Bitcoin experienced important volatility successful the days starring up to President Donald Trump’s inauguration connected Jan. 20. The marketplace saw crisp terms swings the week before, with heightened enactment from US traders during the weekend. Political uncertainty surrounding the inauguration and the motorboat of $TRUMP and $MELANIA memecoins added to the turbulence, pushing Bitcoin’s terms to a caller ATH of $109,460 earlier retracting.

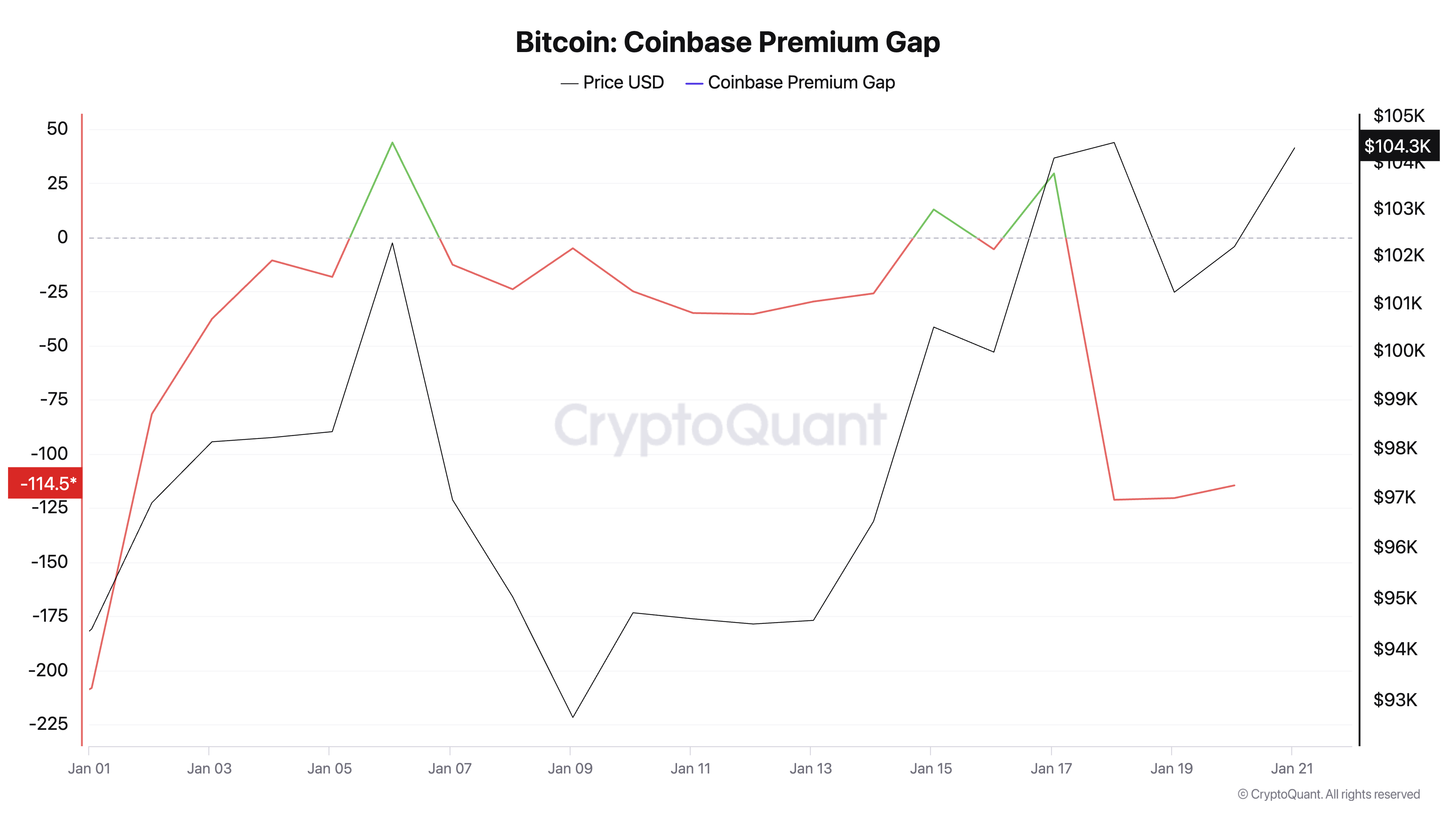

Data from CryptoQuant suggests that the US marketplace was the main operator of this volatility. The Coinbase premium, which measures the terms quality betwixt Bitcoin connected Coinbase and Binance, dropped noticeably successful the days starring up to the inauguration.

Graph showing the Coinbase premium from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)

