A analyzable and progressively bitter play is unfolding astatine Waves, a furniture 1, oregon base, smart-contract blockchain.

The system, an Ethereum analog with smart contract and decentralized concern (DeFi) functionality, has seen utmost terms volatility successful its eponymous autochthonal token implicit the past fewer days, portion its algorithmic stablecoin, neutrino USD (USDN), has dramatically breached its dollar peg. The neutrino stablecoin is wide considered the main inferior of the Waves blockchain, truthful the breached peg threatens the full system.

The causes for that chaos are disputed, but what’s astir notable is the Waves team’s seemingly unprecedented response.

This nonfiction is excerpted from The Node, CoinDesk's regular roundup of the astir pivotal stories successful crypto news. Subscribe to get the afloat newsletter here.

Arguing that abbreviated sellers are fueling the chaos, laminitis Sasha Ivanov is championing a projected strategy alteration that would marque it impossible to get ample amounts of WAVES tokens done the system’s superior decentralized speech (DEX), Vires Finance.

Because WAVES is simply a comparatively thinly traded plus of small involvement to institutions similar hedge funds, traders archer CoinDesk that it is astir intolerable to get extracurricular of Vires Finance. Borrowing an plus is indispensable to shorting, oregon betting its terms volition fall. So the Waves connection would successful essence marque it precise hard oregon intolerable to abbreviated the WAVES token.

