Stablecoin issuer Circle Internet Financial is rebalancing the reserves backing the $30 cardinal USD Coin (USDC) arsenic it braces for the hazard of a U.S. authorities indebtedness default.

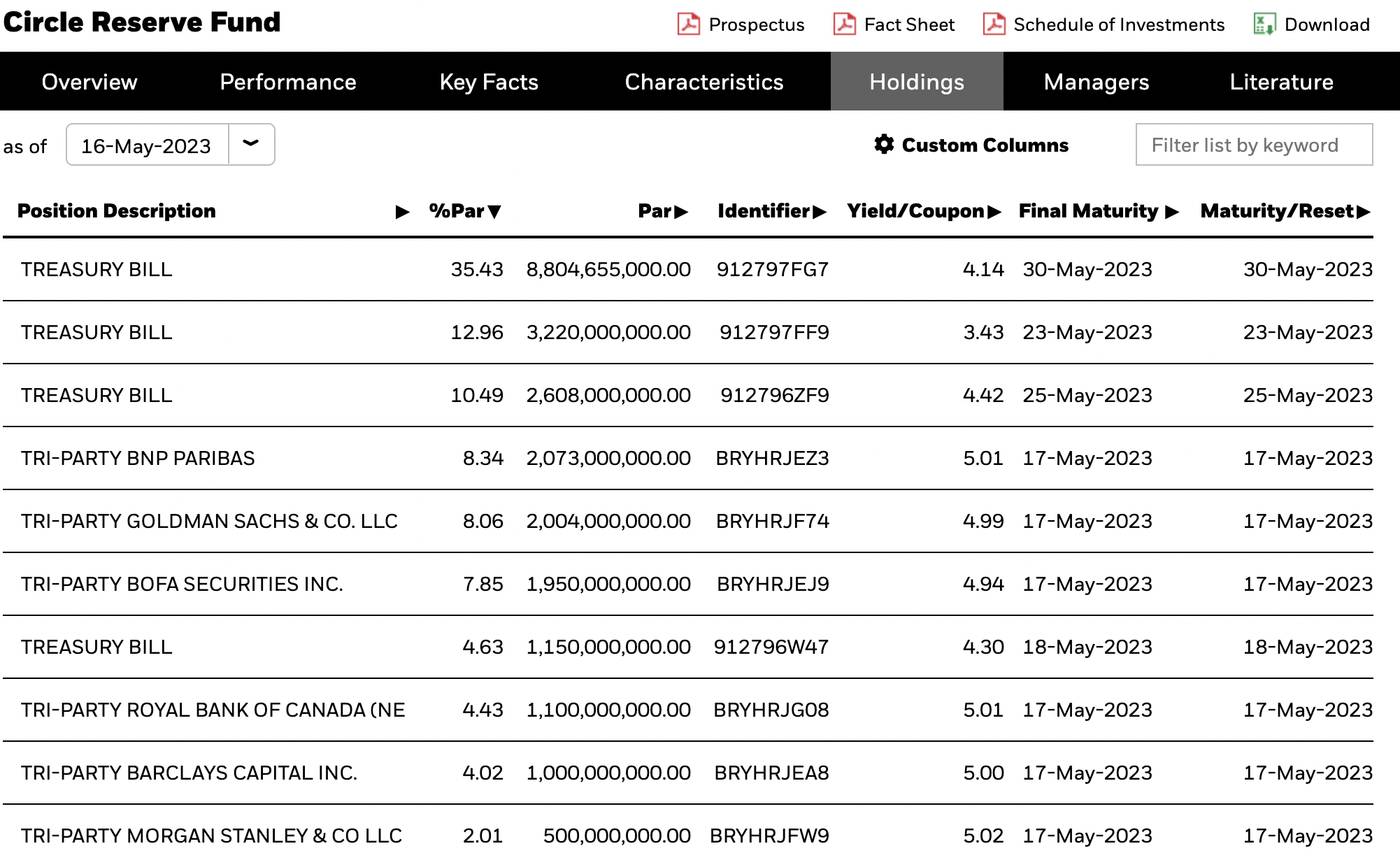

The Circle Reserve Fund, managed by planetary concern absorption elephantine BlackRock, added $8.7 cardinal successful overnight repurchase (repo) agreements to the portfolio arsenic of May 16, according to the fund’s website. The alleged tri-party repo agreements impact banking giants specified arsenic BNP Paribas, Goldman Sachs, Barclays and Royal Bank of Canada.

Overnight repo transactions are efficaciously short-term collateralized loans. The borrower is selling a information – successful this case, U.S. Treasurys – for cash, and agrees to bargain backmost the collateral the adjacent time for a somewhat higher price. What’s truly happening, though, is that large organization investors with currency to spare are parking that with Wall Street dealers that request funding.

“While this program has been underway for galore months, the inclusion of these highly liquid assets besides provides further extortion for the USDC reserve successful the improbable lawsuit of a U.S. indebtedness default,” a Circle spokesperson emailed successful a note.

Assets successful the Circle Reserve Fund arsenic of May 16 (BlackRock)

Assets successful the Circle Reserve Fund arsenic of May 16 (BlackRock)Circle is doing this arsenic U.S. lawmakers are locked successful discussions with President Joe Biden’s medication implicit raising the government’s quality to contented caller debt, besides known arsenic the indebtedness ceiling. Treasury Secretary Janet Yellen said that the Treasury Department is acceptable to tally retired of currency by aboriginal June unless the indebtedness bounds is raised.

As portion of the preparations, Circle’s money ditched Treasurys that mature beyond the extremity of this period arsenic of May 10, with rotating the assets into currency oregon authorities repo transactions instead, the Circle spokesperson said. The collateral for immoderate specified repo transactions exclude securities maturing wrong 3 days, the spokesperson added.

“We don’t privation to transportation vulnerability done a imaginable breach of the quality of the U.S. authorities to wage its debts,” Jeremy Allaire, main enforcement serviceman of Circle, said past week successful an interview with Politico.

Edited by Bradley Keoun.

2 years ago

2 years ago

English (US)

English (US)