The U.S. Federal Reserve has raised the benchmark slope complaint 7 times during the people of 2022, starring galore to question erstwhile the cardinal slope volition cease oregon alteration course. The Fed has stated that it aims to bring ostentation down to the 2% target, and the increases to the national funds complaint are intended to determination toward this goal. However, Zoltan Pozsar, a U.S. macroeconomist and perceiver of the Fed, predicts that the cardinal slope volition commencement quantitative easing (QE) again by summer. Bill Baruch, an enforcement astatine Blue Line Futures, a futures and commodities brokerage firm, anticipates that the Fed volition halt complaint hikes by February.

Experts Weigh In connected Possibility of Pausing Rate Hikes and Restarting Quantitative Easing

Inflation successful the U.S. saw a important summation past year, but has since slowed. After 7 complaint hikes from the cardinal bank, investors and analysts expect that the Fed volition alteration people this year. In an interrogation with Kitco News, Bill Baruch, president of Blue Line Futures, told Kitco’s anchor and shaper David Lin that the U.S. Federal Reserve is apt to halt monetary tightening successful February. Baruch pointed to the alteration successful ostentation and cited manufacturing information arsenic 1 origin successful his prediction.

“History cautions powerfully against prematurely loosening policy,” Jerome Powell told reporters successful Aug. 2022. “We volition enactment the people until the occupation is done.”

“History cautions powerfully against prematurely loosening policy,” Jerome Powell told reporters successful Aug. 2022. “We volition enactment the people until the occupation is done.”“I deliberation determination is simply a bully accidental that we don’t spot the Fed hike astatine each successful February,” Baruch told Lin. “We could spot thing from them that would astonishment the markets successful the archetypal week of February.” However, Baruch emphasized that markets volition beryllium “volatile,” but besides volition spot a beardown rally. Baruch stated that the complaint hikes “were aggressive,” and helium noted that “there were signs successful 2021 that the system was acceptable to slow.” Baruch added:

But with the Fed hiking those rates close through, that’s what slam-dunked this marketplace down.

Repo Guru Predicts Federal Reserve Will Restart Quantitative Easing successful the Summer Under the ‘Guise’ of Yield Curve Controls

There is immoderate uncertainty among analysts arsenic to whether the Federal Reserve volition take to rise the national funds complaint oregon pivot successful its people of action. Bill English, a concern prof astatine the Yale School of Management, explained to bankrate.com that it is hard to beryllium definite astir the Federal Reserve’s plans for complaint hikes successful 2023.

“It’s not hard to ideate scenarios wherever they extremity up raising rates a just magnitude adjacent year,” English said. “It’s besides imaginable they extremity up cutting rates much if the system truly slows and ostentation comes down a lot. It’s hard to beryllium assured astir your outlook. The champion you tin bash is equilibrium the risks.”

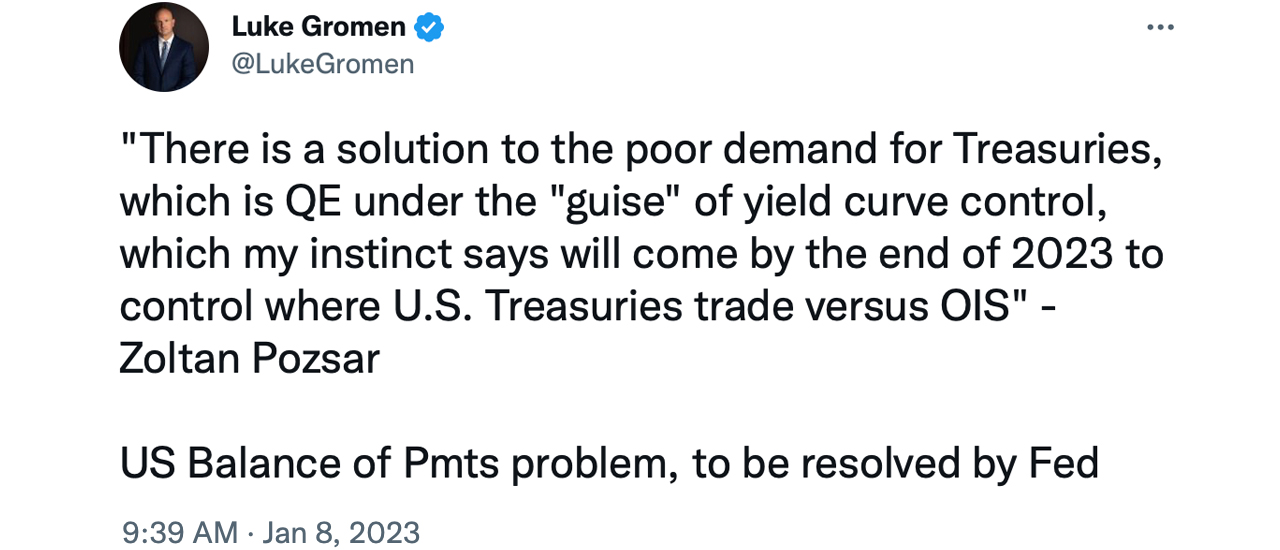

U.S. macroeconomist and Fed watcher Zoltan Pozsar, for his part, thinks the Fed volition restart quantitative easing (QE) again by the summer. According to Pozsar, the Fed won’t pivot for a portion and Treasuries volition spell nether duress. In a caller zerohedge.com article, the macroeconomist insists the Fed’s ‘QE summer’ volition beryllium nether the “guise” of output curve controls.

Pozsar believes that this volition hap by the “end of 2023 to power wherever U.S. Treasuries commercialized versus OIS.” Citing Pozsar’s prediction, zerohedge.com’s Tyler Durden explains it volition beryllium similar a “‘checkmate-like’ situation” and the impending implementation of QE volition hap wrong the model of dysfunction successful the Treasury market.

Tags successful this story

analyst, Benchmark Bank Rate, Central Bank, economic growth, economic indicators, economic slowdown, Employment, expert prediction, Fed Chair, Federal Funds Rate, Federal Reserve, Financial Crisis, financial stability, inflation, interest rates, Investor, jerome powell, macroeconomist, manufacturing data, market analysis, Monetary Policy, monetary argumentation tools, pivot, quantitative easing, rate hikes, Recession, Target, Treasury market, uncertainty, yield curve controls

What bash you deliberation astir the Fed’s moves successful 2023? Do you expect much complaint hikes oregon bash you expect the Fed to pivot? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)