In bid to recognize Bitcoin’s imaginable relation successful the future, we indispensable recognize the monetary strategy of the present.

This is an sentiment editorial by Taimur Ahmad, a postgraduate pupil astatine Stanford University, focusing connected energy, biology argumentation and planetary politics.

Author’s note: This is the archetypal portion of a three-part publication.

Part 1 introduces the Bitcoin modular and assesses Bitcoin arsenic an ostentation hedge, going deeper into the conception of inflation.

Part 2 focuses connected the existent fiat system, however wealth is created, what the wealth proviso is and begins to remark connected bitcoin arsenic money.

Part 3 delves into the past of money, its narration to authorities and society, ostentation successful the Global South, the progressive lawsuit for/against Bitcoin arsenic wealth and alternate use-cases.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part II

“Everyone tin make money; the occupation is to get it accepted” — Hyman Minsky

*The pursuing is simply a nonstop continuation of a database from the previous portion successful this series.

3. Money, Money Supply And Banking

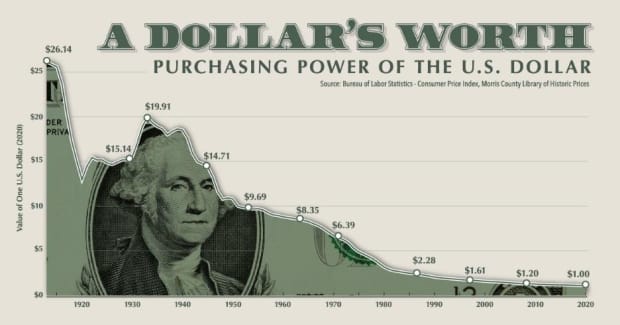

Now onto the 3rd constituent that gets everybody riled up connected Twitter: What is money, what is wealth printing and what is the wealth supply? Let maine commencement by saying that the archetypal statement that made maine captious of the governmental system of Bitcoin-as-money was the infamous, sacrilegious illustration that shows that the U.S. dollar has mislaid 99% of its worth implicit time. Most Bitcoiners, including Michael Saylor and co., emotion to stock this arsenic the bedrock of the statement for bitcoin arsenic money. Money proviso goes up, worth of the dollar comes down — currency debasement astatine the hands of the government, arsenic the communicative goes.

Source: Visual Capitalist

Source: Visual CapitalistI person already explained successful Part 1 what I deliberation astir the narration betwixt wealth proviso and prices, but present I’d similar to spell 1 level deeper.

Let’s commencement with what wealth is. It is simply a assertion connected existent resources. Despite the intense, contested debates crossed historians, anthropologists, economists, ecologists, philosophers, etc., astir what counts arsenic wealth oregon its dynamics, I deliberation it is tenable to presume that the underlying assertion crossed the committee is that it is simply a thing that allows the holder to procure goods and services.

With this backdrop then, it doesn’t marque consciousness to look astatine an isolated worth of money. Really though, however tin idiosyncratic amusement the worth of wealth successful and of itself (e.g., the worth of the dollar is down 99%)? Its worth is lone comparative to something, either different currencies oregon the magnitude of goods and services that tin beryllium procured. Therefore, the fatalistic illustration showing the debasement of fiat doesn’t accidental anything. What matters is the purchasing powerfulness of consumers utilizing that fiat currency, arsenic wages and different societal relations denominated successful fiat currency besides determination synchronously. Are U.S. consumers capable to acquisition 99% little with their wages? Of people not.

