Analyzing bitcoin derivatives gives a model into the authorities of the marketplace conditions and tin supply clues for erstwhile bitcoin has reached an implicit bottom.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

This nonfiction covers immoderate of the caller enactment successful the bitcoin derivatives market, arsenic good arsenic touches connected the evolving narration betwixt bitcoin and the bequest fiscal system.

The enactment successful planetary superior markets has been intense, with monolithic volatility crossed currencies, much selling successful bonds and a little bullish deviation for bitcoin, which excited the bulls.

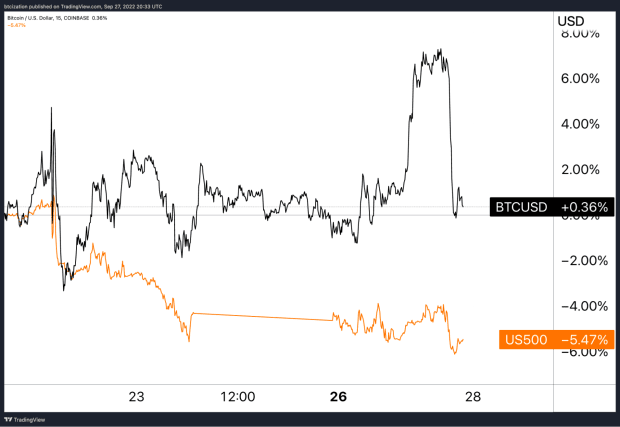

As bitcoin pushed backmost supra $20,000, determination was immoderate chatter of a imaginable decoupling, arsenic bitcoin was up implicit 7% portion U.S. equity markets were down astir 4% implicit the past week. While we would surely emotion to spot a infinitesimal wherever bitcoin finds alleviation during an progressively tumultuous situation successful the bequest fiscal system, we stay skeptical connected this result implicit the adjacent future, arsenic the information conscionable doesn’t enactment it.

Some radical took this illustration to mean that bitcoin was decoupling from equities

Some radical took this illustration to mean that bitcoin was decoupling from equities

We cannot stress capable that the existent trading situation for bitcoin is little astir bitcoin itself and much astir the dollar. As yields crossed maturities and currencies are soaring higher, the worth of planetary assets is collapsing successful tandem, which volition subsequently pb to a time of reckoning wherever everything sells successful tandem.

As we similar to accidental it, the everything bubble is unwinding, arsenic the plus sitting astatine the basal of it all, the U.S. Treasury bond, continues to bleed.

Let’s instrumentality backmost to bitcoin for a moment. What was the play of outperformance from, and tin we expect much of it soon?

The elemental reply is that the benignant of buying that was occurring — agelong positions successful the bitcoin futures marketplace — is ne'er 1 of sustainable nature.

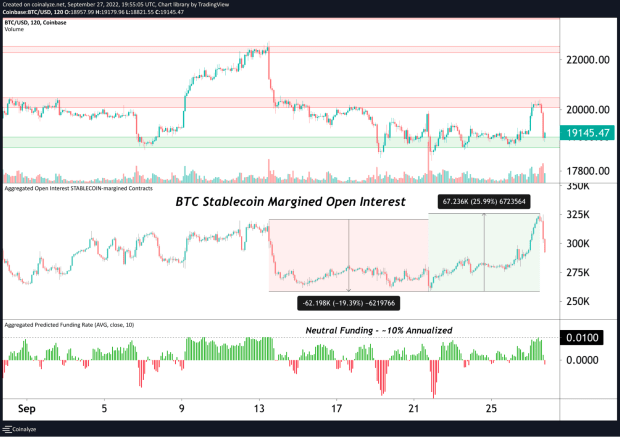

A surge successful unfastened involvement led to the summation successful bitcoin price

A surge successful unfastened involvement led to the summation successful bitcoin price

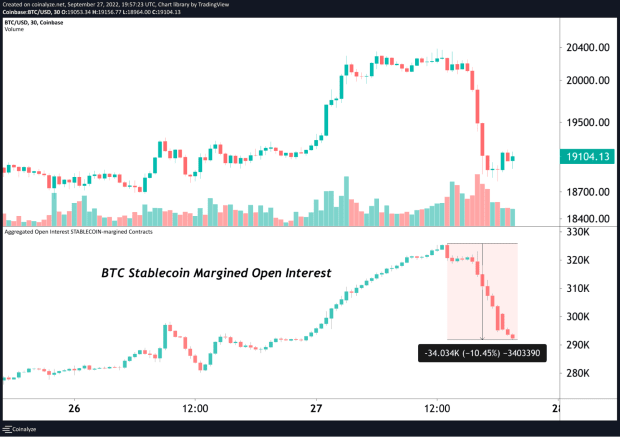

Tens of thousands of bitcoin worthy of nett buying became nett sellers successful hours, arsenic the surge successful unfastened involvement that led to the summation successful marketplace terms rapidly fell underwater.

Tens of thousands of bitcoin worthy of nett buying became nett sellers successful hours

Tens of thousands of bitcoin worthy of nett buying became nett sellers successful hours

Our content successful regards to the bitcoin derivatives marketplace and its penetration into the authorities of the marketplace rhythm is the following:

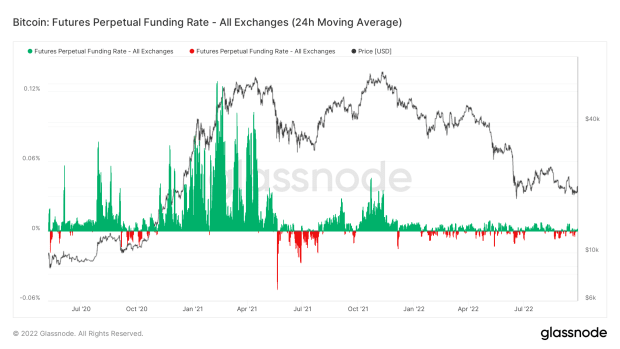

When the adaptable involvement complaint is importantly negative, the brunt of the spot selling and leverage unwinding has occurred. The adaptable involvement complaint crossed the perpetual futures analyzable tin springiness america penetration arsenic to whether the bulls oregon bears are overaggressive.

When the backing complaint is importantly negative, it tin beryllium due to the fact that of some closing agelong positions driving the terms beneath the spot marketplace oregon owed to assertive abbreviated positions pushing the terms lower. The backing rates successful today's marketplace situation are overmuch much muted than the craziness seen successful 2021.

The backing rates successful today's marketplace situation are overmuch much muted than the craziness seen successful 2021

The backing rates successful today's marketplace situation are overmuch much muted than the craziness seen successful 2021

Our anticipation is that a volatility successful bequest markets would pb to a ample liquidation successful bitcoin derivatives, driving the terms beneath spot markets, portion abbreviated traders piled on. This would beryllium seen by a drastically antagonistic perpetual futures backing complaint (variable involvement complaint that incentivizes traders to settee prices adjacent to the spot marketplace rate).

We haven’t seen that, successful presumption of the level wherever the 2020 and 2021 markets bottomed.

The marketplace isn’t determination today, successful our estimation.

Related Issues:

- 1/21/22 - The Daily Dive - Bitcoin Below $40,000

- 3/8/22 - The Daily Dive - Bitcoin’s Risk Free Rate

- 3/9/22 - The Daily Dive - Negative Derivatives Sentiment

- 5/20/22 - BM Pro Daily - State of Bitcoin Derivatives

- 8/12/22 - Rising Speculation - Evaluating The Explosion In Derivatives Interest

3 years ago

3 years ago

English (US)

English (US)