sponsored

In January 2023, ViaBTC Capital and CoinEx jointly released the 2022 Crypto Annual Report to connection information investigation and insights into 9 sectors, including Bitcoin, Ethereum, stablecoins, NFT, nationalist chains, DeFi, SocialFi, GameFi and regulatory policies. This study besides predicts the crypto inclination successful 2023.

According to the report, affected by factors specified arsenic the macro situation and bull-to-bear transition, the full cryptocurrency manufacture became bearish successful 2022. In particular, pursuing the Terra meltdown successful May, astir cryptocurrency sectors were deed by the bearish impact. Below is the overview of each segment.

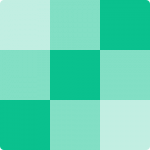

1. Bitcoin

In 2022, the wide show of Bitcoin remained sluggish, with important declines successful terms and trading measurement compared to 2021. The terms astatine the extremity of 2022 adjacent fell beneath the highest of the past bull market. The terms inclination of Bitcoin passim the twelvemonth is evidently influenced by the gait of US involvement complaint hikes, but arsenic the US involvement complaint hike argumentation continues to advance, its interaction connected the terms of bitcoin is gradually diminished. Regarding BTC mining, the web trouble remained astatine a historical high. Meanwhile, the mining gross plummeted, and miners person had to unopen down their aged models. Affected by aggregate factors, the mining manufacture witnessed a beardown crowding-out effect, which drove owners of tiny mining farms retired of the marketplace for assorted reasons. At the aforesaid time, long-established mining pools and mining farms managed to support a definite level of stability.

