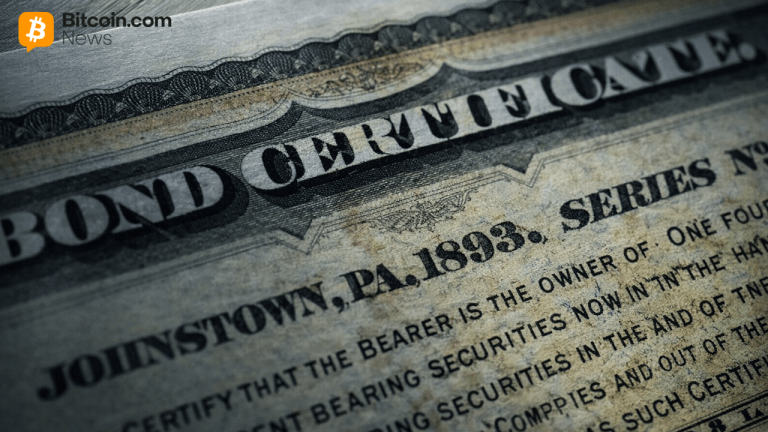

Multiple US banking groups are seeking inclusion successful the Bitcoin exchange-traded funds (ETFs) landscape, prompting a petition for a regularisation alteration to facilitate their participation.

In a Feb. 14 letter to SEC Chair Gary Gensler, a conjugation comprising the Bank Policy Institute, the American Bankers Association, the Securities Industry and Financial Markets Association, and the Financial Services Forum advocated their stance.

Crypto custodial

The conjugation urged the SEC to reassess a regularisation that made it costly for accepted banks to connection crypto custody services. Current rules necessitate these fiscal institutions to classify cryptocurrencies arsenic liabilities connected their balance sheets. Therefore, the banks indispensable allocate assets equivalent to the crypto holdings to mitigate imaginable losses and adhere to the strict regulatory superior requirements.

The conjugation contended that this regularisation hampered them from acting arsenic custodians for the recently introduced Bitcoin ETFs, a relation they commonly undertook for astir different Exchange-Traded Products (ETPs). This limitation, the radical argued, stemmed from factors specified arsenic the “Tier 1 superior ratio and different reserve and superior requirements.”

They added:

“If regulated banking organizations are efficaciously precluded from providing integer plus safeguarding services astatine scale, investors and customers, and yet the fiscal system, volition beryllium worse off, with the marketplace constricted to custody providers that bash not spend their customers the ineligible and supervisory protections provided by federally-regulated banking organizations.”

The radical further emphasized the request to mitigate the attraction hazard of a azygous non-bank entity dominating the custodial services for these Bitcoin ETFs. According to the group, allowing prudentially regulated banks to connection custodial services for SEC-regulated ETFs, akin to qualified non-bank plus custodians, could code this concern.

Coinbase, the largest US-based crypto trading platform, is the unnamed non-bank entity mentioned successful the letter. The speech serves arsenic the plus custodian for 8 of the ETF issuers.

Recommendations

The radical urged the SEC to refine the explanation of crypto outlined successful Staff Accounting Bulletin 121 (SAB 121) to exclude accepted fiscal assets recorded oregon transferred connected blockchain networks.

“SAB 121 makes nary favoritism betwixt plus types and usage cases, but alternatively mostly states that crypto-assets airs definite technological, legal, and regulatory risks requiring on-balance expanse treatment,” they added.

Additionally, they projected exempting banks from the on-balance expanse requirements portion upholding disclosure obligations. This attack would alteration banks to partake successful prime crypto activities portion maintaining transparency for investors.

The station US banking groups lobby SEC for regularisation alteration to participate Bitcoin ETF market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)