Voyager files for Chapter 11 bankruptcy owed to their ample vulnerability to Three Arrows Capital arsenic the contagion continues to dispersed crossed the market.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

In Case You Missed It: Bitcoin Magazine Pro Special Edition Contagion Report

Early connected July 6, 2022, it was announced that Voyager has filed for Chapter 11 bankruptcy.

Voyager Digital Commences Financial Restructuring Process to Maximize Value for All Stakeholders

This was pursuing the announcement from the steadfast connected June 22 that they had ample vulnerability to Three Arrows Capital (3AC) successful the signifier of unsecured loans.

“Voyager concurrently announced that its operating subsidiary, Voyager Digital, LLC, whitethorn contented a announcement of default to Three Arrows Capital ("3AC") for nonaccomplishment to repay its loan. Voyager's vulnerability to 3AC consists of 15,250 BTC and $350 cardinal USDC. The Company made an archetypal petition for a repayment of $25 cardinal USDC by June 24, 2022, and subsequently requested repayment of the full equilibrium of USDC and BTC by June 27, 2022. Neither of these amounts has been repaid, and nonaccomplishment by 3AC to repay either requested magnitude by these specified dates volition represent an lawsuit of default.” - Voyager Press Release

In our June 16 release, pursuing the announced insolvency of 3AC, we speculated connected the likelihood of Voyager vulnerability to 3AC successful our issue, Fears Of Further Contagion.

“With the caller developments, rumors person been flying, with speculation that aggregate crypto lending/borrowing desks person been deed from insolvency.

“While it is uncertain which firms whitethorn person experienced immoderate equilibrium expanse impairment, determination is simply a ample anticipation of losses crossed firms successful the industry, and it's apt that we haven’t seen the particulate settle.

“Shares of crypto custody/borrowing steadfast Invest Voyager ($VOYG) person fallen 33% implicit the past 2 days. The firm’s latest quarterly merchandise showed that the institution had lent $320 cardinal to a Singapore-based entity (home of 3AC earlier relocation). Regardless of whether the indebtedness was to 3AC, the illness successful stock terms is surely not a ballot of assurance by the marketplace for a U.S.-based nationalist crypto lending platform.” - Fears Of Further Contagion

Now, with the announcement of Voyager’s bankruptcy proceedings, immoderate absorbing findings tin beryllium seen successful the bankruptcy filings.

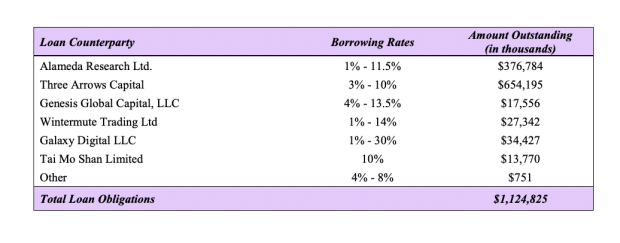

In the company’s filing, it was reported that Alameda Research has borrowed $376 cardinal from Voyager, for chartless reasons.

Link to filing

Link to filing

While it is somewhat funny that the steadfast supposedly is moving to enactment up the manufacture and stem the equilibrium expanse contagion is presently borrowing wealth from an insolvent steadfast (that Alameda holds 9.49% ownership in), determination are a fewer reasons that travel to mind.

- It is not antithetic for a proprietary trading table to get superior successful the cryptocurrency manufacture (specifically denominated successful assets different than the dollar).

- Given that Voyager’s assets (that were mostly lawsuit deposits) were partially bitcoin denominated, Alameda could perchance beryllium borrowing BTC to usage for marketplace making/shorting, successful which they would purpose to screen the indebtedness astatine a aboriginal date.

- Although the presumption of the indebtedness are unspecified, fixed Alameda’s ownership involvement successful Voyager, it would marque consciousness that the steadfast wouldn't telephone successful the loan, which would little expected involvement revenues.

It is our content that it volition instrumentality the marketplace either little prices and/or important clip to retrieve from the harm suffered successful caller months, from some a equilibrium expanse impairment position arsenic good arsenic a reputational/legitimacy perspective.

3 years ago

3 years ago

English (US)

English (US)