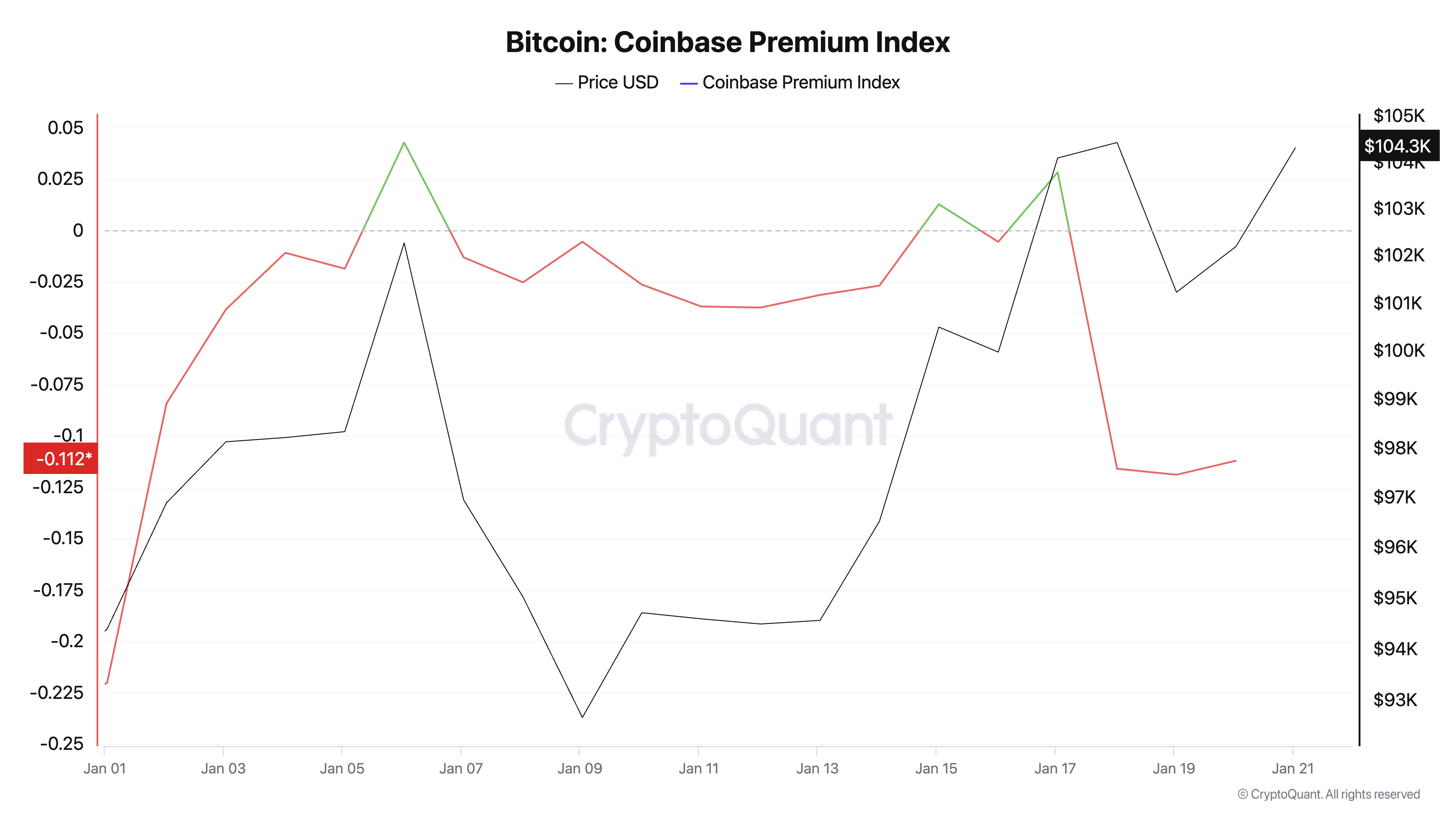

Graph showing the Coinbase premium from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)Its comparative metric, the Coinbase premium index, besides turned negative.

Graph showing the Coinbase premium scale from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)

Graph showing the Coinbase premium scale from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)These declines bespeak either a reduced request oregon accrued selling unit from US investors. Historically, a affirmative Coinbase premium reflected beardown organization demand, making this dip a wide awesome of uncertainty among US investors.

