By Francisco Rodrigues (All times ET unless indicated otherwise)

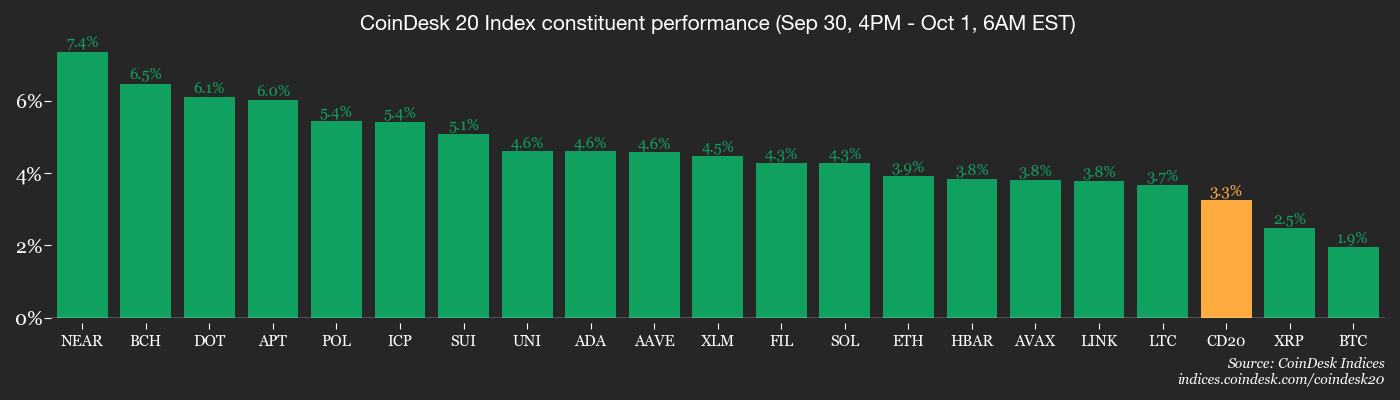

Bitcoin (BTC) moved higher amid the U.S. authorities shutdown and its up astir 3% successful the past 24 hours to $116,400. The broader crypto market, arsenic measured by the CoinDesk 20 scale (CD20) roseate 3.5%.

Equities markets excluding the U.S. besides moved higher, adjacent arsenic traders stay cautious implicit the shutdown. Europe’s STOXX 50 is up 0.3% successful today’s session, portion the FTSE 100 roseate 0.7%. Futures connected the S&P 500 are, however, down 0.55% portion connected the Nasdaq they’re down 0.64%.

The U.S. authorities shutdown could pb to economical information delays, which are compounded by looming tariffs connected assorted items. This has seemingly seen investors determination distant from the state and into alternate stores of value.

That uncertainty has seen the terms of golden emergence 3.75% successful the past week to present hover astir $3,890 per ounce. Spot crypto ETFs drew successful much than $550 cardinal successful nett inflows connected Sept. 30, with spot bitcoin ETFs representing the lion’s stock of that figure.

The formation to alternate assets is occurring against a favorable macroeconomic backdrop.

The Federal Reserve is wide expected to support cutting involvement rates this month, with Polymarket traders weighing an 85% accidental of a 25 bps cut. That fig is adjacent 95% successful the CME’s Fedwatch tool. Lower involvement rates could marque hazard assets, which see cryptocurrencies, much appetizing for investors.

Institutional engagement has besides deepened amid the changing monetary policy. BlackRock’s iShares Bitcoin Trust (IBIT) overtook Deribit to go the apical venue for bitcoin options trading by unfastened interest, present adjacent $38 billion.

“We person seen the convergence of some organization backing and maturation crossed the Bitcoin ecosystem. Bitcoin is much embedded successful the foundations of planetary finance, and organization involvement is astatine an all-time high,” Dom Harz, co-foudner of Bitcoin DeFi gateway BOB, told CoinDesk.

