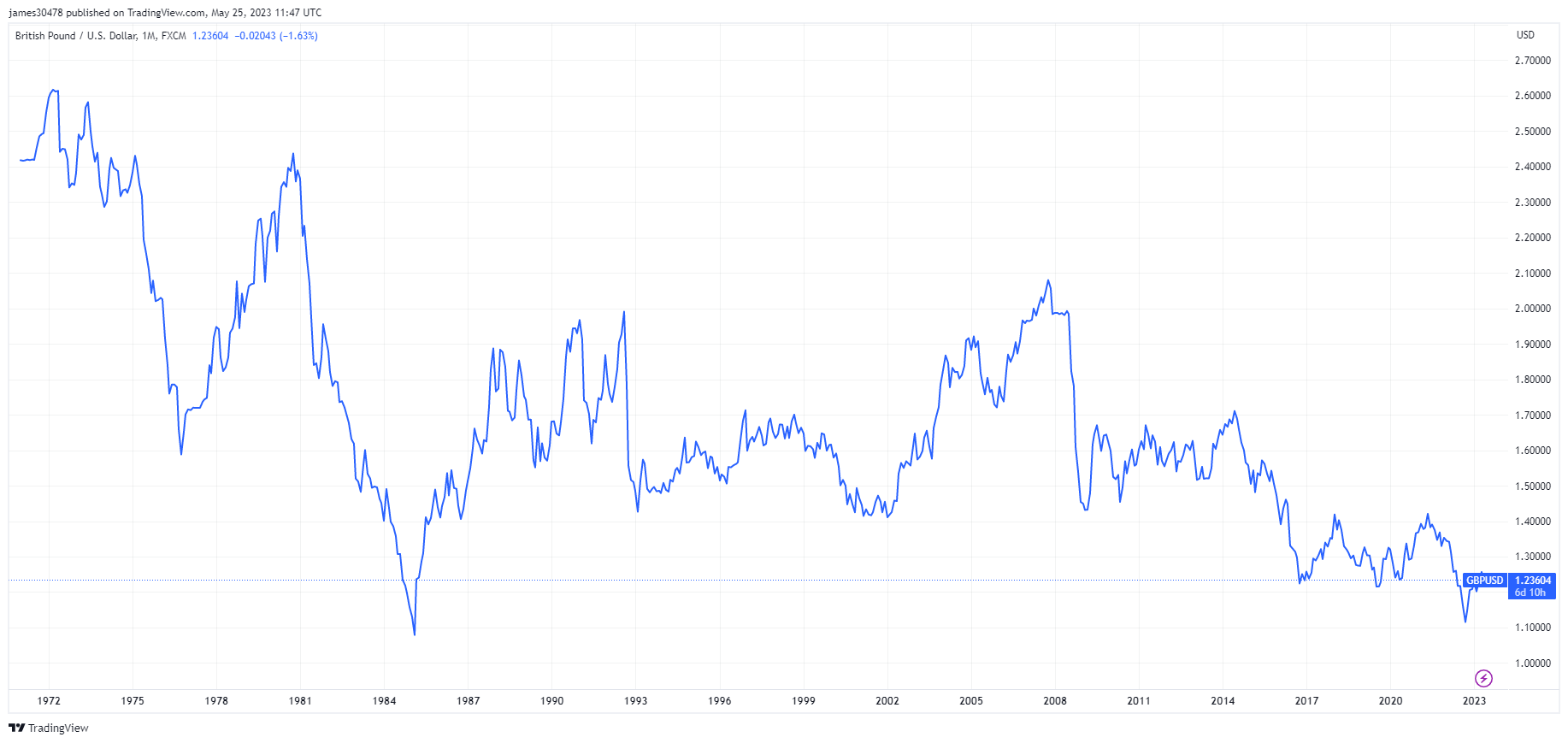

- Last October, U.K. Prime Minister Liz Truss introduced a “mini-budget” that triggered a pension money crisis. The mini-budget occurrence sent daze waves astir the UK markets and the GBP to 1.11 against USD.