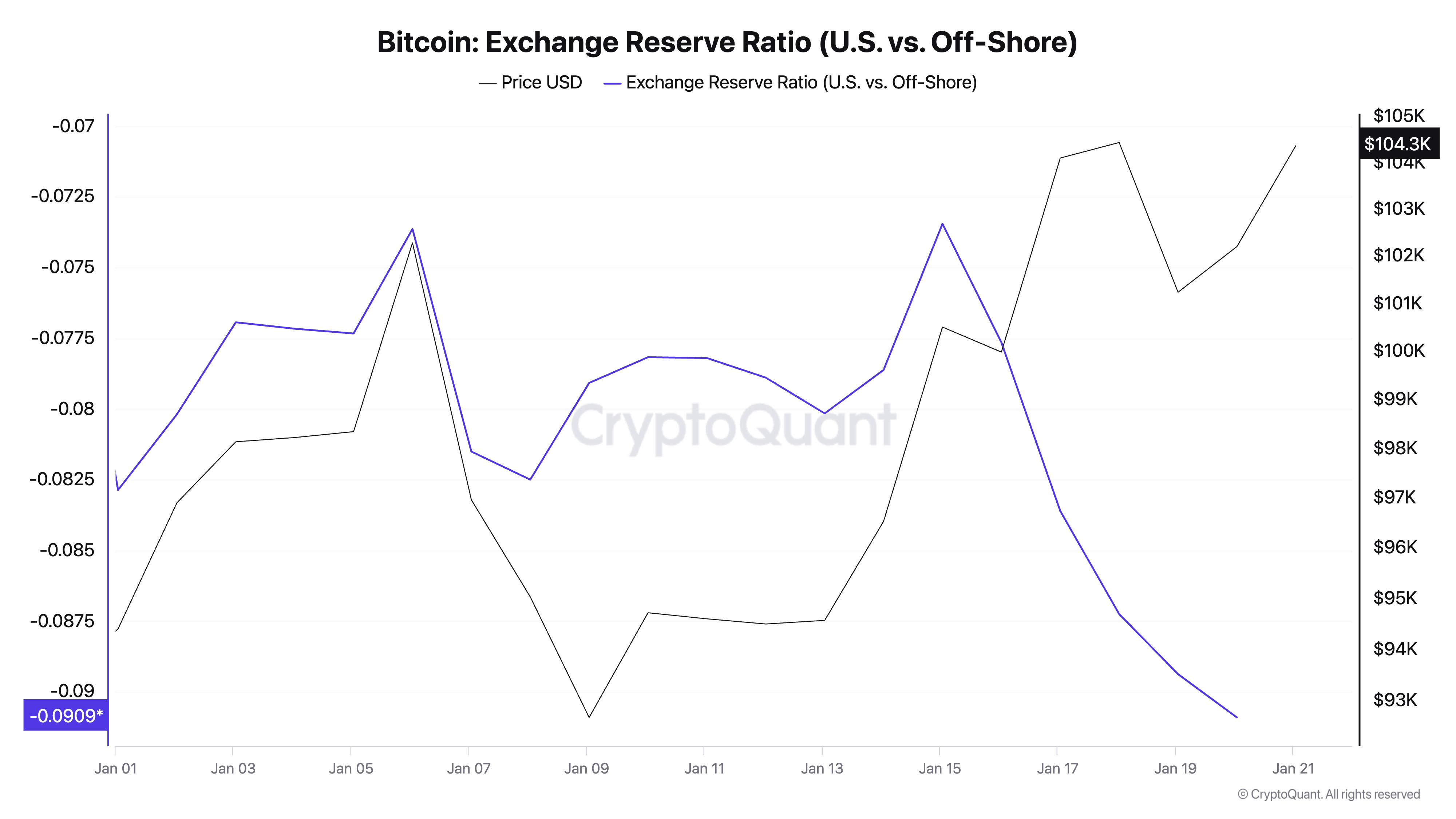

The accrued selling from US investors tin besides beryllium seen done the speech reserve ratio, which tracks the comparative reserves connected US exchanges compared to offshore platforms. The speech reserve ratio began trending downward connected Jan. 15, showing that Bitcoin reserves connected US-based exchanges declined faster than connected offshore exchanges. Such movements typically bespeak heightened withdrawals oregon reduced home liquidity, amplifying volatility from the US market.

Graph showing the speech reserve ratio from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)

