Yesterday, Berkshire Hathaway, the temple of 20th period concern capitalism, led by “the Oracle of Omaha” himself, Warren Buffett, invested successful the largest “neobank” successful Latin America. Brazil’s Nubank has immoderate (very) indirect exposure to cryptocurrency, which caused a disturbance fixed Buffett’s long-time aversion to each things crypto and blockchain. Has Buffett, a antheral known for eating the aforesaid McDonald’s meal each day, changed his mind?

It would beryllium a precise large woody so if helium did. Berkshire Hathaway is 1 of the astir profitable corporations ever. Buffett’s concern thesis is taught successful concern schools astir the world. Lehman Brothers asked Buffett for a bailout successful 2008 – earlier imploding (he declined). And truthful acold helium has stayed astatine arms magnitude from bitcoin, famously calling the integer plus “rat poison, squared.” A reversal, adjacent conscionable a softer view, would beryllium large for validation.

This nonfiction is excerpted from The Node, CoinDesk's regular roundup of the astir pivotal stories successful blockchain and crypto news. You tin subscribe to get the afloat newsletter here.

But immoderate stories are excessively bully to beryllium true. To start, this isn’t adjacent the archetypal concern Berkshire made successful Nubank – it took a $500 cardinal stake a fewer months earlier the institution went nationalist successful December 2021. And portion the slope does connection roundabout bitcoin vulnerability done its concern arm, astatine this constituent it conscionable looks similar a azygous BTC exchange-traded money (ETF).

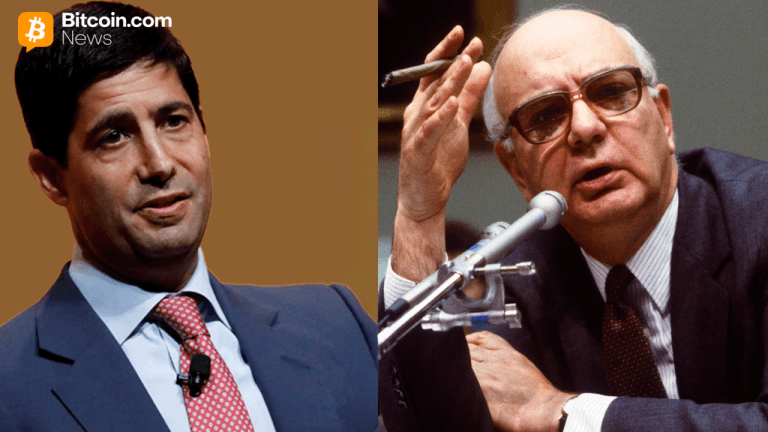

Buffett’s close manus man, Berkshire Vice President Charlie Munger, did the property rounds yesterday day to wide the air. At a Daily Journal league successful Los Angeles, Munger reiterated the famed fiscal duo’s hatred of crypto. "I surely didn't put successful crypto. I'm arrogant of the information that I avoided it. It's similar immoderate venereal disease,” helium told Yahoo Finance Editor-in-Chief Andy Serwer.

That said, successful the aforesaid interview, Munger suggested that though helium wished crypto had “never been invented” oregon was regulated retired of beingness it’s apt to instrumentality astir for the agelong haul. “We can't bash overmuch astir it, truthful we walk our clip connected the matters we tin bash thing about,” helium said. (He did say, if helium were the “benign dictator of the world,” he’d marque it “infeasible” to marque short-term profits from securities.)

This gets astatine thing overmuch deeper and overmuch much absorbing astir the authorities of the crypto markets. Crypto, the large disrupter, is progressively embedded wrong the fiscal system. Over the past two-plus years, much than a fistful of formerly skeptical institutions person begun rolling retired crypto services. JPMorgan offers crypto to affluent investors, contempt CEO Jamie Dimon’s heavy skepticism. Its competitors person akin offerings. Billionaire investors, similar Munger and Buffett’s adjacent Ray Dalio, sermon bitcoin arsenic a imaginable inflation hedge.

Munger said the plus people is thing much than “heavily promotional capitalism.” But it’s besides an manufacture that, whether you similar oregon not, radical tin nary longer avoid. Even though Nubank is not a “crypto” firm, it’s apt to progressively instrumentality connected vulnerability to the region’s blockchain industry. The Association for Private Capital Investment successful Latin America recovered that crypto-related task spending increased tenfold successful 2021 compared to the twelvemonth before. Two of Latin America’s latest unicorns, oregon backstage firms with astatine slightest a $1 cardinal valuation, Mercado Bitcoin and Bitso, are crypto exchanges.

There’s wealth to beryllium made successful the crypto industry, successful portion by disrupting the precise industries and practices that made Berkshire Hathaway truthful profitable. But that doesn’t needfully mean crypto is incommensurate with Buffett’s “value investing” tenets. You don’t adjacent request “dog tokens” to concern a real-world monstrosity similar the “Munger dorm.” Crypto, similar immoderate market, would fundamentally spell to furniture with anyone. Whether that makes it a “speculative orgy,” arsenic Munger said, oregon a going interest is an unfastened question.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)