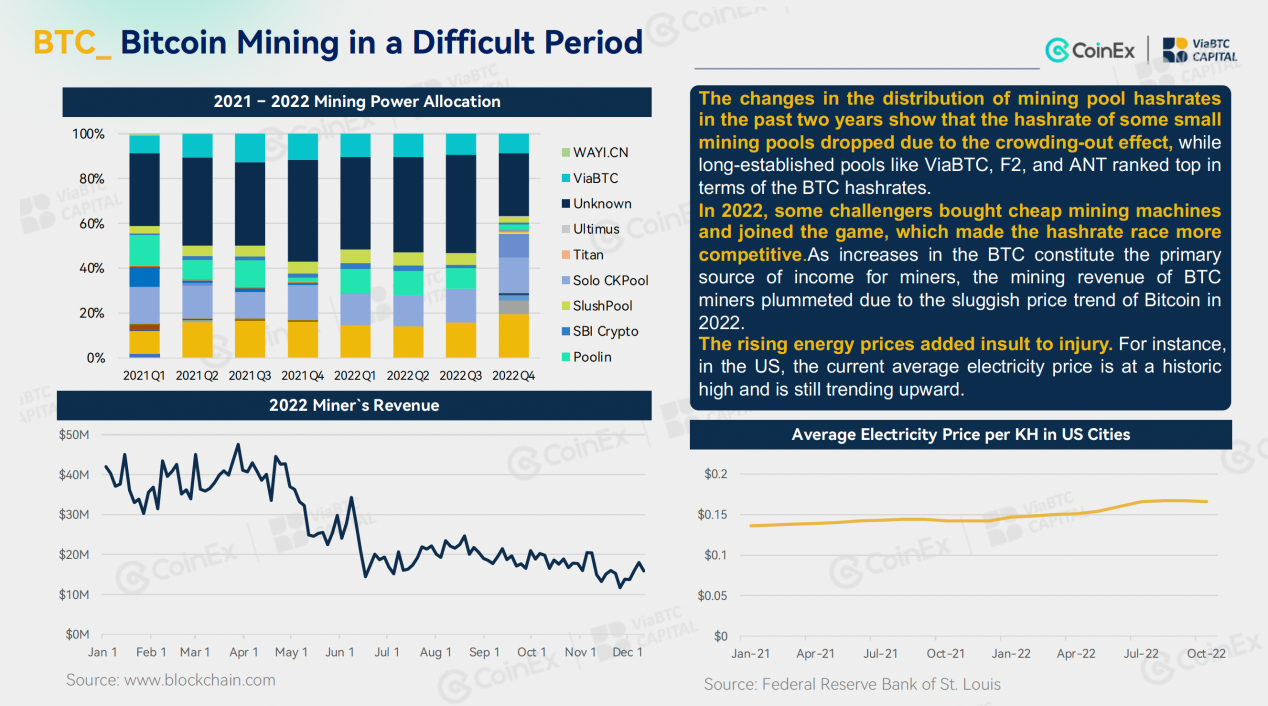

2. Ethereum

The superior statistic of Ethereum trended downward successful 2022. In summation to the secondary marketplace terms and transaction volume, the on-chain data, including TVL, transaction cost, progressive code and burning measurement besides took a plunge. Despite that, the web did execute a batch of advancement successful 2022. On September 15, Ethereum completed the historical modulation from PoW to PoS. The Merge importantly chopped the network’s vigor depletion and regular output, thereby reducing the dumping unit from secondary markets. Meanwhile, Layer 2 projects specified arsenic Arbitrum, Optimism, zkSync, and Starknet launched their mainnet either successful full oregon successful part. Although their regular transaction measurement was acold little than Ethereum mainnet, the projects exceeded Ethereum successful presumption of the fig of addresses. Moreover, their state interest was mostly 1/40 of that charged by Ethereum. At the aforesaid time, the web besides saw an exponential summation successful state fees during 2022.

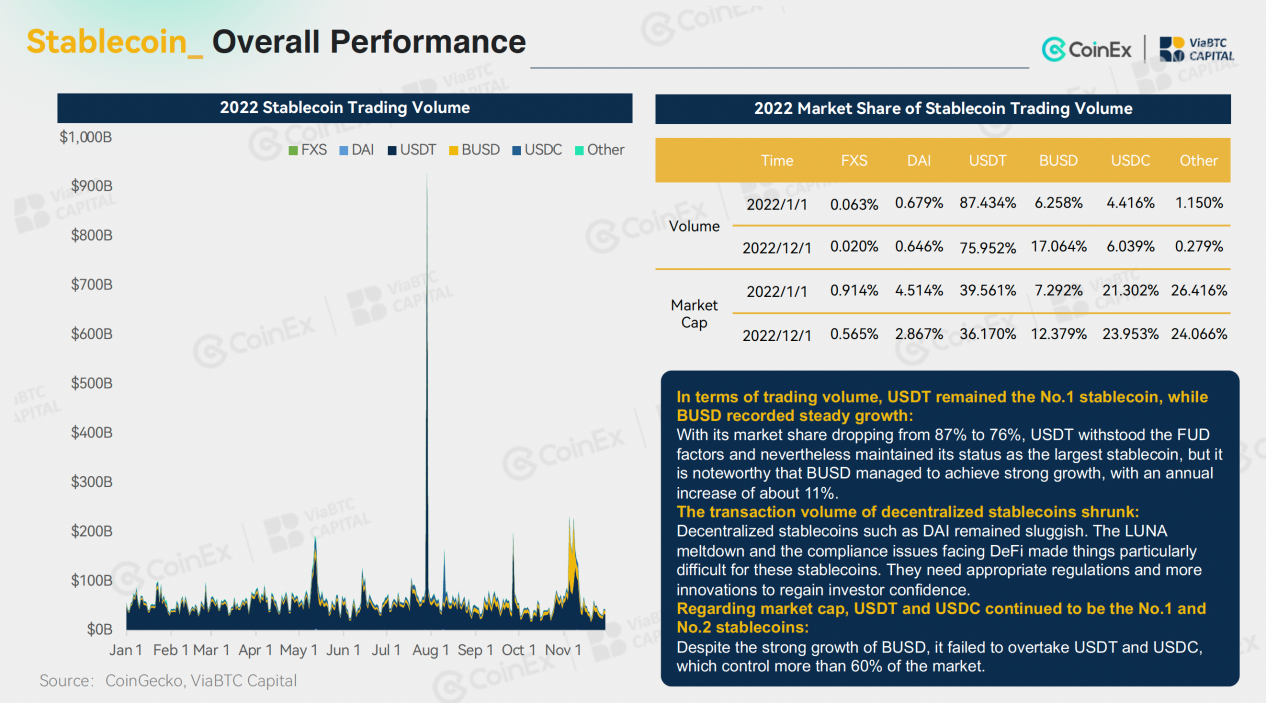

3. Stablecoins

The stablecoin marketplace arsenic a full was unchangeable successful 2022. Specifically, passim the year, the proviso of stablecoins fell from $157 cardinal to $148 billion, a 6% drop. In this regard, the autumn was not substantial. With respect to centralized stablecoins, USDT maintained its dominance, portion BUSD is increasing rapidly connected Binance’s back. By contrast, algorithmic stablecoins were deed hard by the autumn of LUNA, which shattered the religion successful decentralized stablecoins and reduced trading volumes. As a result, determination was a wide driblet successful the fig of caller decentralized stablecoins.

