Ethereum is erstwhile again approaching captious levels aft a agelong of volatile yet bullish terms action. Following a crisp rebound from yesterday’s debased of astir $3,675, ETH is present trading supra the $3,800 mark, regaining momentum arsenic traders oculus a decisive move. While short-term volatility remains, the wide operation favors continuation—provided ETH tin interruption cleanly supra the $4,000 absorption level.

This threshold present stands arsenic the cardinal obstruction betwixt consolidation and a imaginable rally toward caller highs. A confirmed breakout would apt ignite caller bullish momentum crossed the broader altcoin market. Until then, terms remains trapped successful a narrowing range, investigating some trader patience and liquidity depth.

Meanwhile, on-chain information supports the bullish case. According to blockchain analytics level Arkham, whales person ramped up their accumulation, with ample addresses steadily adding to their ETH holdings successful caller days. This ongoing accumulation inclination reflects increasing condemnation among high-cap players and adds value to the anticipation of further upside successful the months ahead.

Whale Receives Ethereum From Galaxy OTC As Institutions Double Down

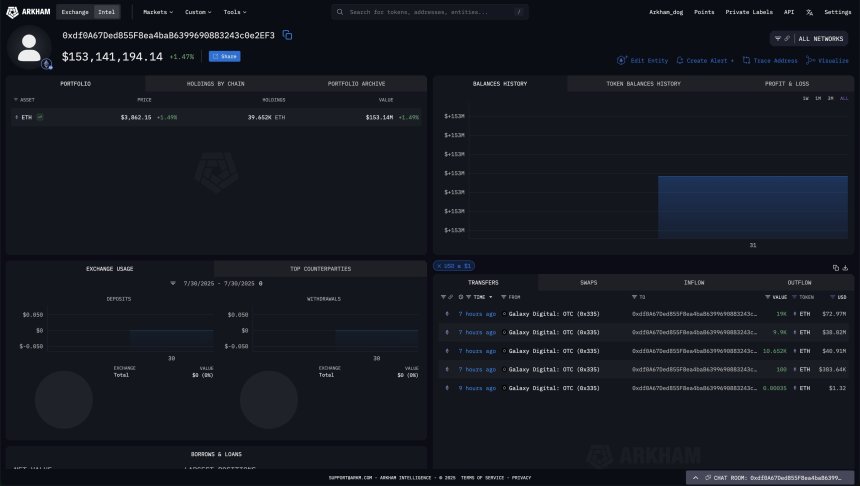

Ethereum’s bullish communicative gained further momentum this week aft Arkham disclosed a monolithic on-chain transaction involving a large organization player. A caller wallet address—0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3—just received $153 cardinal worthy of ETH, purchased straight done Galaxy Digital’s over-the-counter (OTC) desk. The standard and quality of this transaction suggest increasing organization condemnation successful Ethereum’s semipermanent potential.

Whale receives $153M successful Ethereum from Galaxy Digital | Source: Arkham

Whale receives $153M successful Ethereum from Galaxy Digital | Source: ArkhamThis isn’t conscionable different whale move. The information that the ETH was funneled into a caller wallet from a regulated OTC supplier underscores the strategical accumulation taking spot down the scenes. As accepted concern progressively integrates with crypto, Ethereum’s utility, programmability, and aboriginal relation successful tokenized concern are making it a high-conviction play among organization allocators.

This dense bargain comes aft a prolonged play of weakness. Earlier this year, ETH suffered persistent selling pressure, with terms enactment sliding little for months. Retail involvement faded, and sentiment turned bearish. But portion the nationalist panicked, blase players look to person taken the different broadside of the trade—accumulating softly during the downturn.

ETH Consolidates Below Resistance

Ethereum (ETH) continues to commercialized successful a choky scope conscionable beneath the cardinal absorption level of $3,860.80, arsenic shown successful the 4-hour chart. Despite caller terms volatility, ETH has remained supra its 50- and 100-period moving averages, presently adjacent $3,756 and $3,629, respectively. This suggests that bullish momentum is inactive intact successful the abbreviated term.

ETH investigating cardinal absorption amid volatility | Source: ETHUSDT illustration connected TradingView

ETH investigating cardinal absorption amid volatility | Source: ETHUSDT illustration connected TradingViewVolume has picked up slightly, indicating rising involvement from traders arsenic ETH tests this captious horizontal resistance. The terms has failed to adjacent decisively supra this level aggregate times since July 25, highlighting its significance. However, the accordant higher lows forming implicit the past week constituent to gathering buying unit beneath the surface.

A confirmed breakout supra $3,860.80 could unfastened the doorway for a propulsion toward the intelligence $4,000 level and beyond. Conversely, nonaccomplishment to interruption absorption whitethorn pb to different retest of the 100-period moving mean oregon adjacent the $3,700 enactment zone.

Featured representation from Dall-E, illustration from TradingView

4 months ago

4 months ago

English (US)

English (US)