The pursuing is simply a impermanent station by Rajagopal Menon, the Vice President of WazirX.

Come the bull market, cometh the models to foretell the terms of Bitcoin. In the past bull marketplace successful 2021, the Stock-to-Flow (S2F) exemplary was the flavour of the season. This model, created by Plan B, assessed plus scarcity by comparing banal to yearly production. Applied to Bitcoin, the S2F exemplary emphasised its ‘digital gold’ imaginable and provided scarcity-based, semipermanent terms forecasts. However, the S2F exemplary faded successful the crypto wintertime successful 2022.

But fearfulness not, successful the existent bull run, there’s a caller exemplary successful municipality – the Power Law Model, claiming to foretell the terms of Bitcoin with singular accuracy.

Understanding Power Laws

In a satellite seemingly filled with chaos and randomness, scientists person uncovered hidden patterns and relationships known arsenic powerfulness laws. These laws supply a model for knowing however antithetic phenomena interact, revealing accordant mathematical patterns that govern assorted aspects of our universe.

Power Laws successful Everyday Life

Power laws are fascinating mathematical relationships that look successful galore phenomena, offering insights into the underlying simplicity of analyzable systems. They picture however 2 quantities subordinate to each other, with a alteration successful 1 quantity starring to a proportional alteration successful the other. This narration spans antithetic scales, from the microcosmic to the cosmic, influencing biology, society, technology, and earthy phenomena.

The Size Limits of Animals

Galileo’s square-cube instrumentality is simply a classical illustration of a powerfulness instrumentality successful nature, explaining however an animal’s size affects its strength. As animals turn larger, their measurement and value summation overmuch faster than their strength. This instrumentality sets earthy limits, explaining wherefore larger animals person thicker bones and wherefore the largest animals are recovered successful aquatic environments wherever buoyancy offsets weight.

Metabolic Rates

Max Kleber’s probe connected metabolic rates further demonstrates the applicability of powerfulness laws. It reveals that an organism’s metabolic complaint scales to the ¾ powerfulness of its mass, indicating that larger animals are much energy-efficient. This rule importantly impacts knowing species’ lifecycles, maturation rates, and sustainability.

Natural Phenomena and Human Activities

Power laws govern divers phenomena, from the organisation of earthquake magnitudes to the frequence of words successful a language. They explicate wherefore we observe a tiny fig of important events alongside galore smaller instances. For example, Zipf’s instrumentality describes connection frequence successful languages, highlighting the disproportionate occurrence of communal words compared to little predominant ones.

Beyond Natural Phenomena

Power laws widen into quality activities similar economics, finance, and technology. They elucidate wealthiness distribution, wherever a fewer individuals person a important information of wealth. In technology, powerfulness laws picture however contented interacts connected the internet, with a fewer highly fashionable nodes and galore little fashionable ones forming a agelong process distribution.

Bitcoin’s Power Law

Astrophysicist Giovanni Santasi discovered this connection. He says that 15 years of information amusement that Bitcoin besides follows a powerfulness instrumentality principle. Santostasi archetypal shared the powerfulness instrumentality exemplary successful the r/Bitcoin subreddit successful 2018. However, it witnessed a resurgence successful January aft concern YouTuber Andrei Jeikh mentioned it to his 2.3 cardinal subscribers successful a video.

Giovanni’s mentation says that Bitcoin’s terms is not arsenic random arsenic it seems. There is randomness to it, but implicit the agelong term, Bitcoin terms follows a circumstantial mathematical model. It’s not conscionable a mathematical look that immoderate feline drew a enactment through; instead, it follows a powerfulness instrumentality similar the ones observed passim the universe.

