WAVES terms and its USDN stablecoin suffer worth aft the Digital Asset eXchange Association issues a caution announcement and Upbit speech delists the token.

58 Total views

2 Total shares

Own this portion of crypto past

Collect this nonfiction arsenic NFT

Algorithmic stablecoins person had a unsmooth year, starting with UST de-pegging to zero and the consequent blow-up of Terra’s LUNA token which was utilized for the asset’s backing. Algorithmic stablecoins are not afloat collateralized and trust connected antithetic mechanisms to support the peg, making them inherently fragile to marketplace conditions.

The UST implosion created a domino effect that caused another stablecoin, Magic Internet Money (MIM) to de-peg. Despite the fragility of algorithmic stablecoins, new projects similar Djed by Cardano (ADA) are inactive readying connected launching, but that doesn’t mean that the conception has improved since the crises seen earlier successful the year.

Let’s look astatine the latest de-peg lawsuit successful the cryptocurrency space.

Warning issued for WAVES and its USDN stablecoin

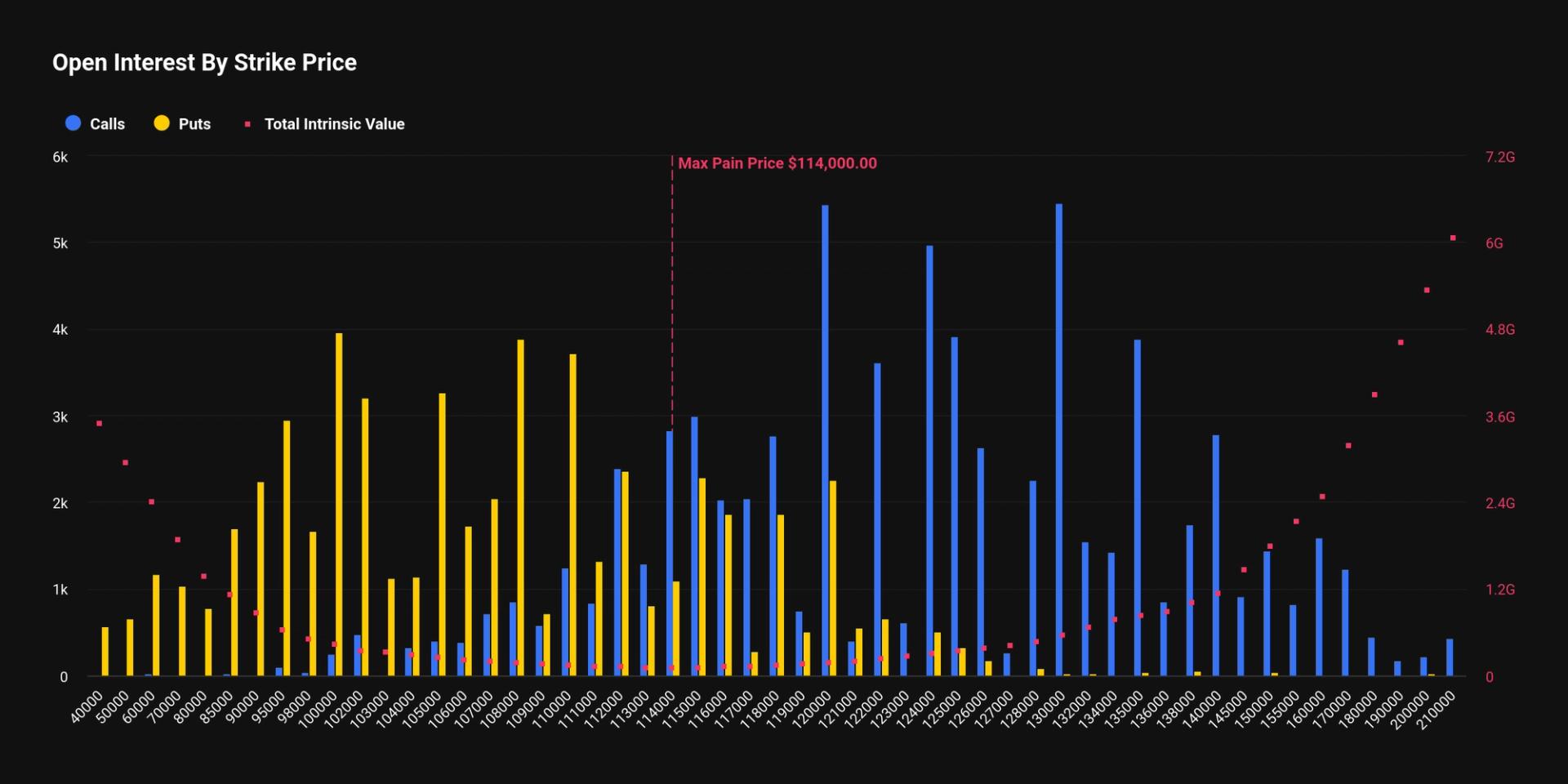

On Dec. 8, the Digital Asset eXchange Association (DAXA), which consists of the 5 large crypto exchanges successful Korea issued a warning for Waves and its (WAVES) token.

The informing comes aft the stablecoin, USDN which is backed by WAVES, de-pegged and has frankincense acold failed to re-establish the $1 peg successful much than 180 days. This means that the USDN protocol whitethorn liquidate WAVES done the automatic arbitrage process successful an effort to regain the peg. On Dec. 8, USDN was 16% beneath the peg.

USDN/USD 180-day chart. Source: Coingecko

USDN/USD 180-day chart. Source: CoingeckoThe determination by DAXA to contented the informing has led Upbit to delist some WAVES and USDN. The delisting, combined with the DAXA informing appears to beryllium playing immoderate relation successful the terms diminution presently seen successful WAVES and USDN.

$WAVES and its stablecoin $USDN some crashing.

Upbit delisting WAVES with a beardown "investor warning" lmao.

Also proceeding rumours of exit scam.

For arsenic agelong arsenic I tin retrieve this task has been a full shitshow. pic.twitter.com/mnPv4aCik9

Algorithmic stablecoins are not unsocial successful depegging. Constant concerns astir Tether’s (USDT) backing and its wide solvency proceed to rise de-peg fears among each levels of investors.

Over the years, USDT has mislaid its peg but ne'er to the grade seen with UST and USDN.

As the assemblage continues to reel from algorithmic stablecoins, regulators are taking announcement and placing priority connected regulating the space.

The views, thoughts and opinions expressed present are the authors’ unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)