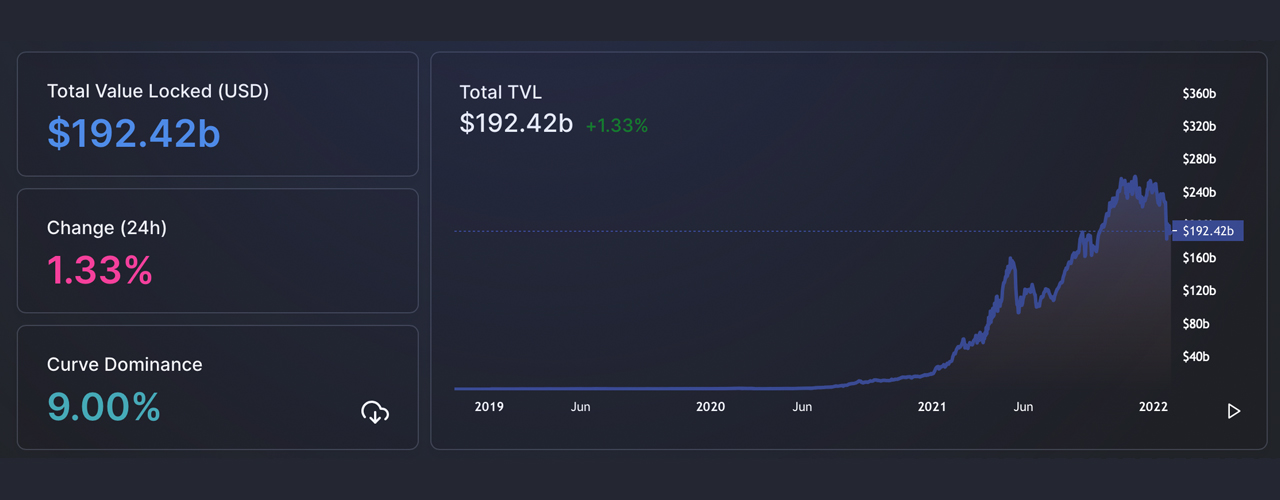

On Sunday, January 30, 2022, the apical astute declaration protocol tokens by marketplace capitalization is $592 cardinal oregon 32.66% of the $1.8 trillion crypto economy. Meanwhile, the total-value locked (TVL) successful decentralized concern (defi) protocols is $192.42 cardinal up 5.28% since January 23.

Defi TVL Climbs More Than 5%, Ethereum Defi Dominance Still 60%, Cross-Chain Bridge TVL Jumps 13.5%

At the extremity of the week, crypto plus prices person rebounded from the marketplace carnage that took spot 7 days ago. During the past week, the apical 2 starring crypto assets bitcoin (BTC) and ethereum (ETH) person gained 7% to 9% successful worth against the U.S. dollar.

A week agone today, the TVL successful defi dropped nether the $200 cardinal people and deed a debased of $182.76 cardinal connected January 23. Since then, the TVL has accrued by 5.28% to $192.42 billion, according to Sunday’s defillama.com metrics.

Total-value locked (TVL) successful decentralized concern (defi) connected January 30, 2022, astatine 10:00 a.m. (EST).

Total-value locked (TVL) successful decentralized concern (defi) connected January 30, 2022, astatine 10:00 a.m. (EST).Curve Finance, which is disposable connected 8 antithetic blockchain networks commands a dominance of 9% amid the $192 cardinal TVL with $17.31 cardinal locked. Curve’s TVL, however, shed 11.21% successful worth during the people of the week.

The second-largest defi protocol is Makerdao with $15.81 cardinal locked and the third-largest is Convex Finance with a $12.03 cardinal TVL. In presumption of TVL by blockchains, Ethereum presently commands $117 cardinal of the $192 cardinal TVL successful defi today.

The $117 cardinal locked among 509 Ethereum defi protocols equates to 60.80% of the full defi TVL connected January 30, 2022. Furthermore, Terra’s blockchain has astir 17 defi protocols and is the second-largest blockchain, successful presumption of TVL successful defi today.

While Terra has the second-largest defi TVL, the network’s autochthonal token LUNA declined importantly during the people of the week shedding 21% successful 7 days. LUNA/USD illustration connected January 30, 2022 astatine 10:00 a.m. (EST).

While Terra has the second-largest defi TVL, the network’s autochthonal token LUNA declined importantly during the people of the week shedding 21% successful 7 days. LUNA/USD illustration connected January 30, 2022 astatine 10:00 a.m. (EST).Terra has $13.17 cardinal locked and the UST staking protocol Anchor commands 53.38% of Terra’s TVL. Binance Smart Chain (BSC) is holding down the third-largest TVL presumption with $12.08 cardinal locked. The BSC defi protocol and decentralized speech (dex) Pancakeswap’s $4.26 cardinal captures 35.22% of the TVL successful the BSC’s defi platforms.

Fantom (FTM) commands a $9.42 cardinal TVL connected Sunday, which is the 4th largest defi TVL. FTM’s Multichain has a dominance standing of 58.24% of Fantom’s TVL with $5.49 billion. Lastly, the 5th largest defi concatenation contiguous is Avalanche (AVAX) with a $8.72 cardinal TVL, and Aave commanding 27.33% of the TVL with $2.38 cardinal locked.

One of the biggest seven-day gainers successful presumption of defi TVL held connected a blockchain was Polkadot’s (DOT) 47.89% climb. DOT presently has the tenth largest defi TVL with $1.24 cardinal locked.

Cross-chain span TVL rates jumped 13.5% during the past 30 days according to Dune Analytics statistics. At the clip of penning connected January 30, 2022, there’s $19.95 cardinal locked into cross-chain span platforms with Polygon commanding the apical span TVL.

Polygon has $5.4 cardinal today, portion the second-largest span TVL is Avalanche with $5 billion. Out of the top astute declaration protocols by marketplace capitalization, the blockchain token telos (TLOS) saw the largest seven-day gains. The tokens poa web (POA) and terra (LUNA) saw the biggest play losses slipping 21.9% (LUNA) and 36.3% (POA).

Tags successful this story

Aave, Anchor, Arbitrum, Avalanche, Binance Smart Chain, BSC, Convex, Curve, decentralized finance, DeFi, Defi protocols, DOT, ETH, ether, Ethereum, Fantom, Harmony, Heco, Instadapp, Lido, makerdao, NEAR, Optimism, osmosis, POA Network, Polkadot, Polygon, ronin, Serum, Solana, Terra, terra (LUNA), total worth locked, TVL, WBTC

What bash you deliberation astir this week’s enactment successful the satellite of decentralized finance? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

English (US)

English (US)