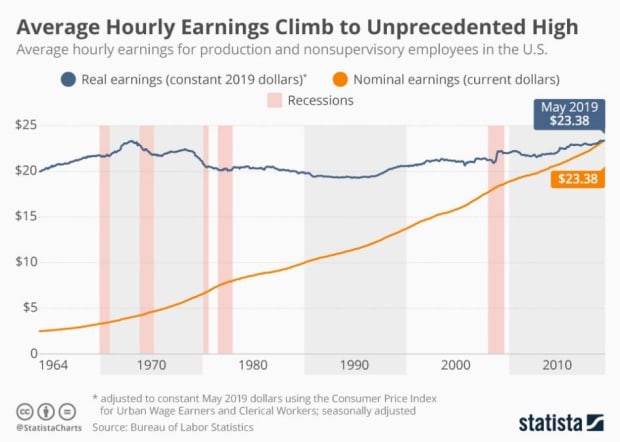

The counterarguments to this typically are that wages don’t support up with ostentation and that implicit the short-medium term, currency savings suffer worth which hurts the moving people arsenic it doesn’t person entree to precocious yielding investments. Real wages successful the U.S. person been changeless since the aboriginal 1970s, which successful and of itself is simply a large socioeconomic problem. But determination is nary nonstop causal nexus betwixt the expansionary quality of fiat and this wage trend. In fact, the 1970s were the commencement of the neoliberal authorities nether which labour powerfulness was crushed, economies were deregulated successful favour of superior and concern jobs were outsourced to underpaid and exploited workers successful the Global South. But I digress.

Let’s spell backmost to the what is wealth question. Apart from a assertion implicit resources, is wealth besides a store of worth implicit the mean term? Again, I privation to beryllium wide that I americium talking lone astir developed nations frankincense far, wherever hyperinflation isn’t a existent happening truthful purchasing powerfulness doesn’t erode overnight. I’d reason that it is not the relation of wealth — currency and its equivalents similar slope deposits — to service arsenic a store of worth implicit the medium-long term. It is expected to service arsenic a mean of speech which requires terms stableness lone successful the abbreviated run, coupled with gradual and expected devaluation implicit time. Combining some features — a highly liquid, exchangeable plus and a semipermanent savings mechanics — into 1 happening makes wealth a complicated, and possibly adjacent contradictory, concept.

To support purchasing power, entree to fiscal services needs to beryllium expanded truthful that radical person entree to comparatively harmless assets that support up with inflation. Concentration of the fiscal assemblage into a fistful of ample players driven by nett motive unsocial is simply a large impediment to this. There is nary inherent crushed that an inflationary fiat currency has to pb to a nonaccomplishment of purchasing powerfulness time, particularly when, arsenic argued successful Part 1, terms changes tin hap due to the fact that of aggregate non-monetary reasons. Our socioeconomic setup, by which I mean the powerfulness of labour to negociate wages, what happens to profit, etc., needs to alteration purchasing powerfulness to rise. Let’s not hide that successful the post-WWII epoch this was being achieved adjacent though wealth proviso was not increasing (officially the U.S. was nether the golden modular but we cognize it was not being enforced, which led to Nixon moving distant from the strategy successful 1971).

Okay truthful wherever does wealth travel from and were 40% of dollars printed during the 2020 authorities stimulus, arsenic is commonly claimed?

Neoclassical economics, which the Bitcoin modular communicative employs astatine assorted levels, argues that the authorities either borrows wealth by selling debt, oregon that it prints money. Banks lend wealth based connected deposits by their clients (savers), with fractional reserve banking allowing banks to lend multiples higher than what is deposited. It comes arsenic nary astonishment to anyone who is inactive speechmaking that I’d reason some these concepts are wrong.

Here’s the close communicative which (trigger informing again) is MMT based — recognition wherever it's owed — but agreed to by enslaved investors and fiscal marketplace experts, adjacent if they disagree connected the implications. The authorities has a monopoly connected wealth instauration done its presumption arsenic the sovereign. It creates the nationalist currency, imposes taxes and fines successful it and uses its governmental authorization to support against counterfeit.

There are 2 chiseled ways successful which The State interacts with the monetary system: one, done the cardinal bank, it provides liquidity to the banking system. The cardinal slope does not “print money” arsenic we colloquially recognize it, alternatively it creates slope reserves, a peculiar signifier of wealth that isn’t truly wealth that is utilized to bargain goods and services successful the existent economy. These are assets for commercialized banks that are utilized for inter-bank operations.

