The bitcoin terms whitethorn beryllium down from its all-time highs, but off-chain uses for bitcoin assets are successful their ain bull market.

This is an sentiment editorial by Zack Voell, a bitcoin mining and markets researcher.

One of the much absorbing and arguable developments successful the Bitcoin ecosystem is off-chain usage cases. Many of these applications are not technologically identical, but they each nevertheless grow the database of imaginable usage cases isolated from the Bitcoin basal furniture for a fixed bitcoin holder. And immoderate of these products are wholly extracurricular the Bitcoin system altogether.

This nonfiction takes nary presumption connected the unsocial merits of immoderate peculiar off-chain usage for Bitcoin, but it summarizes immoderate maturation trends and proviso information showing maturation and adoption crossed Layer 2 protocols, bitcoin-backed tokens and more. Using bitcoin successful these ways is not suited for each investor, but anyone who cares astir the wide scope of Bitcoin adopters should instrumentality enactment of these trends to amended recognize wherever and however bitcoin are moving.

Defining ‘Off-Chain Bitcoin’

Before examining immoderate data, this conception volition hopefully mitigate immoderate of the imaginable intelligence blocks oregon preconceived critiques readers whitethorn person astir these applications that could colour their nonsubjective mentation of information successful the pursuing sections.

The catch-all class of “off-chain” bitcoin is not meant to equate oregon conflate each the aboriginal mentioned protocols arsenic identical oregon adjacent mostly equivalent. But it is simply a sufficiently workable statement for these tools that connection uses for bitcoin that are not straight connected the basal later. Some of these uses stock characteristics of simply holding assets connected a custodial exchange, but a cardinal quality is that astir each of these protocols are not permissioned, closed root oregon arsenic centralized arsenic exchanges. The pursuing information focuses connected these unfastened fiscal tools for alternate bitcoin uses.

Overview Of Layer 2 Bitcoin Capacity

Protocols built successful layers of the Bitcoin exertion stack supra the basal furniture blockchain are often criticized for their meager adoption. Usually, these criticisms travel from proponents of alternate blockchains. But the information shows maturation is nevertheless dependable adjacent if comparatively slower.

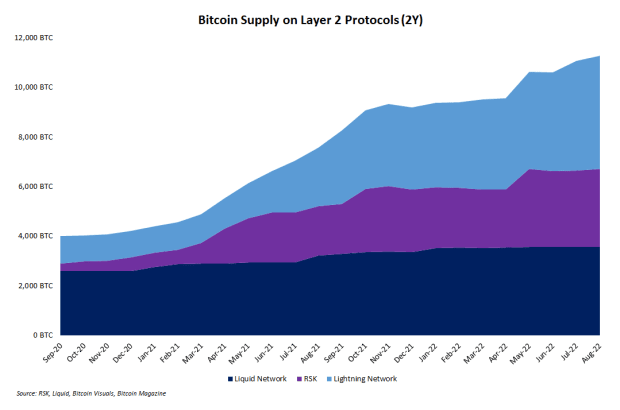

The colored country illustration beneath shows bitcoin supplies connected the Lightning Network, Liquid Network and RSK implicit the past 2 years. It’s evident that of these three, immoderate are seeing proviso turn faster than others. But the wide maturation trajectory is markedly other of bitcoin’s current terms action. Despite the carnivore market, adoption continues.

These 3 “built-on-bitcoin” protocols are not alone, however. Other Bitcoin-adjacent networks similar Stacks besides enactment a benignant of synthetic bitcoin asset. Built with the motto of “unleashing Bitcoin’s afloat potential,” Stacks announced its offering of a signifier of wrapped bitcoin successful January 2021. The plus uses the ticker symbol xBTC.

Data Overview Of Tokenized Bitcoins

It’s nary concealed that synthetic bitcoin products connected different blockchains are often derided connected Twitter and not universally utilized oregon welcomed by the broader Bitcoin community. But information shows that a non-trivial magnitude of bitcoin investors are progressively utilizing bitcoin-backed tokens.