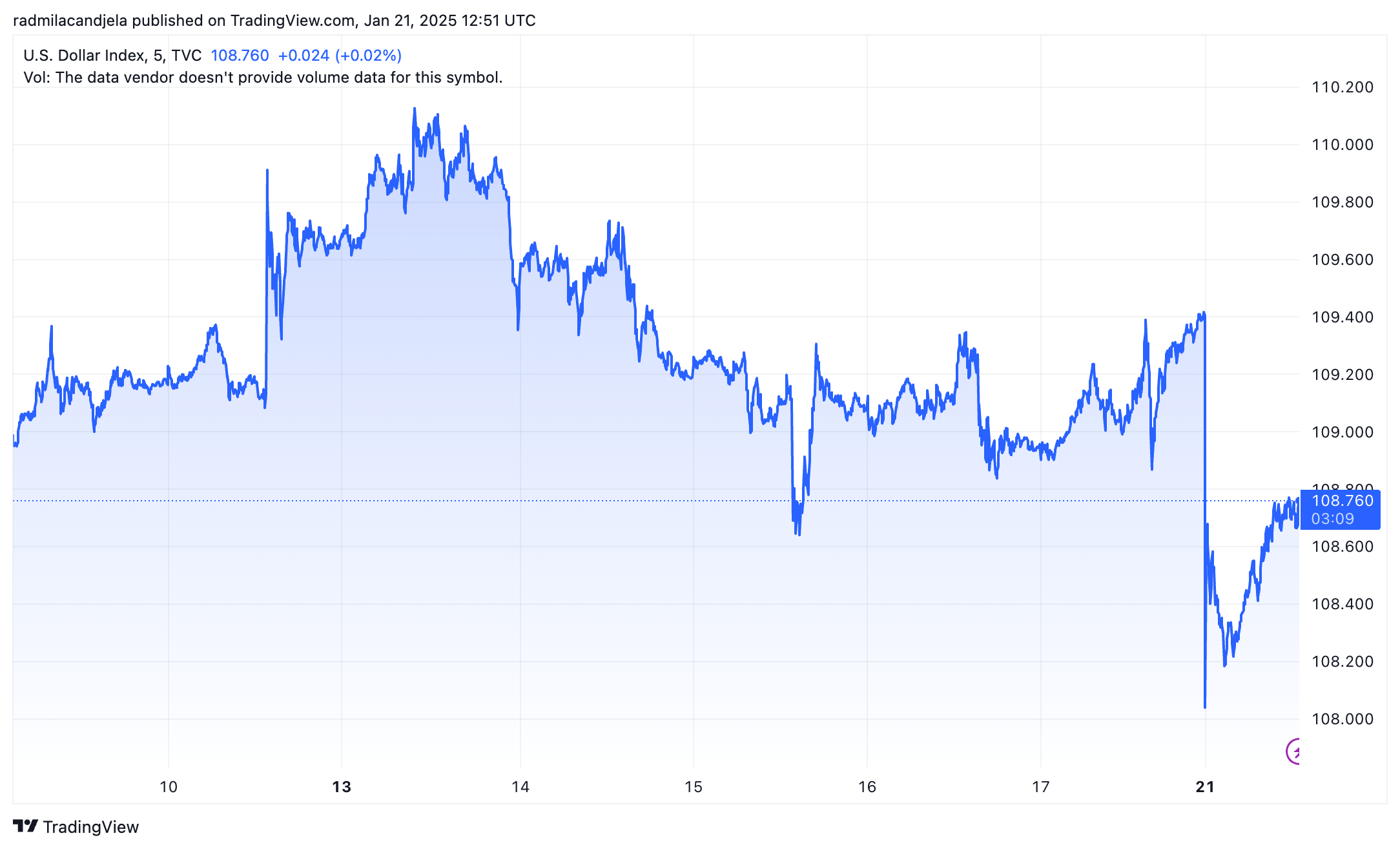

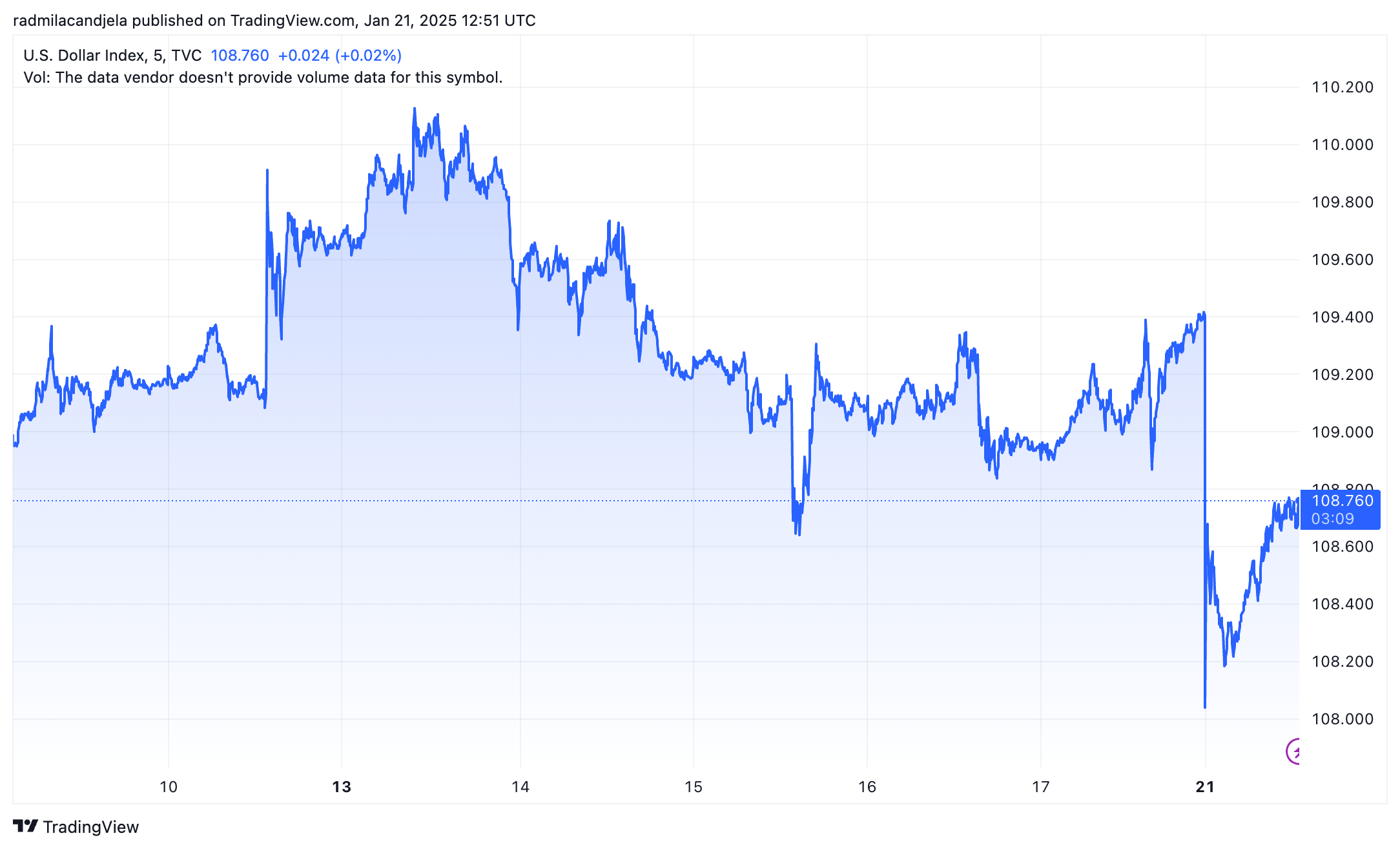

Graph showing the speech reserve ratio from Jan. 1 to Jan. 20, 2025 (Source: CryptoQuant)The US Dollar Index (DXY) besides steeply declined implicit the aforesaid period, reflecting macroeconomic uncertainty tied to the governmental transition. Bitcoin’s inverse correlation with the dollar further supports the mentation that US-based selling was driven by broader marketplace hazard aversion.

Graph showing the US dollar Index (DXY) from Jan. 9 to Jan. 21, 2025 (Source: TradingView)

Graph showing the US dollar Index (DXY) from Jan. 9 to Jan. 21, 2025 (Source: TradingView)While the US marketplace drove archetypal volatility, planetary markets stabilized Bitcoin’s price. Offshore exchanges showed comparative strength, with