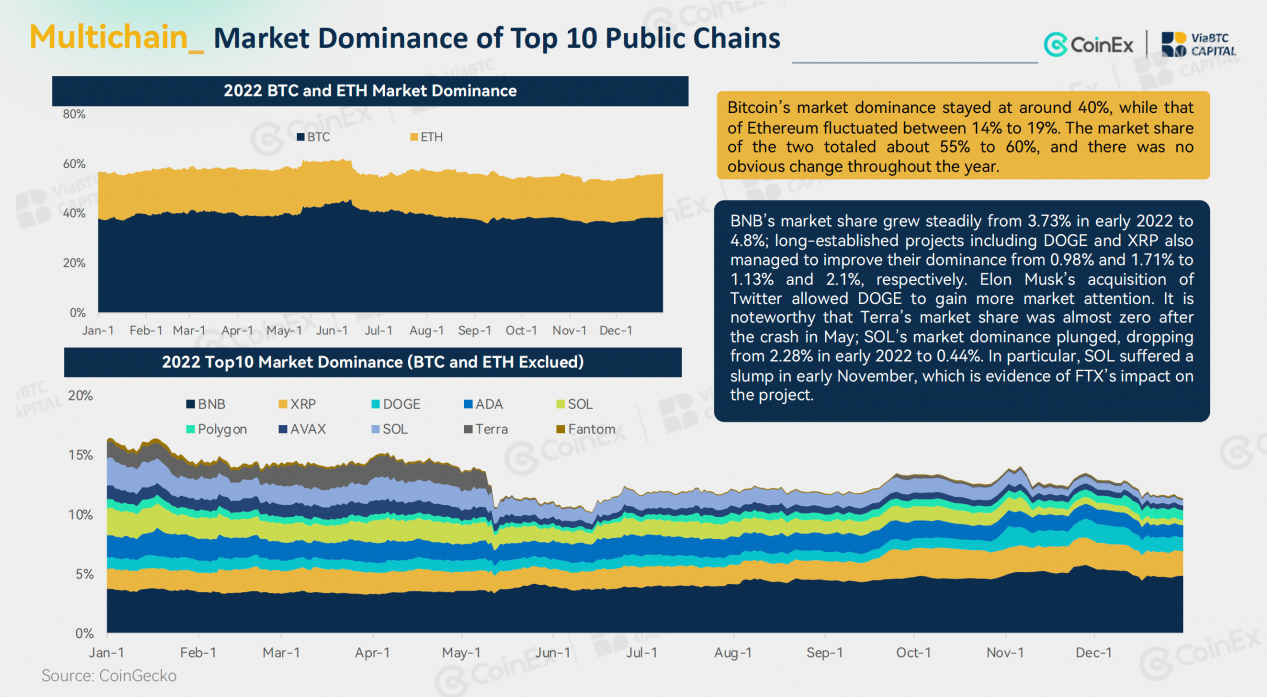

4. Public chains

Despite the unsmooth marketplace conditions successful 2022, nationalist chains remained a competitory sector. Due to the overflow of request caused by the congestion of the Ethereum network, the caller nationalist concatenation with debased fees maintained a agleam show earlier May. However, arsenic assorted atrocious quality brewed and fermented, a bid of bankrupt occurred 1 aft another. Many nationalist chains were greatly impacted, and the diminution was adjacent worse than that of Ethereum. In May, Terra collapsed successful lone a fewer days, making it the archetypal well-known nationalist concatenation to fall. Furthermore, the Terra meltdown was besides a awesome that the marketplace turned afloat bearish. In November, deed by the autumn of FTX and Alameda Research, Solana’s token terms and TVL took different plunge, and the projects wrong its ecosystem were besides hurt. Other caller chains specified arsenic Fantom and Avalanche were besides struggling. At the aforesaid time, a fig of caller nationalist chains, including Layer 2 projects similar Arbitrum and Optimism and Meta-related chains specified arsenic Aptos and Sui, made their debut successful 2022.