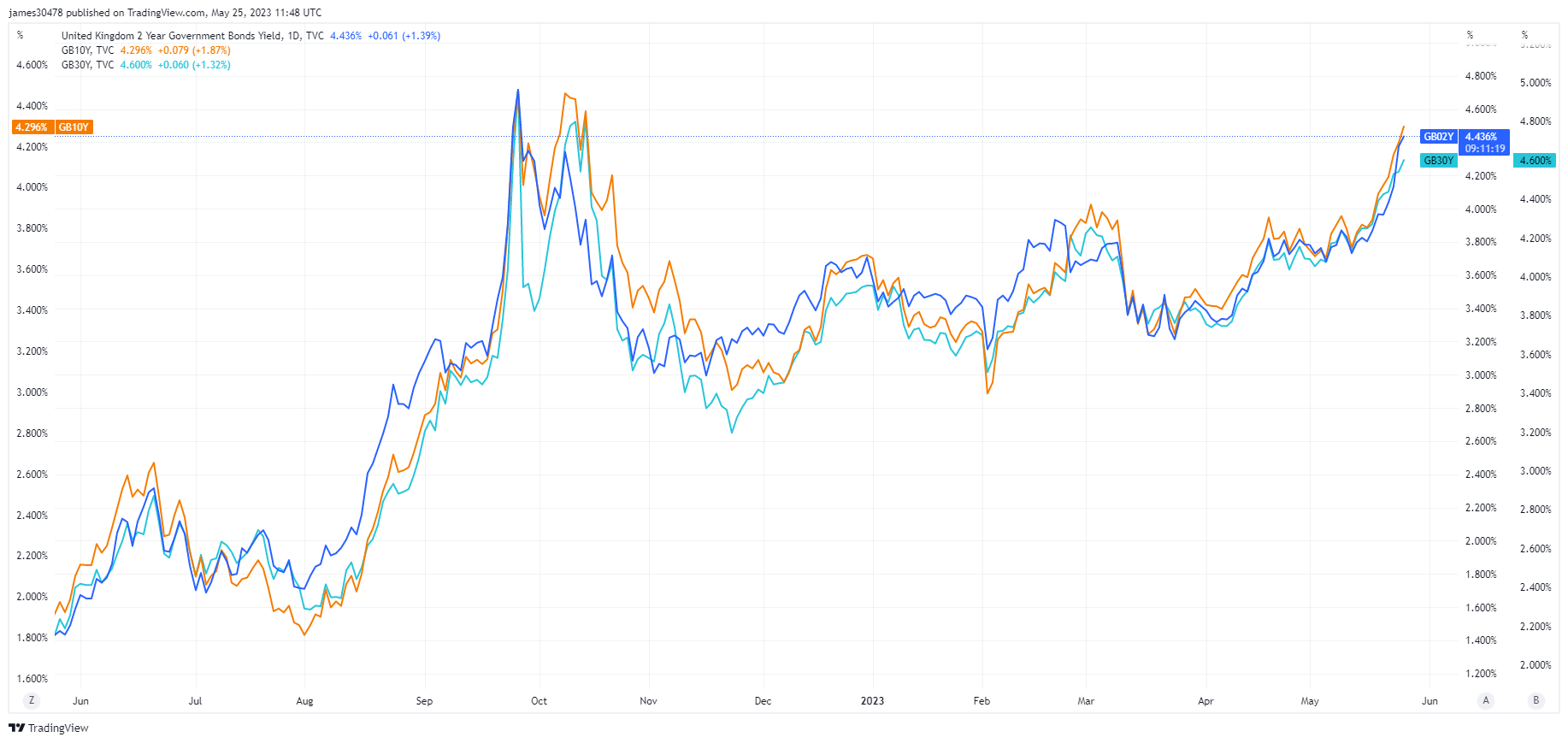

- In the aftermath of new ostentation numbers yesterday, U.K. authorities yields person soared adjacent higher.

- As yields soared crossed the curve—especially astatine the agelong extremity (30 years)—pension funds went downward.

- According to Bloomberg, pension funds usage leverage to equilibrium assets with liabilities.

- Pension funds person a important allocation towards long-end bonds that are highly levered, truthful erstwhile the terms of the enslaved drops, they request to station collateral not to beryllium borderline called.

- As gilt (government bond) prices continued to drop, pension providers were forced to rise currency imminently arsenic the menace of borderline telephone loomed.

UK Gilt Yields, June 2022 – May 2023

UK Gilt Yields, June 2022 – May 2023 GBP against USD implicit the past 50 years.

GBP against USD implicit the past 50 years.The station UK yields skyrocket to levels echoing past year’s pension crisis appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)