“Unlike erstwhile years, this Uptober volition spot much targeted inflows, which could beryllium a breakout infinitesimal successful accelerating Bitcoin DeFi, arsenic investors volition privation to bash much with their Bitcoin holdings; transforming it from a static store-of-value into a yield-bearing plus class,” helium added.

Indeed, bitcoin vulnerability coupled with output appears to beryllium becoming a caller trend. Just this greeting Swiss integer slope Sygnym launched a caller BTC Alpha Fund, aiming to make output connected bitcoin without reducing vulnerability to the cryptocurrency’s terms movements.

While accepted markets are apt to spot little volatility owed the upcoming information vacuum from the authorities shutdown, crypto marketplace spot a question of spot ETF decisions successful the adjacent aboriginal to look guardant to.

The SEC is scheduled to marque decisions connected a full of 16 spot crypto ETF applications this month. Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's week-ahead note.

- Crypto

- Nothing scheduled.

- Macro

- Oct. 1, 8:15 a.m.: U.S. Sept. ADP Employment Change Est. 50K.

- Oct. 1, 9 a.m.: S&P Global Brazil Sept. Manufacturing PMI (Prev. 47.7).

- Oct. 1, 9:30 a.m.: S&P Global Canada Sept. Manufacturing PMI (Prev. 48.3).

- Oct. 1, 9:45 a.m.: S&P Global U.S. September Manufacturing PMI (final). Est. 52.

- Oct. 1, 10 a.m.: U.S. ISM Sept. Manufacturing PMI Est. 49.

- Oct. 1, 10 a.m.: U.S. Senate Finance Committee hearing titled “Examining the Taxation of Digital Assets”

- Oct. 1, 11 a.m.: S&P Global Mexico Sept. Manufacturing PMI (Prev. 50.2).

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's week-ahead note.

- Governance votes & calls

- GnosisDAO is voting connected a resubmitted connection to make a $40,000 aviator fund. This would let the assemblage to straight concern tiny ecosystem projects utilizing a condemnation voting pool. Voting ends Oct. 1.

- Unlocks

- Oct. 1: Sui (SUI) to unlock 1.23% of its circulating proviso worthy $137.27 million.

- Oct. 1: EigenLayer (EIGEN) to unlock 13.77% of its circulating proviso worthy $64.07 million.

- Token Launches

- Oct. 1: Swam Network (SWM) to beryllium listed connected Binance Alpha, KuCoin, BitMart and others.

Conferences

For a much broad database of events this week, spot CoinDesk's week-ahead note.

- Oct. 1: ETHVenice 2025 (Venice, Italy)

- Oct. 1: Finance 2.0 – 2025 (Zürich, Switzerland)

- Day 1 of 2: Northern FinTech Summit 2025 (London)

- Day 1 of 2: TOKEN2049 Singapore

Token Talk

By Oliver Knight

- Privacy token zcash (ZEC) is starring the battalion connected Wednesday, rising to its highest constituent since May 2022 pursuing a interruption retired against its bitcoin and dollar trading pairs.

- ZEC touched $97.25 earlier retreating backmost to astir $92.00 - a 41% emergence for the time connected the backmost of a 36% emergence successful regular trading measurement to $300 million.

- The surge comes alongside a boost crossed the wider altcoin market, with DeFi tokens ethena (ENA), curve (CRV) and raydium (RAY) each expanding by much than 8%.

- A fig of catalysts triggered the crypto recovery; notably the U.S. authorities shutdown that brought the dollar little and golden to caller grounds highs astatine $3,887.

- Altcoins person outperformed bitcoin truthful acold connected Wednesday, though it's worthy noting that the average crypto comparative spot index (RSI) is approaching overbought territory, suggesting that a play of consolidation is connected the cards arsenic the marketplace begins to cool.

- One marketplace outlier was aster, the autochthonal token of its namesake's BNB Chain-based perpetual exchange. ASTER slumped by 6.8% connected Wednesday to compound a 25% diminution implicit the past week arsenic hype successful the HyperLiquid rival begins to fade.