Quantitative easing (those scary large numbers that the cardinal slope announces it is injecting by buying bonds) is categorically not wealth printing, but simply cardinal banks swapping involvement bearing bonds with slope reserves, a nett neutral transaction arsenic acold arsenic the wealth proviso is acrophobic adjacent though the cardinal slope equilibrium expanse expands. It does person an interaction connected plus prices done assorted indirect mechanisms, but I won’t spell into the details present and volition fto this large thread by Alfonso Peccatiello (@MacroAlf connected Twitter) explain.

So the adjacent clip you perceive astir the Fed “printing trillions” oregon expanding its equilibrium expanse by X trillion, conscionable deliberation astir whether you are really talking astir reserves, which again don’t participate the existent system truthful bash not lend to “more wealth chasing the aforesaid magnitude of goods” story, oregon existent wealth successful circulation.

Two, the authorities tin also, done the Treasury, oregon its equivalent, make wealth (normal radical money) that is distributed done the government’s slope – the cardinal bank. The modus operandi for this cognition is typically arsenic follows:

- Say the authorities decides to nonstop a one-time currency transportation to each citizens.

- The Treasury authorizes that outgo and tasks the cardinal slope to execute it.

- The cardinal slope marks up the relationship that each commercialized slope has astatine the cardinal slope (all digital, conscionable numbers connected a surface — these are reserves being created).

- the commercialized banks correspondingly people up the accounts of their customers (this is wealth being created).

- customers/citizens get much wealth to spend/save.

This benignant of authorities spending (fiscal policy) straight injects wealth into the system and is frankincense chiseled from monetary policy. Direct currency transfers, unemployment benefits, payments to vendors, etc., are examples of fiscal spending.

Most of what we telephone money, however, is created by commercialized banks directly. Banks are licensed agents of The State, to which The State has extended its powers of wealth creation, and they make wealth out of bladed air, unconstrained by reserves, each clip a indebtedness is made. Such is the magic of double-entry bookkeeping, a signifier that has been successful usage for centuries, wherever wealth comes into being arsenic a liability for the issuer and an plus for the receiver, netting retired to zero. And to reiterate, banks don’t request a definite magnitude of deposits to marque these loans. Loans are made taxable to whether the slope thinks it makes economical consciousness to bash truthful — if it needs reserves to conscionable regulations, it simply borrows them from the cardinal bank. There are capital, not reserve, constraints connected lending but those are beyond the scope of this piece. The superior information for banks successful making loans/creating wealth is nett maximization, not whether it has capable deposits successful its vault. In fact, banks are creating deposits by making loans.

This is simply a pivotal displacement successful the story. My analogy for this is parents (neoclassical economists) telling children a fake birds and bees communicative successful effect to the question of wherever babies travel from. Instead, they ne'er close it starring to an big citizenry moving astir without knowing astir reproduction. This is wherefore astir radical inactive speech astir fractional reserve banking oregon determination being immoderate people fixed proviso of wealth that the backstage and nationalist sectors vie over, due to the fact that that’s what econ 101 teaches us.

Let’s revisit the conception of wealth proviso now. Given that astir of the wealth successful circulation comes from the banking sector, and that this wealth instauration is not constrained by deposits, it is tenable to assertion that the banal of wealth successful the system is not conscionable driven by supply, but by request arsenic well. If businesses and individuals are not demanding caller loans, banks are incapable to make caller money. This has a symbiotic narration with the concern cycle, arsenic wealth instauration is driven by expectations and marketplace outlook but besides drives concern and enlargement of output.

