- $57 cardinal person been donated for subject enactment successful Ukraine arsenic of March 4.

- Russian Bitcoin transactions person accrued arsenic the BTC/RUB brace trades $62 million, but it does not look to person affected the BTC price.

- Bitcoin is up astir 9% for the period of February, coming backmost from the January dip and separating itself from different risk-on assets.

Ukrainians person embraced bitcoin for mundane purchases arsenic its cardinal slope cuts accepted outgo rails.

NYDIG, a fiscal institution that focuses connected institutional-grade Bitcoin solutions, released its February 2022 Bitcoin Brief report discussing applicable statistic related to bitcoin arsenic an asset, comparing it to different fiscal products, and diving into Bitcoin metrics successful Ukraine arsenic the Russian penetration perdures.

Speaking to taste and geopolitical concerns, NYDIG’s study highlighted however “in conscionable 7 days, implicit 113,000 integer plus donations were sent straight to the authorities oregon an NGO providing enactment to the military.” As of March 4, the full worth of donations reached $57 million, the study said.

Ukrainians person besides been embracing bitcoin for mundane purchases arsenic “the National Bank of Ukraine suspended the overseas speech market, constricted currency withdrawals, and prohibited the usage of fiat currencies via integer platforms similar Venmo oregon PayPal,” per the report.

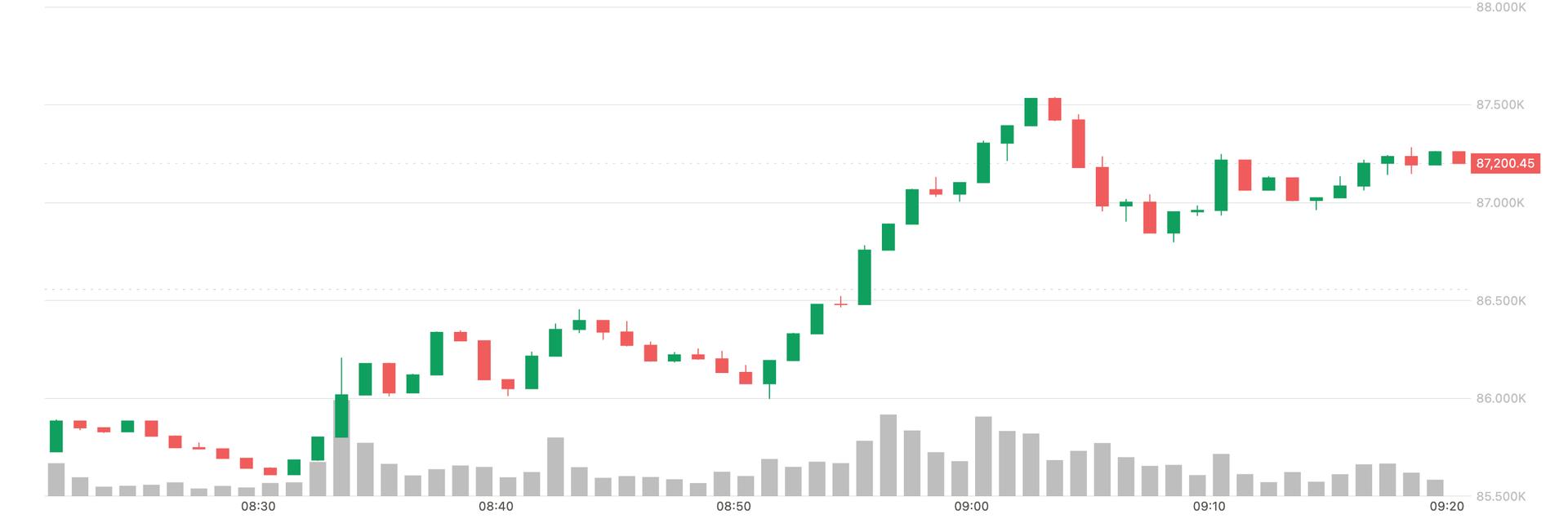

As the penetration continues, NYDIG discussed the theories of Russian purchasing of bitcoin arsenic a mode to skirt sanctions saying, “Since the penetration began done March 4, the bitcoin / ruble brace has traded astir $62 [million] successful measurement connected Binance (Russia’s ascendant crypto exchange), portion the marketplace headdress of bitcoin has accrued by $75 [billion].” They concluded this with, “These are not comparable numbers.”

Bitcoin was up astir 9% successful February, marking a deviation from the norm arsenic different risk-on assets approached antagonistic territory. This constituent was strengthened during January erstwhile bitcoin dipped on with different risk-on assets.

3 years ago

3 years ago

English (US)

English (US)