A lesser-known cryptocurrency has risen to prominence successful a broader marketplace sentiment marred by macro uncertainties, acknowledgment to a cocktail of affirmative cardinal developments and speculative flows stemming from the integer asset's Russia links.

WAVES is an inflationary token offered arsenic a reward for mining blocks connected the decentralized, open-source blockchain Waves. The token has rallied 240% to $30 successful the past 4 weeks and is connected the best-performing coins with a marketplace capitalization of astatine slightest $1 billion, CoinDesk information shows.

The rally has helped the cryptocurrency marque it to the database of apical 50 cryptocurrencies by marketplace value. At property time, WAVES was the 41st largest integer plus with a marketplace capitalization of $3.35 billion.

"The main crushed waves has climbed up is that Neutrino protocol's full worth locked has accrued by 338% successful the past month," Rudy Chen, an expert astatine crypto ratings steadfast TokenInsight, told CoinDesk successful a Telegram chat.

Neutrino Protocol is an algorithmic price-stable multi plus protocol based connected Waves facilitating the instauration of stablecoins with values pegged to real-world assets specified arsenic nationalist currencies oregon commodities. Data tracked by Defi Llama amusement Neutrino is the biggest protocol connected Waves, accounting for 62% oregon $1.74 cardinal of the $2.8 cardinal locked successful the Waves-based DeFi ecosystem. Total worth locked is 1 of the astir commonly utilized metrics to measure the DeFi sector's growth.

The proviso of Neutrino's dollar-pegged decentralised stablecoin USDN has accrued substantially successful 1 month, possibly putting an upward unit connected WAVES. Per Messari, generating USDN requires locking WAVES successful Neutrino's astute contracts, portion USDN redemptions person the other effect of destroying the stablecoin to unlock WAVES supply.

"The outstanding proviso of USDN has accrued by astir 66% since mid-Feb (around +350 cardinal USDN) which means that an equivalent dollar magnitude of WAVES was locked up successful Neutrino to mint that caller magnitude of USDN," Gabriel Tan, concern expert astatine The Spartan Group told CoinDesk successful a Telegram chat. "This could person been a important request operator for WAVES if a ample chunk of the locked-up WAVES was bought disconnected secondary markets."