5. NFT

Last year, the NFT assemblage declined aft its archetypal boom. In April, the marketplace headdress of the NFT reached $4.15 billion, a historical high; In May, driven by the roar of Otherside, a metaverse NFT postulation developed by Yuga Labs, the trading measurement of the assemblage deed a grounds precocious of $3.668 billion. But soon afterward, arsenic the NFT marketplace turned sluggish, the trading measurement declined. Meanwhile, the terms of blue-chip NFTs, arsenic good arsenic the ETH price, plummeted, which some negatively affected the market. On the different hand, the fig of NFT holders kept increasing and reached a historical precocious successful December.

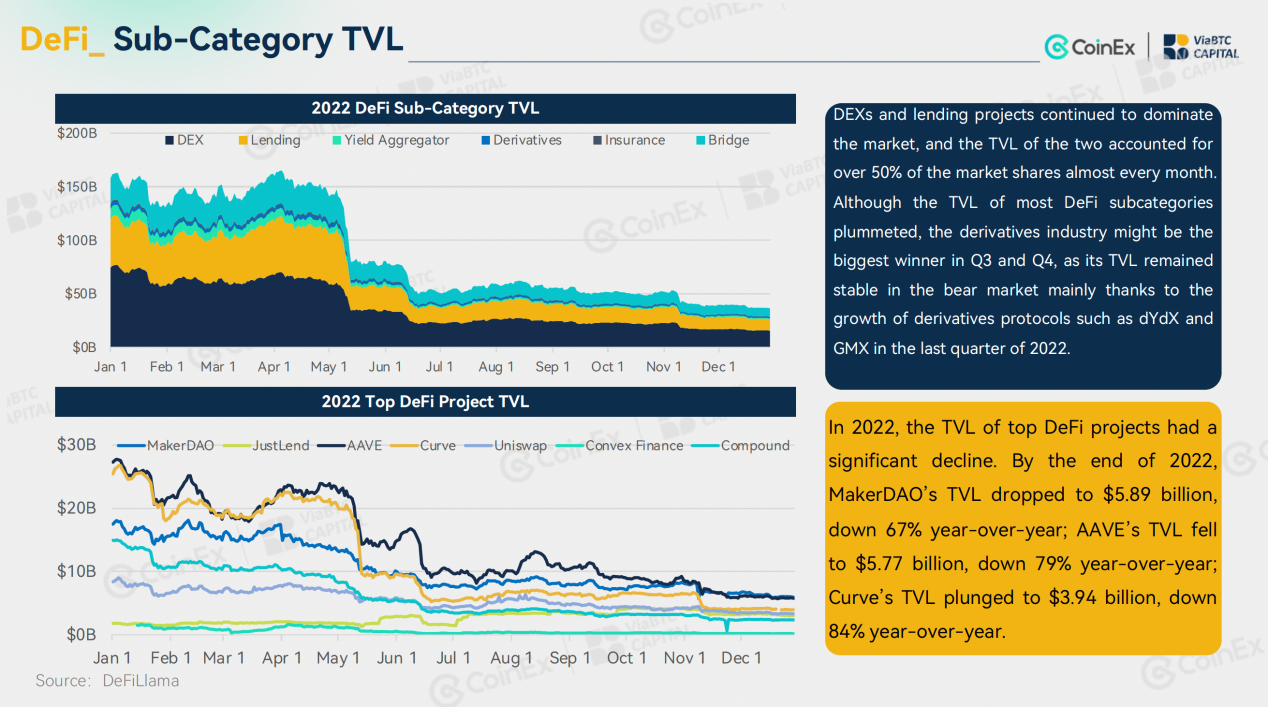

6. DeFi

DeFi’s TVL besides trended downward successful 2022. In particular, during the LUNA/UST meltdown successful May, mainstream coins witnessed the astir spectacular clang successful the past of cryptocurrencies, which was followed by a TVL collapse. Additionally, implicit the year, DeFi besides suffered predominant hacks, which raised information concerns for DeFi. In presumption of innovation, though the archetypal 2 quarters of 2022 saw trending hypes astir DeFi 2.0 from clip to time, on with the slump of OHM and the (3, 3) meme, DeFi 2.0 was astir proven to