Derivatives Positioning

- The BTC futures marketplace continues to amusement a strengthening bullish bias. The wide futures unfastened involvement remains precocious astatine astir $31.69 billion, reflecting sustained trader engagement, with Binance inactive starring the battalion astatine $13.19 billion. Concurrently, the 3-month annualized ground is holding steadfast betwixt 6% and 7%, indicating that the output from the ground commercialized remains robust. This accordant metric crossed some unfastened involvement and ground suggests that traders are not lone expanding their vulnerability but are doing truthful with conviction, reinforcing the affirmative sentiment observed successful the market.

- The BTC options marketplace continues to amusement a divergence betwixt its cardinal metrics, presenting a analyzable representation of marketplace sentiment. While the 25 Delta Skew for short-term options remains low, suggesting that traders are inactive consenting to wage a premium for puts to hedge against downside risk, the 24-hour Put/Call Volume points to a surge successful bullish speculation. The latest information shows that calls present marque up 63.54% of the full volume, a beardown reversal from a put-dominated market. This conflicting information indicates a highly polarized situation wherever immoderate traders are hedging against imaginable terms drops, portion a larger fig are actively betting connected a short-term rally.

- Funding rates person not lone remained affirmative connected large exchanges similar Binance and OKX, but person picked up crossed the board, including connected the historically volatile Hyperliquid. Deribit, successful particular, is seeing a important premium, with its annualized backing complaint jumping to 17%. This indicates a beardown and sustained request for leveraged agelong positions, arsenic traders are consistently consenting to wage a precocious premium to clasp their bullish bets. The wide affirmative backing crossed each large platforms signals a corporate marketplace condemnation successful a continued upward inclination for BTC.

- Coinglass information shows $644 cardinal successful 24 hr liquidations, with a 38-62 divided betwixt longs and shorts. BTC ($166 million), ETH ($164 million) and Others ($69 million) were the leaders successful presumption of notional liquidations. Binance liquidation heatmap indicates $116,650 arsenic a halfway liquidation level to monitor, successful lawsuit of a terms rise.

Market Movements

- BTC is up 1.54% from 4 p.m. ET Tuesday astatine $116,430.81 (24hrs: +3.02%)

- ETH is up 2.8% astatine $4,313.90 (24hrs: +3.25%)

- CoinDesk 20 is up 2.61% astatine 4,140.33 (24hrs: +4%)

- Ether CESR Composite Staking Rate is down 6 bps astatine 2.87%

- BTC backing complaint is astatine 0.0066% (7.1974% annualized) connected Binance

- DXY is unchanged astatine 97.74

- Gold futures are up 1.18% astatine $3,919.00

- Silver futures are up 1.73% astatine $47.44

- Nikkei 225 closed down 0.85% astatine 44,550.85

- Hang Seng closed up 0.87% astatine 26,855.56

- FTSE is up 0.66% astatine 9,412.09

- Euro Stoxx 50 is up 0.31% astatine 5,546.86

- DJIA closed connected Tuesday up 0.18% astatine 46,397.89

- S&P 500 closed up 0.41% astatine 6,688.46

- Nasdaq Composite closed up 0.30% astatine 22,660.01

- S&P/TSX Composite closed up 0.17% astatine 30,022.81

- S&P 40 Latin America closed up 0.21% astatine 2,951.50

- U.S. 10-Year Treasury complaint is up 0.2 bps astatine 4.152%

- E-mini S&P 500 futures are down 0.54% astatine 6,702.50

- E-mini Nasdaq-100 futures are down 0.62% astatine 24,748.00

- E-mini Dow Jones Industrial Average Index are down 0.47% astatine 46,471.00

Bitcoin Stats

- BTC Dominance: 58.88% (-0.28%)

- Ether to bitcoin ratio: 0.03690 (1.51%)

- Hashrate (seven-day moving average): 1,058 EH/s

- Hashprice (spot): $51.68

- Total Fees: 3.15 BTC / $359,057

- CME Futures Open Interest: 134,400 BTC

- BTC priced successful gold: 30.1 oz

- BTC vs golden marketplace cap: 8.49%

Technical Analysis

- PUMP has been 1 of the strongest assets disconnected the lows earlier this week, bouncing from the aureate pouch astatine $0.0048 aft the drawdown from all-time highs. After uncovering acceptance supra the yearly open, which coincides with the 20D EMA, PUMP has present traded backmost to the archetypal highs astatine $0.0069.