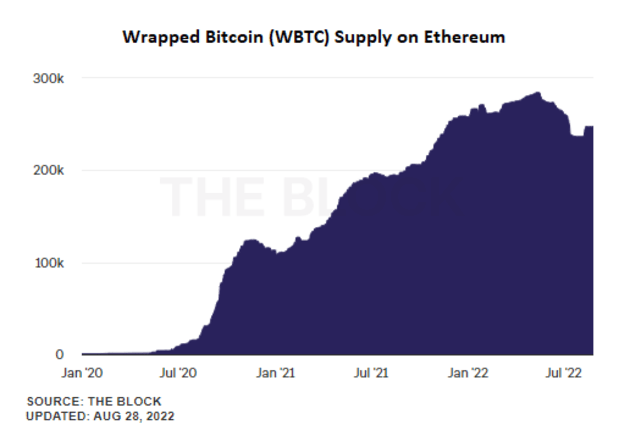

The champion illustration is the maturation of Wrapped Bitcoin (WBTC), an ERC-20 token launched by BitGo. The illustration beneath taken from The Block shows the bonzer maturation successful WBTC proviso implicit the past 2 years irrespective of immoderate downward bitcoin terms action:

BitGo’s bitcoin-backed token is not the lone plus of its benignant connected Ethereum. Six different teams person launched akin assets, including tBTC, pBTC, renBTC and more. Each 1 offers somewhat antithetic features and protocol architectures to service antithetic demographics of users.

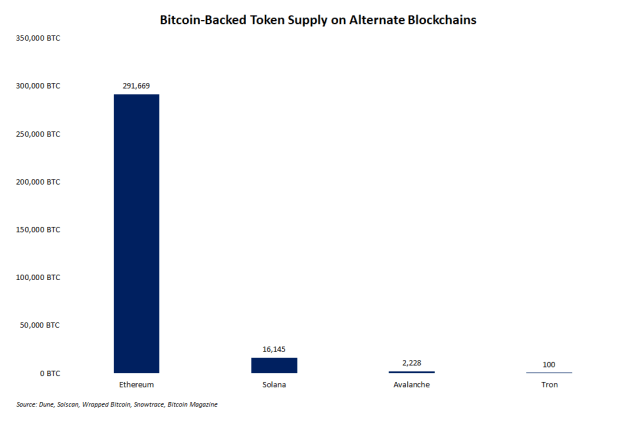

Ethereum is besides not unsocial successful supporting synthetic bitcoin products isolated from the Bitcoin blockchain. Other chains launched these products aboriginal arsenic gimmicks (e.g., Tron) oregon to effort and imitate the occurrence of Ethereum’s bitcoin-backed tokens (e.g., Solana and Avalanche). But Ethereum is by acold the web with the largest magnitude of synthetic bitcoin assets, successful ample portion acknowledgment to the craze of “DeFi Summer” successful 2020.

The barroom illustration beneath shows existent supplies of synthetic bitcoin connected alternate blockchains:

Are These Bitcoin Products ‘Good’?

Mention tokenized bitcoin products successful a crowd, and the reactions are definite to beryllium polarized. In orthodox Bitcoin communities, Layer 2 protocols (e.g., Lightning and Liquid) are casual favorites, and their adoption is steady, adjacent if comparatively slow.

So, are these products “good”? All of these off-chain uses for bitcoin contiguous assorted tradeoffs, but the idiosyncratic inferior of each cannot beryllium ignored. Whether oregon not everyone should prime 1 mode to usage their coins is beside the point. Because becoming a reserve plus — of the planetary fiat system oregon the internet-based “crypto” system — is bitcoin’s astir commonly accepted purpose, mostly speaking, products that execute this extremity should beryllium encouraged. Lightning pushes inferior successful the Bitcoin-native system successful the aforesaid mode that tokenized bitcoin has a wide and nonstop effect connected bitcoin serving arsenic a signifier of reserve plus for non-Bitcoin-native sectors of the broader cryptocurrency market.

Rehypothecation is different fashionable interest with astir bitcoin fiscal products. Importantly, this interest does not use to these off-chain products. The deficiency of rehypothecation for Lightning products is clear. And, successful fact, astir each of these products built connected and isolated from the Bitcoin protocol itself are designed to work a one-for-one bitcoin-backed oregon -swapped asset, whether it’s a elemental transference of bitcoin from the basal furniture to the Lightning Network oregon a swap of “real” bitcoin for a bitcoin token utilized connected different blockchains. One of the starring tokenized bitcoin products maintained by BitGo, for example, publishes impervious of the reserves backing the bitcoin tokens it issues.

The Future Of Off-Chain Bitcoin

Readers who ideologically cull the acceptable of tradeoffs inherent to tokenized bitcoin products volition surely not beryllium convinced by thing successful this nonfiction to alteration their thinking, nor are they criticized per se successful this article. The constituent of this information and investigation is simply to amusement that some radical (in fact, a consistently increasing number) spot worth successful choosing to usage their bitcoin determination too the Bitcoin blockchain — and adjacent places extracurricular of the Bitcoin-native economy. After all, HODLing successful acold retention is conscionable arsenic valid of a usage lawsuit arsenic tokenization.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)