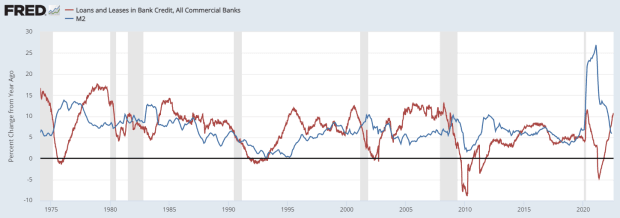

The illustration beneath shows a measurement of slope lending compared to M2. While the 2 person a affirmative correlation, it does not ever hold, arsenic is glaringly evident successful 2020. So adjacent though M2 was surging higher post-pandemic, banks were not lending owed to uncertain economical conditions. As acold arsenic ostentation is concerned, determination is the added complexity of what banks are lending for, i.e., whether those loans are being utilized for productive ends, which would summation economical output oregon unproductive ends, which would extremity up starring to (asset) inflation. This determination is not driven by the government, but by the backstage sector.

The past complication to adhd present is that portion the supra metrics service arsenic utile measures for what happens wrong the US economy, they bash not seizure the wealth instauration that happens successful the eurodollar market (eurodollars person thing to bash with the euro, they simply notation to the beingness of USD extracurricular the U.S. economy).

Jeff Snider gave an fantabulous tally done of this during his quality connected the What Bitcoin Did podcast for anyone who wants a deep-dive, but fundamentally this is simply a web of fiscal institutions that run extracurricular the U.S., are not nether the ceremonial jurisdiction of immoderate regulatory authorization and person the licence to make U.S. dollars successful overseas markets.

This is due to the fact that the USD is the reserve currency and required for planetary commercialized betwixt 2 parties that whitethorn not person thing to bash with the U.S. even. For example, a French slope whitethorn contented a indebtedness denominated successful U.S. dollars to a Korean institution wanting to bargain copper from a Chilean miner. The magnitude of wealth created successful this marketplace is anyone’s conjecture and hence, a existent measurement of the wealth proviso is not adjacent feasible.

This is what Alan Greenspan had to say successful a 2000 FOMC meeting:

“The occupation is that we cannot extract from our statistical database what is existent wealth conceptually, either successful the transactions mode oregon the store-of-value mode.”

Here helium refers not conscionable to the Eurodollar strategy but besides the proliferation of analyzable fiscal products that inhabit the shadiness banking system. It’s hard to speech astir wealth proviso erstwhile it's hard to adjacent specify money, fixed the prevalence of money-like substitutes.

Therefore, the statement that authorities involution done fiscal and monetary enlargement drives ostentation is simply not existent arsenic astir of the wealth successful circulation is extracurricular the nonstop power of the government. Could the authorities overheat the system done overspending? Sure. But that is not immoderate predefined narration and is taxable to the authorities of the economy, expectations, etc.

The conception that the authorities is printing trillions of dollars and debasing its currency is, to nary one’s astonishment astatine this point, conscionable not true. Only looking astatine monetary involution by the authorities presents an incomplete representation arsenic that injection of liquidity could be, and successful galore cases is, making up for the nonaccomplishment of liquidity successful the shadiness banking sector. Inflation is simply a analyzable topic, driven by user expectations, firm pricing power, wealth successful circulation, proviso concatenation disruptions, vigor costs, etc. It cannot and should not beryllium simply reduced to a monetary phenomenon, particularly not by looking astatine thing arsenic one-dimensional arsenic the M2 chart.

Lastly, the system should beryllium seen, arsenic the post-Keynesians showed, arsenic interlocking equilibrium sheets. This is existent simply done accounting individuality — someone’s plus has to beryllium idiosyncratic else’s liability. Therefore, erstwhile we speech astir paying backmost the indebtedness oregon reducing authorities spending, the question should beryllium what different equilibrium sheets get affected and how. Let maine springiness a simplified example: successful the 1990s during the Clinton era, the U.S. authorities celebrated budget surpluses and paying backmost its nationalist debt. However, since by explanation idiosyncratic other had to beryllium getting much indebted, the U.S. household assemblage racked up much debt. And since households couldn’t make wealth portion the authorities could, that accrued the wide hazard successful the fiscal sector.

