USD Coin (USDC), the second-largest stablecoin by marketplace capitalization, has seen its marketplace stock connected centralized crypto trading platforms turn importantly during the past months.

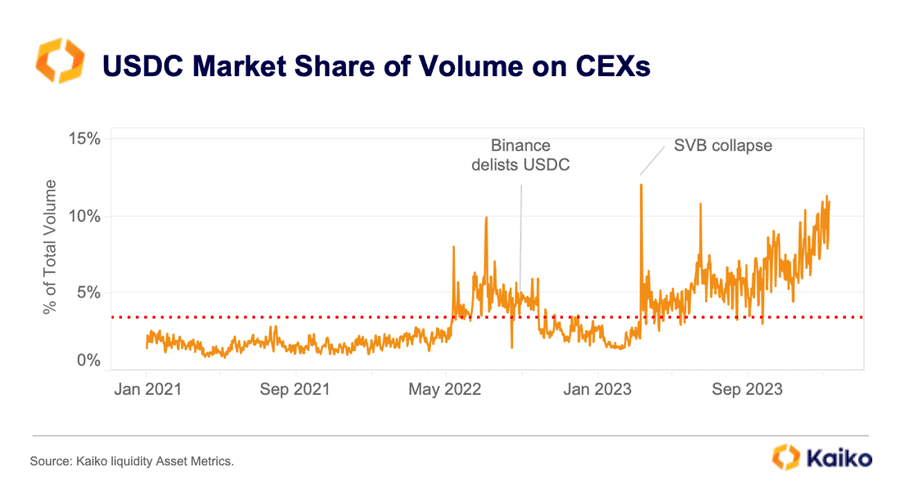

Data from Paris-based crypto quality level Kaiko showed that USDC’s marketplace stock doubled to implicit 10% from astir 5% successful September 2023, chiefly owed to the rising volumes recorded connected Bybit.

USDC Stablecoin Market Share. (Source: Kaiko)

USDC Stablecoin Market Share. (Source: Kaiko)Why USDC’s marketplace stock is growing

Bybit has emerged arsenic the largest marketplace for USDC, apt owed to its instauration of a zero-fee trading inducement for its USDC trading pairs successful February past year.

Binance’s relisting of the USDC stablecoin, pursuing the legal troubles that emerged with Binance USD (BUSD), besides perchance played a relation successful helping to amended USDC’s marketplace stock during the period.

Coinbase, the largest crypto trading level successful the U.S., besides progressively increased the involvement rates connected USDC, starting from 2% and incrementally moving it to 6% passim past year. This greatly incentivized users of the level to clasp the stablecoin.

Also, Circle, the stablecoin issuer, has notable partnerships with large fiscal institutions similar Japanese fiscal elephantine SBI Holdings and licensing successful large jurisdictions similar Singapore, which further helps to boost USDC’s circulation and presence.

USDC’s supply

Despite these improved numbers, USDC’s existent circulating proviso remains drastically beneath its all-time precocious of $45 billion.

Circle attributed this diminution to respective factors, including “rising involvement rates, regulatory crackdowns, bankruptcies, and outright fraud.”

In addition, USDC faced important headwinds past twelvemonth aft 1 of its banking partners, Silicon Valley Bank, collapsed. This resulted successful USDC concisely losing its peg and a monolithic outflow from the integer asset.

Meanwhile, Circle precocious revealed its volition to spell nationalist again done an archetypal nationalist offering (IPO) filed with the U.S. Securities and Exchange Commission.

The station USDC doubles marketplace stock connected centralized crypto trading platforms to implicit 10% appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)