reserves expanding arsenic US reserves fell. This indicates that planetary participants, peculiarly extracurricular the US, accumulated Bitcoin during the selloff. This absorption of selling unit helped forestall a deeper terms drop.

Graph showing the US dollar Index (DXY) from Jan. 9 to Jan. 21, 2025 (Source: TradingView)

Graph showing the US dollar Index (DXY) from Jan. 9 to Jan. 21, 2025 (Source: TradingView)The flimsy betterment successful the Coinbase premium aft Jan. 19 shows that planetary request persisted. As US selling subsided, offshore liquidity apt supported Bitcoin’s price, demonstrating the planetary market’s quality to counterbalance localized volatility. This besides shows the US market’s outsized power connected Bitcoin’s price. Political and macroeconomic events successful the US person ever been 1 of the main drivers of sentiment, chiefly arsenic US exchanges similar Coinbase cater to a important fig of organization and high-profile investors.

The information confirms that US investors were the superior drivers of Bitcoin’s play volatility starring up to the inauguration, arsenic evidenced by declining Coinbase Premiums, a crisp driblet successful the US to offshore reserve ratio, and DXY’s weakening. However, planetary markets—particularly offshore platforms—stabilized Bitcoin’s price. This reinforces Bitcoin’s presumption arsenic a resilient, globally traded plus susceptible of weathering localized shocks portion maintaining semipermanent stability.

The station US marketplace drove Bitcoin’s volatility up of Trump’s inauguration appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)