beryllium a wholly mendacious narrative, and the marketplace shifted its attraction backmost to DeFi 1.0 infrastructure projects specified arsenic Uniswap, Aave, and MakerDAO. Despite the bearish conditions, mainstream DeFi projects including AAVE and Compound managed to support dependable operations and attracted galore caller users from definite CeFi projects (e.g. Celsius and FTX).

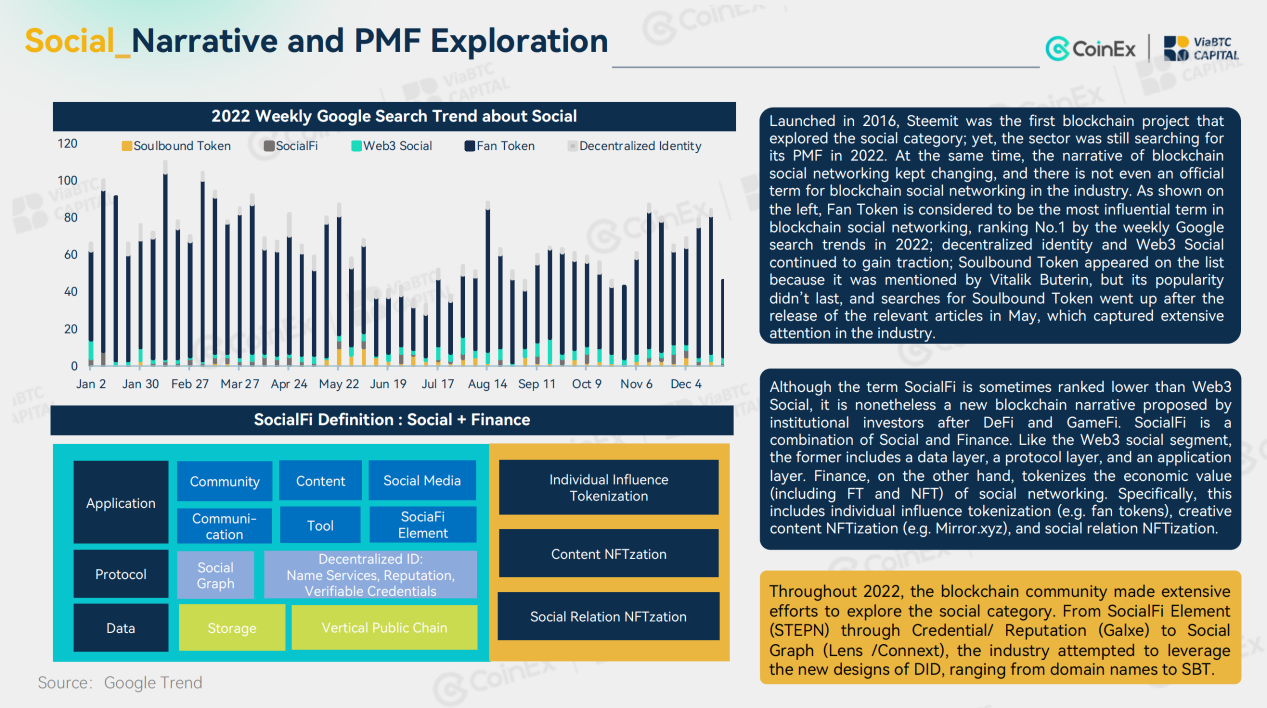

7. SocialFi

In 2022, the blockchain manufacture continued to research caller possibilities for SocialFi. Over the year, we saw the quality of iconic presumption similar Fan Token, Soulbound Token (SBT), Web3 Social, and Decentralized Identity (DID), but the PMF (Product- Market Fit) was ne'er identified. Despite that, the SocialFi inactive managed to contiguous america with a fig of prima projects, including Web3 manner app STEPN featuring SocialFi elements, credential web Galxe, BNB Chain domain sanction work SPACE ID, societal graph Lens Protocol, and Web3 gamified societal learning level Hooked Protocol. Apart from that, the 2022 Qatar World Cup besides helped Fan Tokens pull extended marketplace attention. As a result, alternatively of plummeting owed to the bearish impact, the Fan Tokens besides performed somewhat amended successful 2022 than successful 2021.

