It is not excessively precocious to put successful bitcoin, said multinational fiscal services elephantine Wells Fargo successful a Monday report, drafting parallels betwixt the adoption rates of the net successful the 1990s and that of cryptocurrencies today.

Wells Fargo’s planetary concern strategy squad explained successful the study that Bitcoin’s implicit 200% annualized gains since its archetypal transaction successful 2010 often pb immoderate investors to deliberation that it whitethorn beryllium excessively precocious to articulation the party. However, the large slope disagrees.

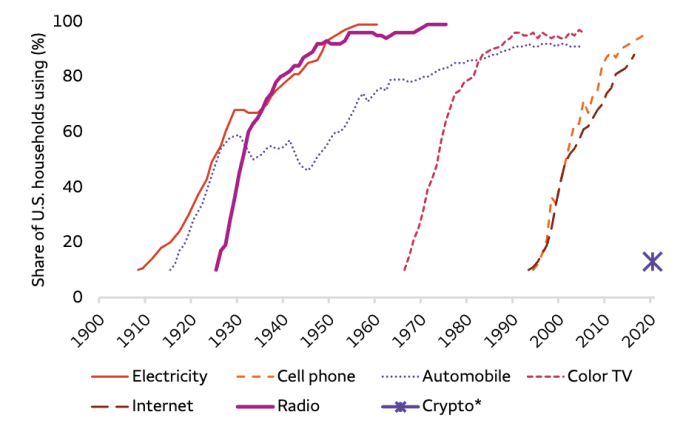

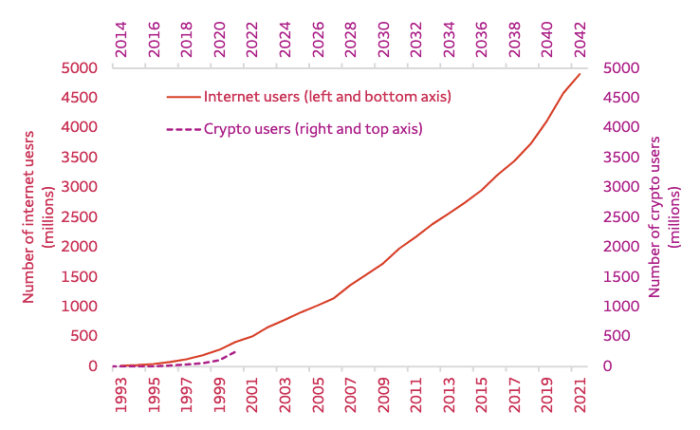

“We recognize the ‘too precocious to invest’ statement but bash not subscribe to it,” the report said, explaining that akin to the net successful the mid-to-late-1990s, Bitcoin and cryptocurrencies “could soon exit the aboriginal adoption signifier and participate an inflection constituent of hyper-adoption.”

Moreover, Wells Fargo believes that Bitcoin’s adoption complaint volition beryllium adjacent faster than that of the net due to the fact that “each caller integer invention rides the coattails of the integer infrastructure already built,” arsenic evidenced by the steeper emergence successful smartphone adoption.

“We expect that cryptocurrencies yet volition travel an accelerated adoption way akin to caller integer inventions,” the study said.

“It appears that cryptocurrency usage contiguous whitethorn adjacent beryllium a small up of the mid-to-late 1990s internet,” Wells Fargo said, referring to the illustration above. “Precise numbers aside, determination is nary uncertainty that planetary cryptocurrency adoption is rising and could soon deed a hyper-inflection point.”

The study said a steeper S-curve for Bitcoin mightiness beryllium fueled successful portion by greater regulatory clarity arsenic ineligible frameworks that person begun being drawn solidify the integer currency arsenic an investable plus for galore high-net-worth individuals that person been unwilling to marque an allocation.

However, Wells Fargo suggests that investors get bitcoin vulnerability done backstage placements by nonrecreational plus managers alternatively than buying the integer currency straight from an exchange, arguing that “the exertion is complex.”

Buying bitcoin isn’t arsenic analyzable arsenic it utilized to beryllium arsenic intuitive developments get built astir the world. In the U.S., for instance, users tin bargain BTC straight from Cash App, the fashionable fiscal services exertion by Block, and retreat to a bitcoin wallet of their choice. Even though determination is simply a learning curve with self-custodying bitcoin, the positives outweigh the negatives successful the agelong tally since it is the lone mode to payment from Bitcoin’s worth proposition of implicit fiscal freedom.

3 years ago

3 years ago

English (US)

English (US)