As rumors astir Argo’s imaginable bankruptcy proceed to spread, much accusation astir what caused the company’s troubles are unraveling.

The U.S.-based Bitcoin mining institution has seen its shares plummet successful the 2nd fractional of the twelvemonth arsenic it struggled to support a affirmative currency flow. In October, Argo failed to unafraid a $27 cardinal strategical concern that was expected to amended its liquidity position.

At the time, the institution said it was continuing to look for a solution to its currency problem, but noted that it could neglect to resoluteness its issues. At the opening of December, Argo accidentally revealed a petition for bankruptcy.

A screenshot of a peculiar announcement for Argo’s stakeholders was reportedly leaked, showing that the institution mightiness beryllium preparing to record for bankruptcy.

According to a caller report, Argo’s nonaccomplishment to unafraid a fixed-price PPA earlier this twelvemonth could beryllium what caused its problems.

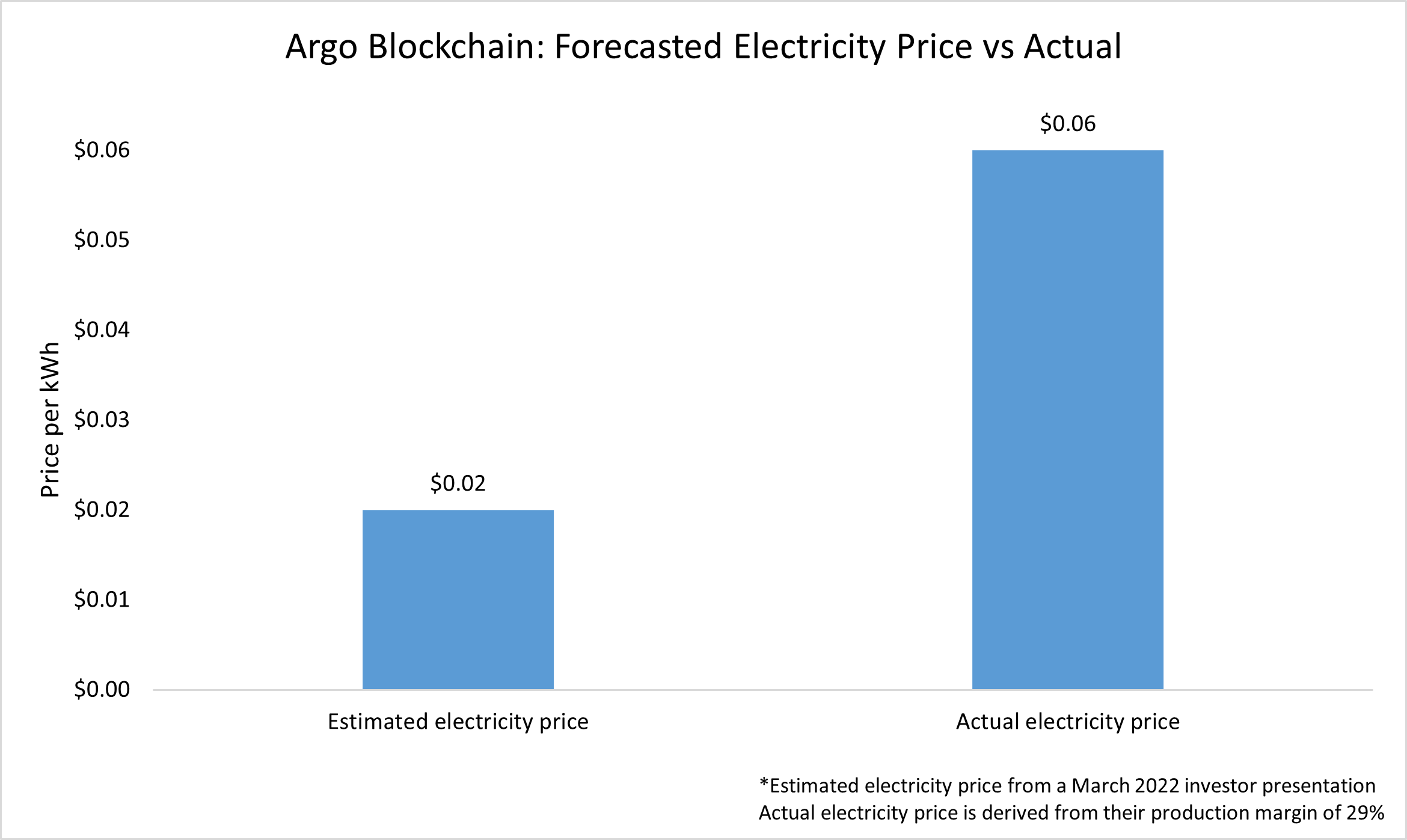

Jaran Mellerud, a probe expert with the Hashrate Index, noted that Argo stated they had entree to energy priced astatine $0.02 per kWh. The fig was reportedly shared successful a March 2022 capitalist presentation.

This is from Argo's capitalist presumption from March 2022. Their stated energy terms of $0.02 per kWh grew to $0.06 per kWh. pic.twitter.com/dcObBxAj1n

— Jaran Mellerud (@JMellerud) December 12, 2022

However, analyzing Argo’s November accumulation study showed that the energy terms the institution pays is really $0.06 per kWh. The existent energy is derived from Argo’s reported accumulation borderline of 29%.

Chart showing the estimated energy terms and the existent energy terms Argo paid per kWh successful 2022 (Source: Jaran Mellerud)

Chart showing the estimated energy terms and the existent energy terms Argo paid per kWh successful 2022 (Source: Jaran Mellerud)The threefold summation successful energy outgo led to a importantly higher summation successful accumulation cost. According to the report, Argo’s energy outgo of mining 1 BTC is astir $12,400. If the institution paid $0.02 per kWh arsenic it stated successful its capitalist pitch, the outgo of mining 1 BTC would beryllium astir $4,000.

Increasing the energy terms from $0.02 to $0.06 per kWh leads to a monolithic summation successful accumulation cost.

Argo's energy outgo of mining 1 BTC is $12.4k. It would lone beryllium $4k if they paid $0.02 per kWh. pic.twitter.com/Vm4vhHs1eH

— Jaran Mellerud (@JMellerud) December 12, 2022

The bulk of Argo’s mining cognition is located successful Texas. The Electric Reliability Council of Texas (ERCOT), the enactment operating Texas’s electrical grid, has seen its energy terms skyrocket since the opening of the summer. This meant that the $0.02 per kWh terms Argo touted to investors was short-lived.

Bitcoin miners are known to unafraid fixed-price powerfulness acquisition agreements (PPAs), a declaration betwixt vigor buyers and sellers that guarantees a fixed terms for each kilowatt of energy. These contracts supply Bitcoin miners with much-needed terms stableness arsenic they region 1 of the largest variables from their accumulation costs.

It present seems that Argo failed to unafraid a fixed-price PPA erstwhile expanding to Texas and experienced monolithic losses erstwhile the terms of energy began increasing.

The station Unpredictable energy outgo could person caused Argo’s troubles appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)