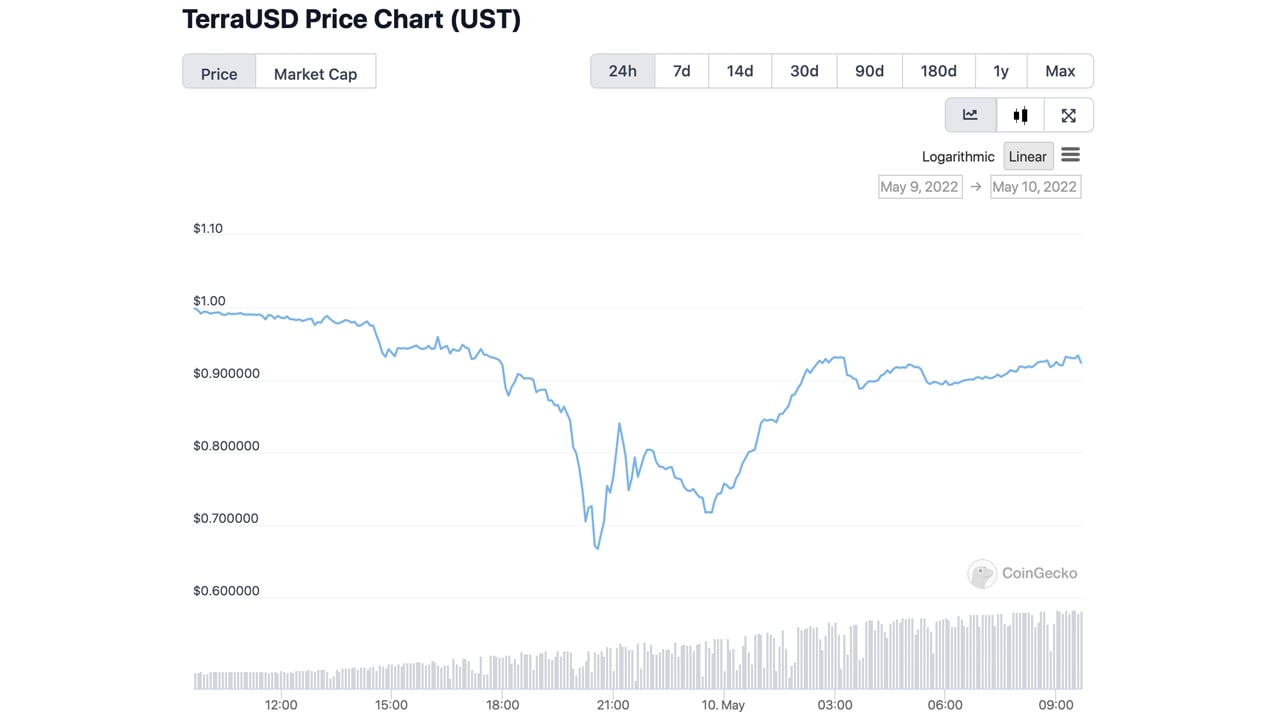

On Monday, May 9, 2022, the stablecoin terrausd (UST) mislaid its parity with the U.S. dollar and dropped to an all-time debased of $0.66 per unit. The stablecoin has been 1 of the astir topical discussions successful crypto during the past 24 hours, arsenic galore person been betting connected whether it volition neglect oregon recover. However, by 9:15 a.m. (ET) connected Tuesday morning, the stablecoin has managed to ascent backmost to $0.934 per unit.

UST Stablecoin Plunged to $0.66 per Unit, Rumors Spread Like Wildfire

The Terra blockchain task has been suffering successful caller times, arsenic the network’s autochthonal plus LUNA has shed 43.6% against the U.S. dollar during the past 24 hours. Moreover, the stablecoin terrausd (UST) has besides been dealing with intense pressure arsenic the token’s worth plummeted from $0.99 to a debased of $0.66 per unit. On a fewer exchanges, UST dropped arsenic debased arsenic $0.62 per portion during periods of utmost selling. Just earlier UST dipped $0.09 little than the $1 peg, Terra’s co-founder Do Kwon told the public that the squad was “deploying much capital.”

A-Team is assembling.