8. GameFi

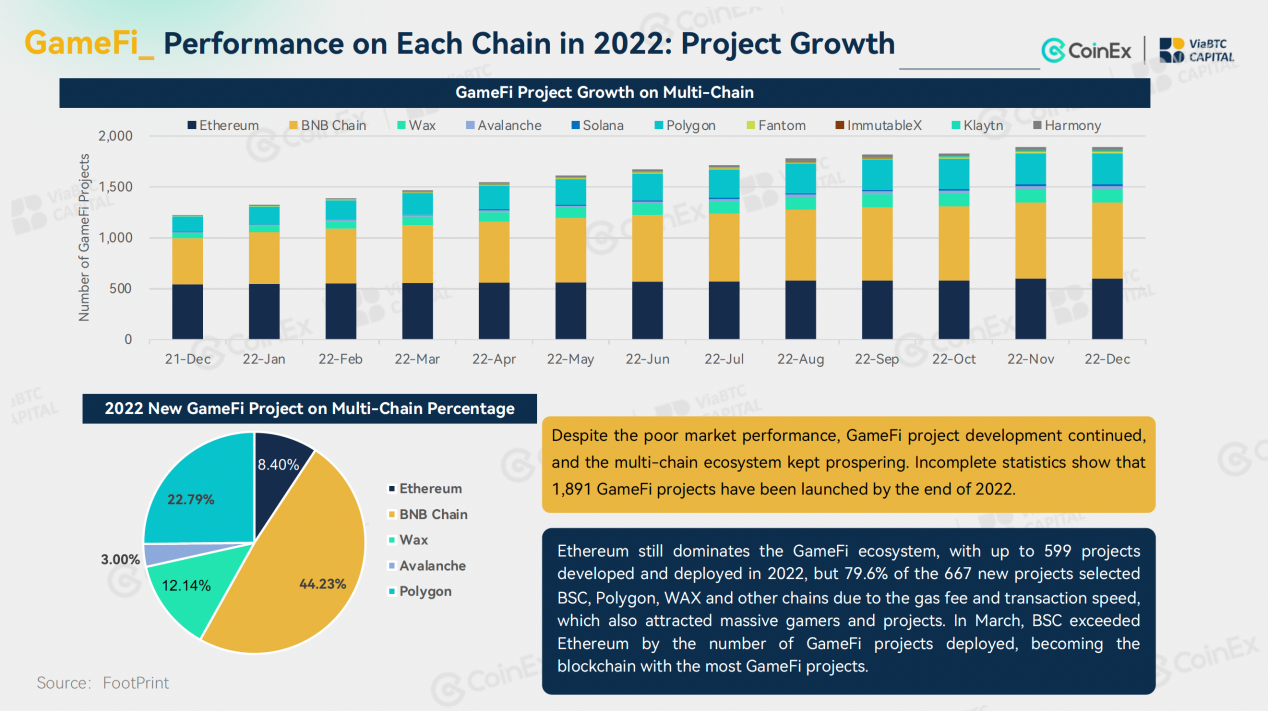

2022 was besides the opening of the GameFi bear. There was nary important innovation successful P2E blockchain crippled model. As the maturation of users and trading volumes dwindled, organization investors looked distant from the P2E model. In the archetypal fractional of the year, the Move-2-Earn exemplary created by STEPN captured the spotlight with its innovative dual tokenomics and selling approach, bringing caller dynamics to GameFi. Last year, blockchain projects raised the largest funds successful April, with blockchain investments totalling $6.62 billion. However, the marketplace didn’t respond to different task teams focusing connected the world positive token model. As the multi-chain ecosystem gained increasing popularity, Ethereum maintained its dominance successful the GameFi ecosystem, but the maturation complaint of projects connected Ethereum failed to lucifer that of BNB Chain and Polygon. In addition, astir chains relied heavy connected their apical projects, and determination were inactive plentifulness of low-quality GameFi projects with a tiny idiosyncratic base, subpar interactions and debased trading volumes.

