North America has erstwhile again claimed the apical spot arsenic the world’s astir important crypto marketplace acknowledgment to accrued organization enactment successful the US, according to an Oct. 17 Chainalysis report.

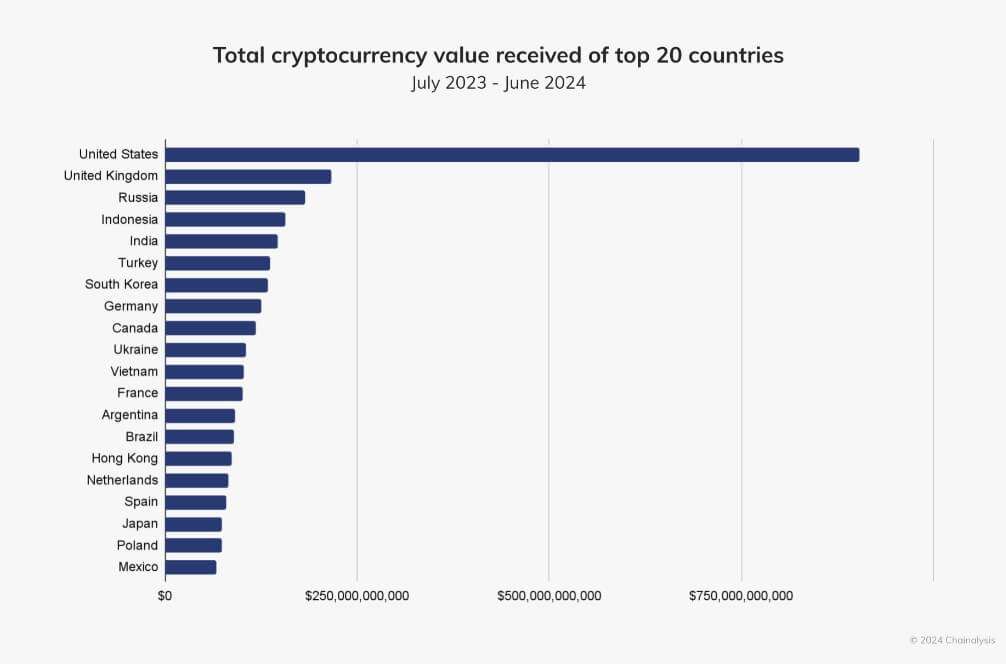

Between July 2023 and June 2024, North America generated $1.3 trillion successful on-chain value, representing 22.5% of the planetary total. Chainalysis credits this dominance to heightened organization activity, particularly successful the US, wherever large-scale transactions exceeding $1 cardinal relationship for 70% of the region’s crypto transfers.

US Crypto Dominance (Source: Chainalysis)

US Crypto Dominance (Source: Chainalysis)While the US leads the North American crypto landscape, Canada follows, with $119 cardinal successful on-chain worth during the aforesaid period.

US dominance

The US remains ascendant successful North America’s crypto market, chiefly owed to important organization activities astir spot Bitcoin and Ethereum exchange-traded funds (ETFs).

However, this enactment is not without challenges. Chainalysis notes that the US marketplace has been much volatile than its planetary counterparts.

The study stated:

“In caller quarters, the U.S. has demonstrated heightened sensitivity to some bull and carnivore markets. When cryptocurrency prices rise, the U.S. marketplace shows larger increases successful maturation than the planetary marketplace — and the inverse is existent erstwhile cryptocurrency markets decline.”

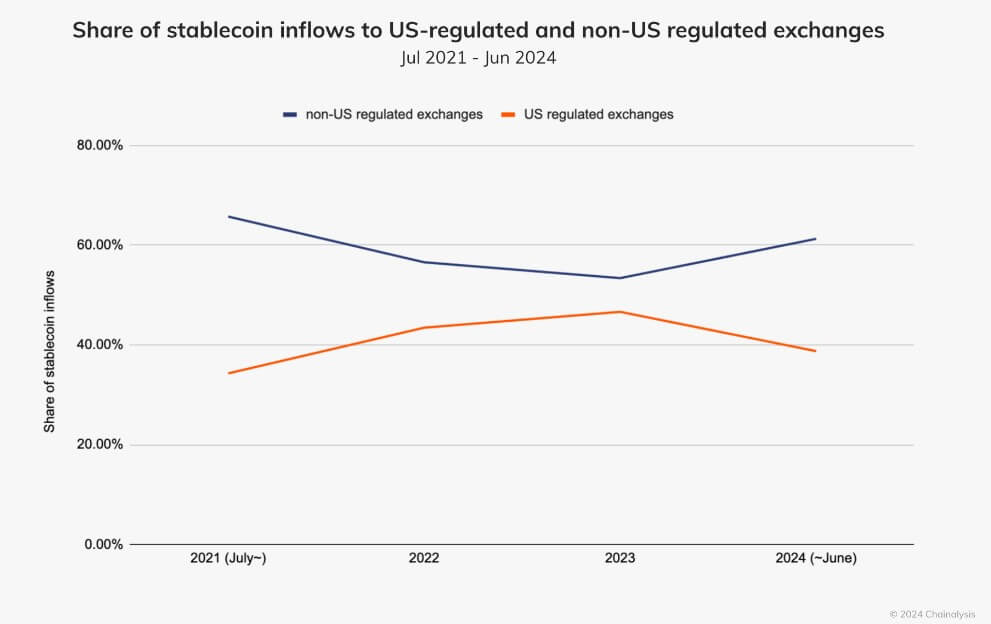

Although crypto adoption has grown successful the US, the state has seen a crisp driblet successful stablecoin holdings connected exchanges. The stock of stablecoin transactions connected US-regulated exchanges fell from astir 50% successful 2023 to nether 40% successful 2024.

Chainalysis reported that this diminution could beryllium linked to the regulatory uncertainty surrounding these integer assets successful the US. Circle, the issuer of the USDC stablecoin, has pointed retired that unclear regulations successful the US person prompted stablecoin projects to question much favorable environments successful Europe and the UAE.

Stablecoin usage rises extracurricular the US

In contrast, stablecoin transactions person surged extracurricular the US, accounting for much than 60% of transactions successful non-US markets by 2024.

Stablecoins Inflows Across US and Non-US Markets (Source: Chainalysis)

Stablecoins Inflows Across US and Non-US Markets (Source: Chainalysis)This inclination is peculiarly beardown successful processing markets, wherever stablecoins supply users entree to US dollars without relying connected accepted banking systems. Circle confirmed this shift, reporting that 45% of US dollar banknotes successful circulation were held overseas arsenic of precocious 2022.

The rising usage of stablecoins extracurricular the US reflects a broader trend. Global markets progressively presumption US dollar-backed stablecoins arsenic some a store of worth and a much affordable method of transaction.

Tether’s CEO Paolo Ardoino has besides emphasized the importance of USDT successful inflation-hit countries similar Argentina, wherever it offers stableness during economical uncertainty.

The station US drives North American crypto dominance contempt determination stablecoin decline appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)