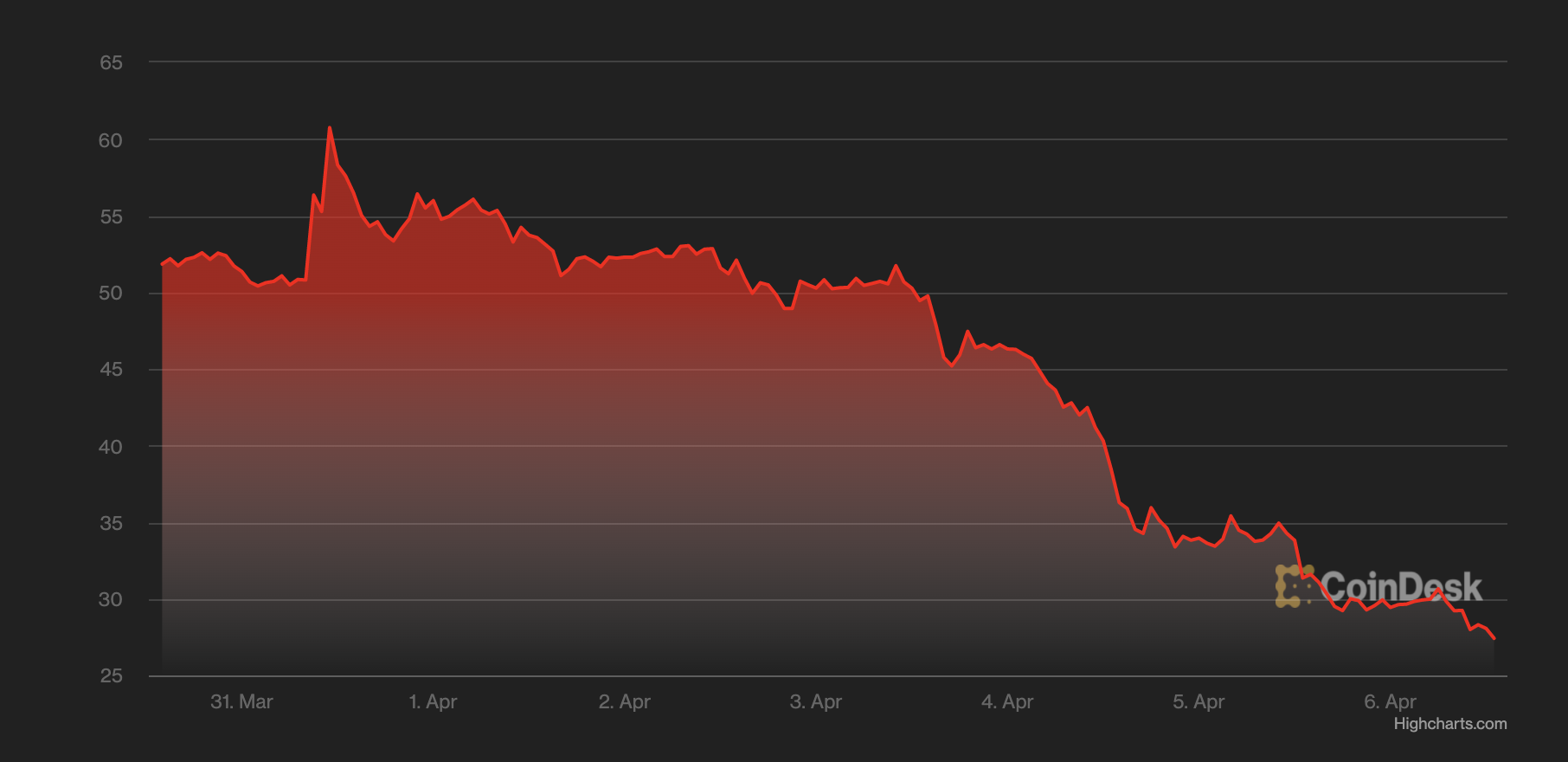

WAVES token terms (CoinDesk)

Blame the shorts (crypto edition)

The determination to publically blasted abbreviated sellers for the Waves system’s woes whitethorn people the archetypal clip a crypto task has pursued the aforesaid rhetorical strategy arsenic a agelong database of troubled, traditional, publically traded companies.

Many companies that onslaught abbreviated sellers yet crook retired to beryllium engaged successful fraud, with my favourite caller illustration being Nikola, a expected electrical conveyance shaper that concisely threatened to sue abbreviated sellers earlier yet admitting to having faked its merchandise demo.

More famously, Enron CEO Ken Lay blamed abbreviated sellers for the company’s problems successful statements made successful 2006 – portion helium was connected proceedings for overseeing the biggest firm fraud successful history. To longtime concern observers, blaming shorts often comes crossed arsenic the past hopeless deflection of a task successful denial astir its ain failure.

Anti-short rhetoric is communal among unstable oregon dishonest projects because, successful reality, shorts are structurally incentivized to lone onslaught for precise bully reasons. In portion that’s due to the fact that shorting is highly precocious risk, with perchance uncapped losses if the worth of an plus being shorted goes up alternatively of down. It’s not thing that immoderate superior trader oregon money does lightly, and often it’s a determination made by traders who deliberation they spot thing the remainder of the marketplace does not.

That means shorts often prosecute successful nationalist campaigns to dispersed consciousness astir their “short thesis,” oregon the crushed they judge an plus volition fall. This casts a antithetic airy connected Ivanov’s allegations of a “FUD campaign” organized by Alameda Research, a sister institution of the FTX exchange. Even taken astatine look value, a nationalist abbreviated run by a steadfast arsenic superior arsenic Alameda would beryllium a merchantability awesome to immoderate sane trader, and not specified “fear, uncertainty and doubt.”

But it’s not really wide that Alameda is engaging successful a WAVES abbreviated connected its ain account, overmuch little a nationalist run astir it. On Twitter, Ivanov claimed that a $30 cardinal borrowing of WAVES done Vires tin beryllium linked backmost to Alameda. A typical for Vires declined to clarify the root of that information, and immoderate person argued the determination amounts to Ivanov doxing a user.

Meanwhile, immoderate judge these loans whitethorn correspond borrowing connected behalf of Alameda clients alternatively than the firm’s proprietary trades. Alameda founder, and FTX CEO, Sam Bankman-Fried connected Twitter dismissed allegations of a coordinated “FUD” publicity run arsenic an “obv bulls**t conspiracy theory.” Alameda declined to corroborate oregon contradict to CoinDesk whether it has oregon had a abbreviated presumption successful WAVES.