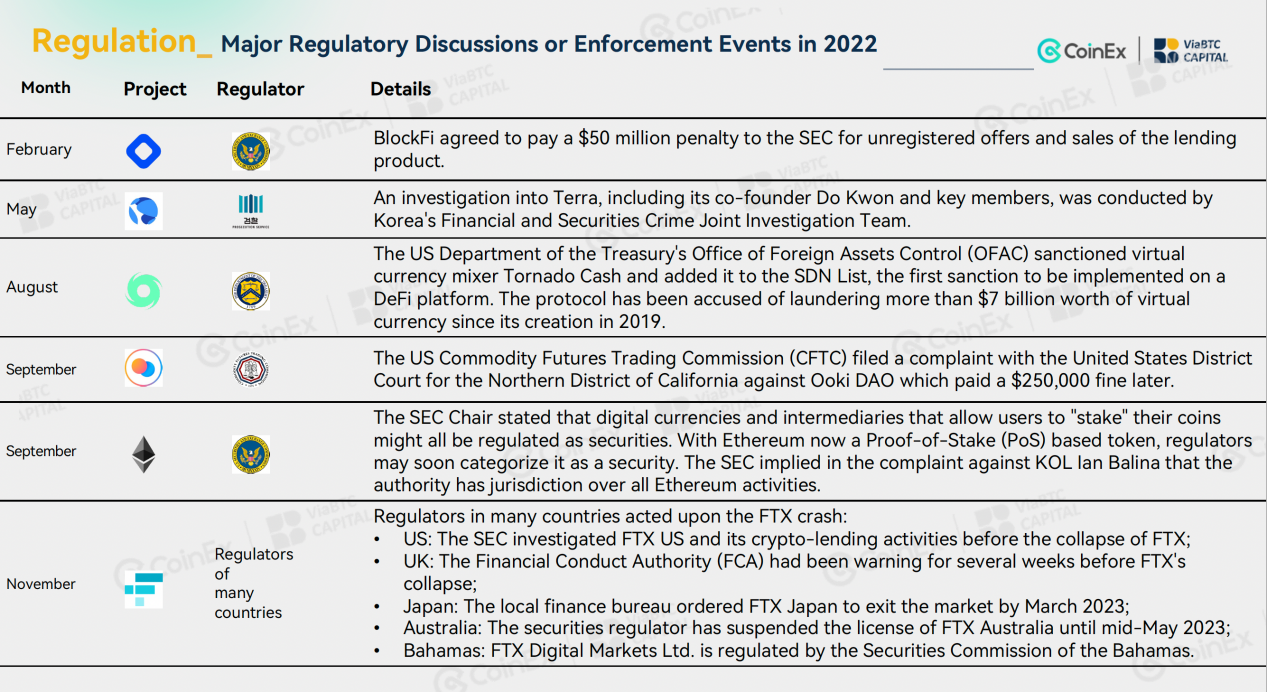

9. Regulatory policies

Generally speaking, for the cryptocurrency industry, 2022 was afloat of ups and downs, but regulations are headed successful the close direction. Over the past year, regulators successful the developed satellite achieved a batch of progress. The United States released a regulatory model for cryptocurrencies; the European Union initially approved the MiCA Act and the TFR Act; the United Kingdom and South Korea made advancement successful the constitution of the applicable organizations; Russia and Hong Kong promoted the treatment and implementation of policies for cryptocurrency mining and virtual plus securities. The turbulence that happened successful the cryptocurrency manufacture successful 2022 was partially the effect of the crisp driblet successful funds and partially the effect of regulatory loopholes and crackdowns. Last year, the bankruptcy of Terra and FTX, 2 apical cryptocurrency projects, prompted nationalist regulators and instrumentality enforcement agencies to further heighten their cryptocurrency oversight and investigations.

For much details, delight sojourn the ViaBTC Capital website via the link:

For much details, delight sojourn the ViaBTC Capital website via the link:

This is simply a sponsored post. Learn however to scope our assemblage here. Read disclaimer below.

Media

Bitcoin.com is the premier root for everything crypto-related.

Contact the Media squad connected [email protected] to speech astir property releases, sponsored posts, podcasts and different options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

English (US)

English (US)