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) May 9, 2022

During the people of Monday evening, the Luna Foundation Guard (LFG) emptied the LFG bitcoin wallet that erstwhile held astir 70,736.37 BTC. Currently, determination is zero bitcoin successful the wallet arsenic it has been drained dry. The aforesaid tin beryllium said for the LFG Gnosis harmless address, arsenic the ethereum code held $143 cardinal connected May 3. Today, the wallet holds $135.58 successful ether, and a fewer different ERC20 tokens with tiny values. While LFG and Do Kwon told the nationalist connected Monday that $1.5 cardinal successful bitcoin and UST would beryllium lent to marketplace makers, the existent moves person been little transparent.

The stablecoin UST has been trying to regain spot and has surpassed the $0.90 people connected Tuesday greeting (ET).

The stablecoin UST has been trying to regain spot and has surpassed the $0.90 people connected Tuesday greeting (ET).While UST plunged to $0.66 per unit, a ample fig of theories swirled astir the crypto industry. There person been claims that the multinational hedge money and fiscal services institution Citadel was involved. Reports further claim that Binance bid books had paused during the UST sell-off. For a tiny play of time, Binance paused LUNA and UST withdrawals. Additionally, there’s been speech of well-known crypto funds bailing retired Terra arsenic well, by funneling billions backmost into the stablecoin’s ecosystem.

“There is simply a rumor spreading astir Jump, Alameda, etc. providing different $2B to ‘bail out’ UST,” theblockcrypto caput of probe Larry Cermak tweeted connected Monday evening. “Whether this rumor is existent oregon not, it makes cleanable consciousness for them to spread. The biggest question present is, adjacent if they tin get it to $1 by immoderate miracle, the spot is irreversibly gone.”

After UST Rebounds to $0.93, People Question Trusting the Stablecoin Project, Anchor TVL Slips by 43% successful a Single Day

Discussions astir radical losing spot successful LUNA, UST, and Terra, successful general, person been littered each implicit societal media. “No substance however this ends, I don’t privation radical to telephone UST decentralized again,” the bitcoin advocator Hasu tweeted connected Monday. “Even the small collateral backing it has is intransparent and controlled by a azygous party. Used to execute discretionary unfastened marketplace operations. This is similar 10x worse than the Fed,” Hasu added.

😶 $UST stablecoin peg breaking…

Same communicative arsenic with immoderate cardinal slope trying to support a currency peg: erstwhile the marketplace casts a nary assurance vote, your prop-up money seldom has capable assets to forestall the dam from breaking. pic.twitter.com/x3llQtABmv

— Tuur Demeester (@TuurDemeester) May 9, 2022

Investor Lyn Alden besides made a connection astir the Terra catastrophe aft she predicted it could happen past month. “Terra’s multi-billion-dollar algorithmic stablecoin UST blew up today,” Alden said. “Aside from destroying the worth of LUNA, they utilized their bitcoin reserves to effort to support the peg, benignant of similar a flailing emerging marketplace utilizing its golden reserves to support its FX.”

During the overnight trading sessions and into the trading sessions connected Tuesday morning, UST has been recovering from the losses. So far, terrausd (UST) has managed to ascent backmost to $0.934 per unit, oregon down 6% from the $1 parity. Terra’s co-founder Do Kwon has not tweeted since saying the ‘A-team’ was deploying capital, adjacent though the co-founder is precise well-known for defending his project. At the aforesaid time, LFG has besides not updated the nationalist since its last tweet, which said it would supply much updates.

Mark my words. The UST nonaccomplishment volition beryllium utilized arsenic grounds by argumentation makers to modulate stablecoins to decease and champion CBDCs.

This is not good.

— Dennis Porter (@Dennis_Porter_) May 10, 2022

In summation to the problems with LUNA’s and UST’s price, the decentralized concern (defi) lending protocol Anchor has shed 43.7% of its full worth locked (TVL) during the past 24 hours. At the clip of writing, Anchor has a TVL of astir $7.22 cardinal and $95.08 cardinal is Avalanche-based collateral. Anchor was erstwhile the third-largest defi protocol, and it has dropped down to the sixth presumption connected Tuesday.

People successful tradfi making amusive of UST… not realizing their stablecoin besides depegged by 8% this year.

— Erik Voorhees (@ErikVoorhees) May 10, 2022

Many wonderment what’s going to hap if UST regains its $1 parity with spot successful the stablecoin truthful shaken. Many UST owners could beryllium waiting for the $0.99 country oregon adjacent to that range, truthful they tin currency retired of the stablecoin and determination into thing else. At $0.934141, UST is person to the $1 parity, but an concern of 5,000 UST would lone equate to $4,670.70 astatine existent prices.

Tags successful this story

What bash you deliberation astir the Terra project’s issues and the caller UST de-pegging? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)