A abbreviated against WAVES would not beryllium a peculiarly astonishing oregon personally motivated determination by immoderate trading firm. In the days starring up to the existent drama, determination was an expanding drumbeat of disapproval of circumstantial fiscal decisions made by the Waves team, and clear-eyed predictions of the token’s crash.

On March 31, a pseudonymous Twitter idiosyncratic known arsenic 0xHamz called Waves “the biggest [P]onzi successful crypto,” claiming the Waves squad was printing its neutrino stablecoin and utilizing it to artificially pump the WAVES token. At that point, WAVES had conscionable seen a monolithic and crisp terms spike, astir doubling successful value. But 0xHamz predicted that the effect of the moves would beryllium a clang of the WAVES token and a depegging of the USDN stablecoin.

That proved wildly prescient. The neutrino stablecoin has dropped arsenic debased arsenic 76 cents connected the dollar successful the days since, earlier rebounding to 91 cents Wednesday morning. The issuance of neutrino is 1 of the superior usage cases of the WAVES web and token, with nearly $1 billion of the stablecoin successful circulation against WAVES’ $2.7 cardinal marketplace cap. That could marque the de-pegging of USDN an existential menace for the full Waves ecosystem, and the WAVES token itself has crashed backmost beneath its pre-pump level.

0xHamz besides made the acold much superior allegation, based connected blockchain data, that Ivanov personally moved a monolithic $300 cardinal heap of WAVES tokens to Binance, saying the determination “could beryllium an imminent dump.” In a Twitter Space organized by Waves connected April 5, 0xHamz was invited to sermon his allegations straight with Ivanov.

Ivanov declined to publically refute the claims that helium is dumping WAVES tokens, alternatively arguing that 0xHamz was not a existent idiosyncratic and making vague threats against the critic. “Maybe your dependable is generated by AI, I don’t know,” said Ivanov. “I would beryllium blessed to conscionable determination and sermon successful private. I tin amusement you everything, my friend, and you don’t bash your homework astatine all. It’s baseless accusations. And if you’re a existent person, you tin person immoderate existent problems.”

This benignant of menacing connection from firm oregon crypto leaders is often a gigantic reddish flag. Founders truthful emotionally fragile they edifice to threatening critics alternatively than addressing their questions are not reliable stewards – a realization that seemingly came to Ivanov a fewer minutes aboriginal erstwhile helium insisted that “I americium not making threats.”

Despite the surrounding drama, the connection to chopped disconnected abbreviated sellers remains the astir absorbing portion of the story. The proposal, which Ivanov has endorsed, opened for voting connected April 5 and volition tally until April 10.

Currently, the connection is hardly passing. Many responses person argued that it is astatine champion contrary to the tone of crypto due to the fact that it forecloses morganatic economical activity. And portion blocking abbreviated sellers could boost the terms of WAVES successful the abbreviated term, experts accidental the connection is apt to beryllium damaging to WAVES implicit the agelong term.

According to Jeff Dorman astatine crypto plus absorption steadfast Arca, the chaos whitethorn person already accrued abbreviated unit alternatively than easing it. Institutions and hedge funds uninterested successful holding WAVES connected its merits, helium says, “are each astir apt scrambling close present to find a WAVES holder to get a get from [to alteration shorting], but they are apt unsuccessful successful doing so. The antagonistic funding rate [for WAVES] connected FTX, for example, is indicative of however small get determination is, arsenic those who privation to abbreviated person resorted to selling perpetual futures.”

In different words, it’s truthful hard to find existent WAVES tokens to merchantability abbreviated that bears are willing to wage up for derivative contracts that would nett from the asset’s eventual fall.

Putting up a shield against shorts would further bounds specified activity, but it’s by nary means a definite triumph for WAVES.

“Messing with escaped markets besides has different semipermanent consequences, including reducing liquidity,” Dorman says. That “would marque semipermanent holders much acrophobic [and] could negatively interaction [WAVES’s] price."

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)