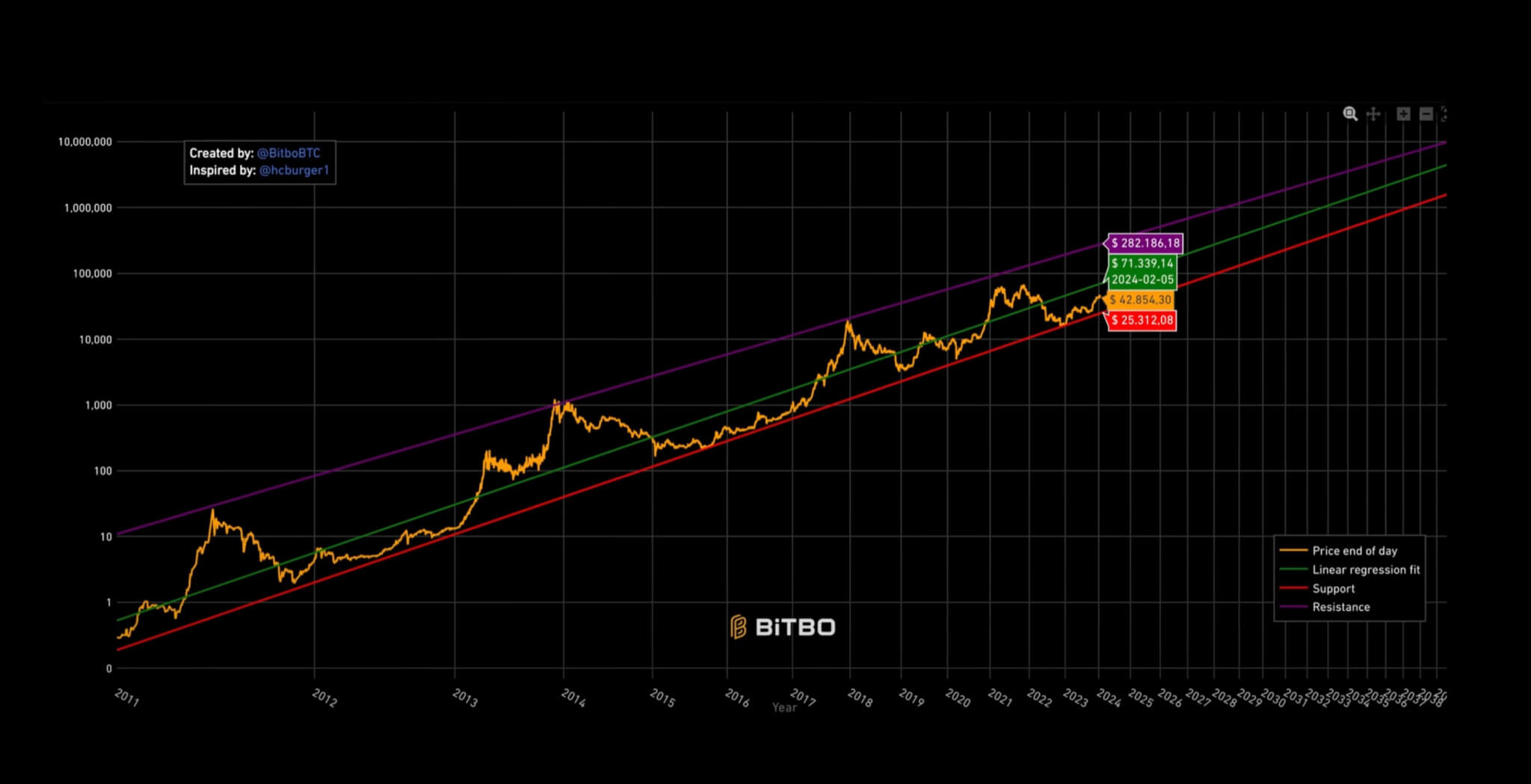

The yellowish enactment represents the existent price, and the reddish enactment represents the enactment line, the level Bitcoin usually ne'er drops below. The greenish enactment is the linear regression line, which is similar the just worth price, wherever Bitcoin volition yet spell backmost to, and the purple enactment is the absorption enactment that Bitcoin typically maxes retired at.

Predicting Bitcoin’s Future

Santostasi’s Power Law Model charts Bitcoin’s terms trajectory with singular precision. It presents a graph showcasing Bitcoin’s existent price, a enactment enactment indicating the level Bitcoin typically doesn’t driblet below, a linear regression enactment representing a just worth price, and a absorption enactment marking the level Bitcoin typically reaches earlier a downturn.

This exemplary underscores the remarkably linear maturation of Bitcoin, peculiarly evident erstwhile outliers are removed. Despite occasional fluctuations, Bitcoin’s wide trajectory follows a discernible signifier reminiscent of different phenomena governed by powerfulness laws.

Implications for Investors

The Power Law Model offers intriguing insights into Bitcoin’s imaginable aboriginal peaks. Santostasi’s investigation suggests that Bitcoin could highest astatine $210,000 successful January 2026, followed by a consequent diminution to astir $60,000. He goes connected to foretell that Bitcoin volition beryllium worthy $1 cardinal successful July 2033. While mathematical models supply invaluable insights, they are not immune to errors and whitethorn neglect to relationship for unforeseen events that tin importantly interaction prices.

“All models are breached but immoderate are useful” means that portion models whitethorn not beryllium perfect, they tin inactive supply invaluable insights. Models, similar the powerfulness instrumentality exemplary oregon the stock-to-flow exemplary for predicting Bitcoin’s price, person their flaws and limitations. For example, Julio Marino from Crypto Quant pointed retired issues with the powerfulness instrumentality model, specified arsenic underestimating errors and giving a misleading content of accuracy.

Interestingly, some the powerfulness instrumentality and stock-to-flow models person faced akin criticisms. Despite their flaws, they person historically made astir the aforesaid predictions for Bitcoin’s price. However, implicit time, they whitethorn diverge successful their forecasts.

The question arises: if these models are correct, wherefore fuss with accepted concern strategies similar the 60/40 portfolio? Some reason that caller models explaining Bitcoin’s behaviour could connection amended returns.

While immoderate whitethorn deliberation these models are worthless, others, similar the idiosyncratic speaking, judge they inactive clasp value. Scarcity, driven by Bitcoin’s fixed supply, plays a relation successful its terms appreciation. Additionally, factors similar M2 maturation besides power Bitcoin’s price.

While models tin supply adjuvant insights, they cannot foretell the future. Even if models person flaws, Bitcoin’s trajectory seems upward. So, portion it’s indispensable to see these models, it’s besides indispensable to admit their limitations.

The station Using Power Laws to foretell erstwhile the Bitcoin terms volition deed $1 million appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)