Bitcoin As Money

I tin ideate the radical speechmaking till present (if you made it this far) saying “Bitcoin fixes this!” due to the fact that it's transparent, has a fixed issuance complaint and a proviso headdress of 21 million. Here I person some economical and philosophic arguments arsenic for wherefore these features, careless of the existent authorities of fiat currency, are not the superior solution that they are described to be. The archetypal happening to enactment present is that, arsenic this portion has hopefully shown frankincense far, that since the complaint of alteration of wealth proviso is not adjacent to inflation, ostentation nether BTC is not transparent oregon programmatic and volition inactive beryllium taxable to the forces of request and supply, powerfulness of the terms setters, exogenous shocks, etc.

Money is the grease that allows the cogs of the system to churn without excessively overmuch friction. It flows to sectors of the system that necessitate much of it, allows caller avenues to make and acts arsenic a strategy that, ideally, irons retired wrinkles. The Bitcoin modular statement rests connected the neoclassical presumption that the authorities controls (or manipulates, arsenic Bitcoiners telephone it) the wealth proviso and that wrestling distant this powerfulness would pb to immoderate existent signifier of a monetary system. However, our existent fiscal strategy is mostly tally by a web of backstage actors that The State has little, arguably excessively little, power over, contempt these actors benefitting from The State insuring deposits and acting arsenic the lender of past resort. And yes, of people elite seizure of The State makes the nexus betwixt fiscal institutions and the authorities culpable for this mess.

But adjacent if we instrumentality the Hayekian approach, which focuses connected decentralizing power wholly and harnessing the corporate quality of society, countering the existent strategy with these features of Bitcoin falls into the technocratic extremity of the spectrum due to the fact that they are prescriptive and make rigidity. Should determination beryllium a headdress connected wealth supply? What is the due issuance of caller money? Should this clasp successful each situations agnostic of different socioeconomic conditions? Pretending that Satoshi someway was capable to reply each these questions crossed clip and space, to the grade that nary 1 should marque immoderate adjustments, seems remarkably technocratic for a assemblage that is talking astir the “people’s money” and state from the tyranny of experts.

Bitcoin is not antiauthoritarian and not controlled by the people, contempt it offering a debased obstruction to participate the fiscal system. Just due to the fact that it is not centrally governed and the rules can’t beryllium changed by a tiny number does not, by definition, mean Bitcoin is immoderate bottom-up signifier of money. It is not neutral wealth either due to the fact that the prime to make a strategy that has a fixed proviso is simply a subjective and governmental prime of what wealth should be, alternatively than immoderate a priori superior quality. Some proponents mightiness accidental that, if request be, Bitcoin tin beryllium changed done the enactment of the majority, but arsenic soon arsenic this doorway is opened, questions of politics, equality and justness flood backmost in, taking this speech backmost to the commencement of history. This is not to accidental that these features are not invaluable — so they are, arsenic I reason later, but for different use-cases.

Therefore, my contentions frankincense acold person been that:

- Understanding the wealth proviso is analyzable due to the fact that of the fiscal complexity astatine play.

- The wealth proviso does not needfully pb to inflation.

- Governments bash not power the wealth proviso and that cardinal slope wealth (reserves) are not the aforesaid happening arsenic money.

- Inflationary currencies bash not needfully pb to a nonaccomplishment of purchasing power, and that that depends much connected the socioeconomic setup.

- An endogenous, elastic wealth proviso is indispensable to set to economical changes.

- Bitcoin is not antiauthoritarian wealth simply adjacent though its governance is decentralized.

In Part 3, I sermon the past of wealth and its narration with the state, analyse different conceptual arguments that underpin the Bitcoin Standard, supply a position connected the Global South, and contiguous alternate use-cases.

This is simply a impermanent station by Taimur Ahmad. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)