- If momentum continues, PUMP tin people the regular bid artifact astir $0.0074, which, if cleared, could pb to caller all-time highs. Bulls volition privation to spot PUMP proceed trading supra the yearly unfastened successful the lawsuit of a drawdown.

Crypto Equities

- Coinbase Global (COIN): closed connected Tuesday astatine $337.49 (+1.05%), +1.83% astatine $343.68 successful pre-market

- Circle Internet (CRCL): closed astatine $132.58 (-0.81%), +1.54% astatine $134.62

- Galaxy Digital (GLXY): closed astatine $33.81 (-1.4%), +2.37% astatine $34.61

- Bullish (BLSH): closed astatine $63.61 (+2.1%), +0.46% astatine $63.90

- MARA Holdings (MARA): closed astatine $18.26 (-2.14%), +2.14% astatine $18.65

- Riot Platforms (RIOT): closed astatine $19.03 (-3.79%), +1.37% astatine $19.29

- Core Scientific (CORZ): closed astatine $17.94 (+3.52%), +0.33% astatine $18

- CleanSpark (CLSK): closed astatine $14.5 (-2.49%), +2.41% astatine $14.85

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $44.24 (+0.07%), +1.6% astatine $44.95

- Exodus Movement (EXOD): closed astatine $27.78 (-4.04%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $322.21 (-1.29%), +2.66% astatine $330.78

- Semler Scientific (SMLR): closed astatine $30 (+2.6%), +2.03% astatine $30.61

- SharpLink Gaming (SBET): closed astatine $17.01 (-1.45%), +2.59% astatine $17.45

- Upexi (UPXI): closed astatine $5.77 (+2.67%), +6.93% astatine $6.17

- Lite Strategy (LITS): closed astatine $2.42 (-4.72%), +6.61% astatine $2.58

ETF Flows

Spot BTC ETFs

- Daily nett flow: $429.9 million

- Cumulative nett flows: $57.72 billion

- Total BTC holdings ~ 1.32 million

Spot ETH ETFs

- Daily nett flow: $127.5 million

- Cumulative nett flows: $13.81 billion

- Total ETH holdings ~ 6.58 million

Source: Farside Investors

While You Were Sleeping

- Shutdown Enters First Full Day With No Hint Either Side Will Give (The New York Times): The archetypal U.S. authorities shutdown since 2019 has begun, with Democrats pressing for wellness subsidy extensions and Medicaid backing arsenic national services stall and workers look furloughs and occupation cuts.

- Tether to Distribute Coins connected Conservative Video Platform Rumble (Bloomberg): Tether volition usage Rumble’s 51 cardinal users to administer its upcoming U.S.-compliant stablecoin, USAT, via Rumble’s planned crypto wallet that volition besides big different integer assets.

- Swiss Bank Sygnum Unveils Bitcoin Yield Fund arsenic BTC DeFi Demand Grows (CoinDesk): The BTC Alpha Fund, developed successful concern with Athens-based Starboard Digital, uses arbitrage strategies to people nett yearly returns of 8%-10%, which are paid straight successful Bitcoin.

- Ripple CTO David Schwartz to Step Back, Joins Board (CoinDesk): Schwartz volition displacement his absorption to household and XRP projects arsenic Dennis Jarosch takes implicit operations, supporting efforts to grow the XRP Ledger beyond payments.

- Russia Named a ‘Permanent Threat’ to Europe’s Security arsenic Leaders Discuss a Drone Wall (CNBC): Airspace incursions by Russian drones and jets person pushed EU leaders to see a “drone wall” defence system, with NATO enactment but besides concerns astir outgo and implementation speed.

4 months ago

4 months ago

English (US)

English (US)