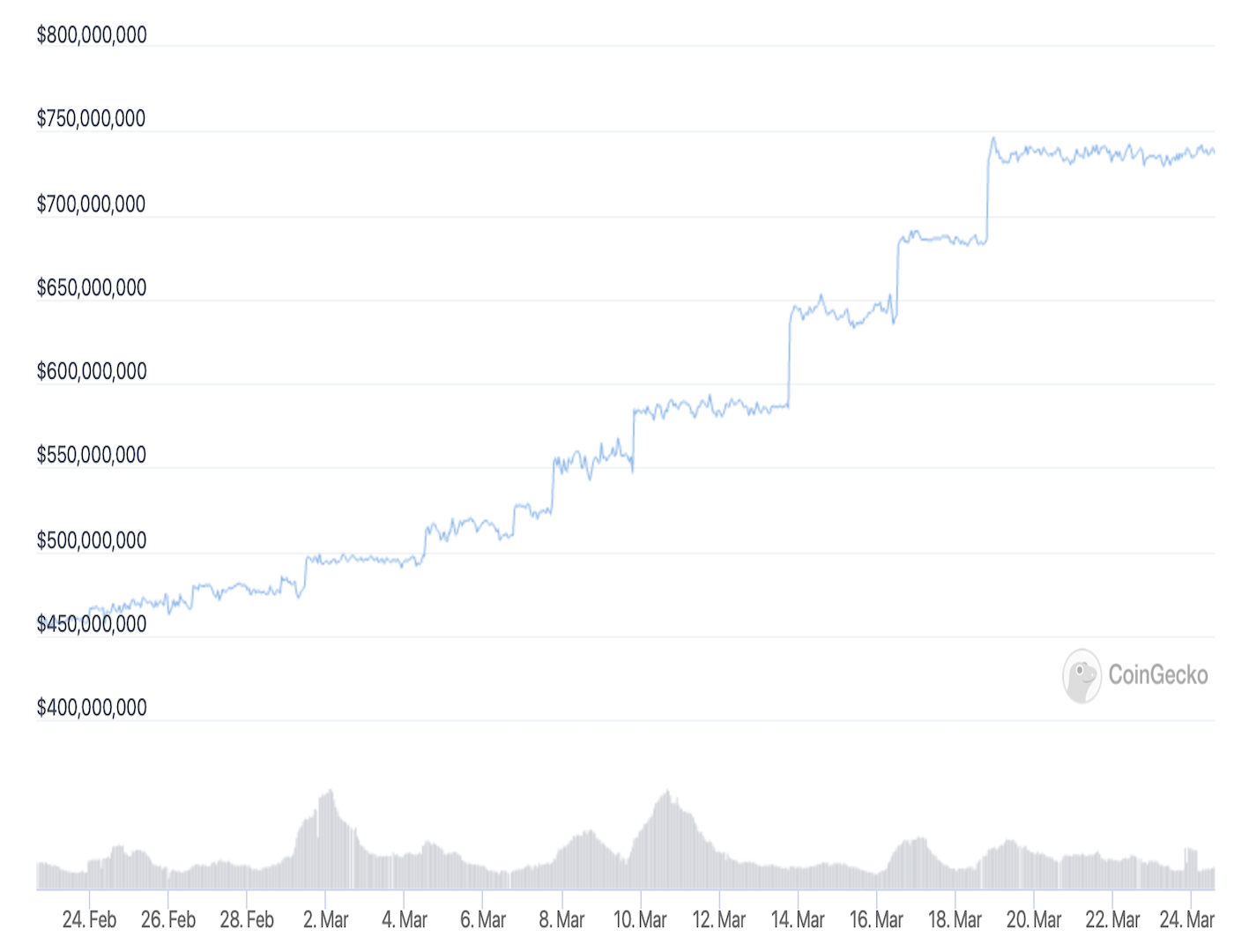

CoinGecko information shows the marketplace capitalization of USDN has accrued by much than 60% to $736 cardinal successful 1 month, possibly powering the waves token higher.

According to observers, determination person been 2 sources of request for USDN and, therefore, bullish pressures for WAVES. First, accrued capitalist involvement successful staking USDN connected Neutrino and different avenues, and secondly, the broader marketplace lull.

"Why the summation successful the outstanding proviso of USDN? It could beryllium due to the fact that of the comparatively precocious USDN staking yearly percent output oregon APR of 9.5% connected Neutrino oregon 19.84% APR for supplying USDN connected Vires.finance," Spartan's Tan said.

Users tin usage USDN arsenic collateral to commercialized oregon mint synthetic assets oregon involvement the stablecoin to gain an other yield. Staking refers to holding coins successful a cryptocurrency wallet to enactment web operations successful instrumentality for recently minted coins. The process is analogous to passive investing. Vires.finance is is simply a decentralized non-custodial liquidity protocol based connected Waves Blockchain, enabling users to enactment arsenic depositors oregon borrowers.

Investors typically parkland their wealth into stablecoins, which connection terms stableness and extortion from broader marketplace volatility during times of stress. And they whitethorn person done truthful implicit the past respective weeks, arsenic Russia's penetration of Ukraine connected Feb. 24 and the-then deficiency of clarity astir the Federal Reserve's monetary tightening plans weighed implicit some crypto and accepted markets.

"When the marketplace fell, radical tended to merchantability their crypto assets and turned into stablecoins. That's wherefore Terra's luna token and waves outperformed the marketplace due to the fact that they some person beardown assemblage statement connected their algorithm unchangeable coin, UST & USDN," Token Insight's Chen noted.

Some person associated the WAVES rally with the precocious implemented Waves 2.0 upgrade announced past month. The upgrade is expected to marque the web faster, much unafraid and Ethereum Virtual Machine (EVM) compatible.

However, Spartan's Tan disagrees. "One could reason that the Waves 2.0 announcement connected Feb. 11 triggered the rally, but I deliberation this is unlikely. The rally lone started happening successful the past week of Feb (unless the markets are truthful inefficient and dilatory to terms successful the announcement)," Tan quipped, drafting attraction to the dour marketplace effect to the akin announcements made by different blockchains successful the past.

"If you look astatine past EVM compatibility announcements for different chains similar Kava, Cronos and Near, nary of those token prices rallied 3x successful the 1-2 months post-announcement similar what waves cryptocurrency has done," Tan added.

While developers announced the Waves 2.0 upgrade connected Feb. 11, the token began rallying aboriginal that period astir the clip Russia invaded Ukraine. That has immoderate observers wondering whether the aboriginal determination higher resulted from speculations jumping the weapon connected Waves blockchain's relation with Russia.

"Waves was misperceived by markets arsenic a Russian/Ukraine-associated task and whitethorn person attracted speculative request from traders who privation to thrust the Russian/Ukraine narrative," Spartan's Tan said.

Waves blockchain is sometimes referred to arsenic Russia's Ethereum owing to its relation with Rostec, a Russian manufacturing elephantine and misconceptions astir Waves laminitis Alexandr "Sasha" Ivanov hailing from Russia.

However, Ivanov told Bloomberg aboriginal this period that helium is simply a Ukrainian national and the rally successful question tokens has got thing to bash with the concern successful Russia.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)