Bear marketplace rallies look to beryllium playing retired for some the S&P 500 Index and bitcoin. How precocious tin the rally go? What bash humanities rallies look like?

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Bitcoin Bear Market Rallies

Bear marketplace rallies, whether it’s equities oregon bitcoin, are a akin cyclical determination that’s played retired successful markets clip and clip again. They tin beryllium convincing and volatile arsenic investors go excessively acold positioned successful 1 direction.

We privation to item the carnivore marketplace rally lawsuit for bitcoin. As bitcoin has been intimately pursuing broader risk-on assets this cycle, it’s apt that continues arsenic the marketplace heads little implicit the coming months.

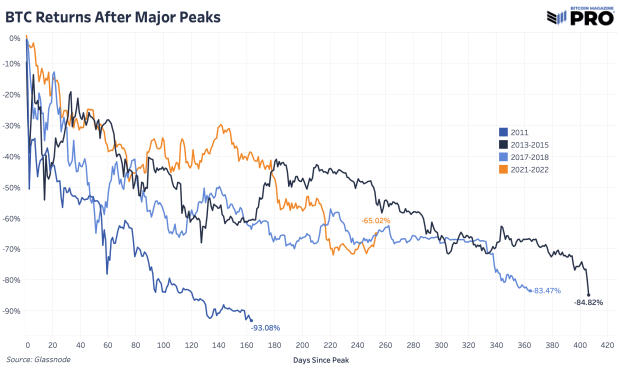

We person bitcoin-specific carnivore marketplace cycles. After the astir caller rally, bitcoin is down 65% from the all-time precocious successful November, 253 days in. 2013 and 2017 cycles recovered a bottommost astatine 84.82% and 83.47% drawdowns, respectively, with some lasting adjacent to astir 400 days. Bitcoin’s latest rally is not retired of the mean for the emblematic carnivore marketplace rally move. Even a determination to $30,000 is reasonable.

Bitcoin returns aft large peaks

Bitcoin returns aft large peaks

Typically, carnivore marketplace cycles successful the bequest satellite extremity aft a 20% determination up from the lows truthful having a rhythm that printed caller all-time highs seems similar a stretch. Yet, looking astatine this mode is compelling from a duration of 435 days and drawdown of 70%, which would acceptable the thought that all-time precocious drawdowns lessen implicit time.

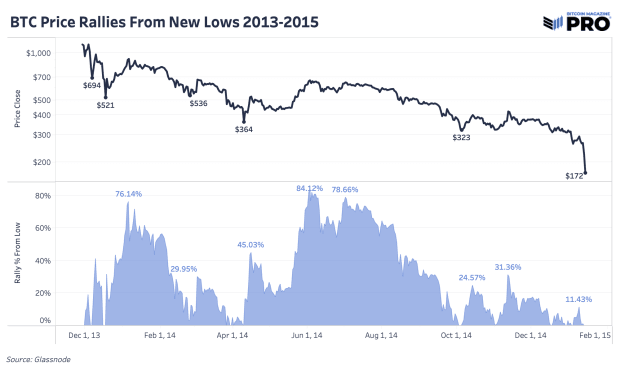

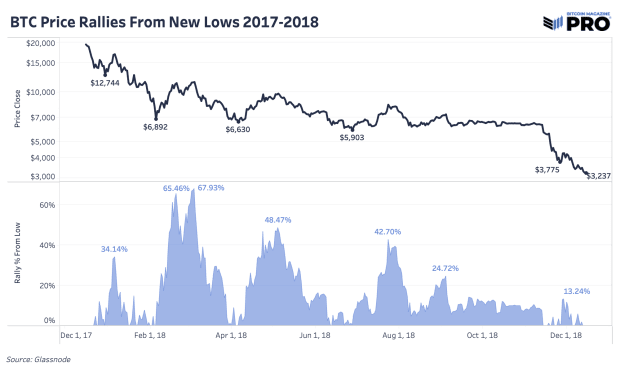

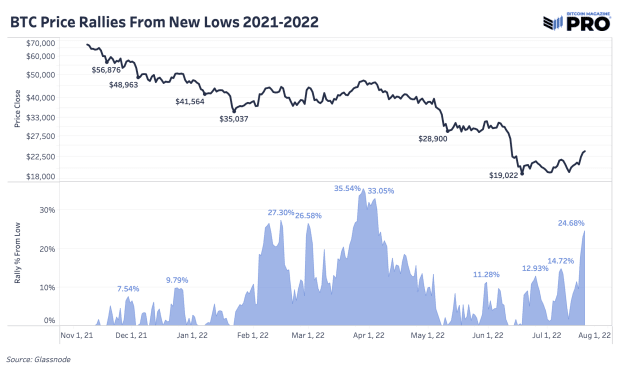

The different mode to look astatine the rallies is to spot however precocious prices determination disconnected of caller lows. Below we person the rally percentages from caller lows crossed cycles. Using regular adjacent prices and not implicit bottommost wick prices, the 2013-2015 rhythm saw rally gains of 84.12% astatine its highest portion 2017-2018 saw 67.93%. In the existent rhythm we’ve seen a 35.54% rally determination astatine its highest portion the latest move, astatine the clip of writing, is astir 26%.

Bitcoin terms rallies from caller lows 2013-2015

Bitcoin terms rallies from caller lows 2013-2015

Bitcoin terms rallies from caller lows 2017-2018

Bitcoin terms rallies from caller lows 2017-2018

Bitcoin terms rallies from caller lows 2021-2022

Bitcoin terms rallies from caller lows 2021-2022

Final Note

There’s a lawsuit to beryllium made for the bitcoin bottommost being successful amid the question of forced liquidations, capitulation-like behaviour and astir each mean-reversing rhythm metric printing a bully semipermanent accidental to accumulate. Yet, our probe and investigation leads america to these questions:

How acold volition equities fall? Is a 23.55% drawdown from all-time precocious successful the S&P 500 Index the worst we spot successful this market? Are economical and liquidity conditions getting amended to warrant a reversal? Has determination been a cardinal alteration oregon catalyst for bitcoin to suggest it won’t travel broader marketplace moves?

It’s imaginable that bitcoin has already front-runned that determination and volition apt beryllium the plus to bottommost first, anyway. We’re convinced that the much apt lawsuit is that bitcoin volition astatine slightest revisit erstwhile lows and apt marque a caller one.

3 years ago

3 years ago

English (US)

English (US)